Market scorecard

US markets took a breather yesterday after inflation came in slightly higher than expected, coupled with signs of a cooling labour market. From the Fed's perspective, these data points are contradictory. This has fuelled the ongoing debate about whether the Fed will go for a smaller rate cut next month, or pause altogether, after the significant cut in September.

In company news, Berkshire Hathaway sold $1.89 billion worth of multi-tranche samurai bonds yesterday, sparking speculation that Warren Buffett may be gearing up to increase his investments in Japanese assets. Elsewhere, Delta Air Lines has projected lower-than-expected profit and sales for the year's final months, pointing to a slower rebound after a rough Northern Hemisphere travel season.

Yesterday, the JSE All-share was up a tiny 0.07%, the S&P 500 fell 0.21%, and the Nasdaq was 0.05% lower.

Our 10c worth

Byron's beats

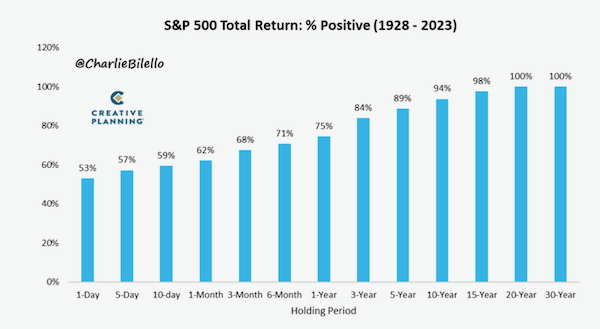

There is no such thing as a sure thing when it comes to investing. The trick is to try and get the odds in your favour. I absolutely love sharing these stats about your chances of making money on the stock market and how they improve over time.

According to historical data from 1928 to 2023, your odds of making money by owning the S&P500 over one day is 53%. Those chances increase to 75% if you hold for one year. If you hold for ten years, you have a 94% chance of making money, and for anything longer than 20 years, you are 100% guaranteed to make a profit.

This graph is from the one and only Charlie Bilello. Time is on your side when it comes to investing. Don't be impatient, even if you have had a bad start.

Michael's musings

Apple TV+ and Amazon Prime Video are two under-performers in the streaming wars. Their respective market shares are disappointing given that they both have good brand recognition and each company has spent billions to create the service. It is a reminder of how well Netflix has done.

The two streaming platforms are joining forces. Later this month, Apple TV+ will be available via Prime Video in the US as an add-on subscription for $9.99 per month. Apple will get access to over 200 million subscribers, and Amazon will get a cut of each subscription sold - sounds good for both companies.

If you sign up for TV+ directly through Apple, it would cost you $9.99. It may be tempting for people to transfer their TV+ subscription to Prime, just for the simplicity of having content in one place. I wonder if Prime will be coming to Apple, in a reciprocal deal?

Bright's banter

Many investing greats stand by this advice: Success isn't just about being right; it's about being right when others are mistaken. When people misjudge the market, it impacts prices, creating opportunities for us to capitalise on.

For me, this is an intriguing aspect of investing: being correct isn't sufficient. You need to be ahead of the crowd, making decisions that differ from theirs. This sounds tough and unattainable for most investors.

The real edge that the average investor can apply, and one we encourage at Vestact, is time and patience. Patience in investing is crucial because building wealth takes time, and markets are unpredictable in the short term.

Overreacting to short-term volatility can lead to poor decisions, like selling during market dips or chasing trends. By staying patient, you allow time for your investments to compound, ride out market fluctuations, and benefit from long-term growth. Essentially, patience helps you avoid emotional decisions and stay focused on your broader financial goals.

The sooner you begin investing, the more time you give your money to grow through compounding. The 8-4-3 rule of compounding suggests that in the first 8 years, your money grows at a steady pace. In the following 4 years, compounding starts to pick up speed, and in the last 3 years, the compounding effect really takes off, leading to a snowball effect where your returns begin to multiply more rapidly. This highlights the power of staying invested for the long term to maximise the benefits of compounding.

Linkfest, lap it up

Most European countries are struggling with over tourism. Norway has a solution that other countries could learn from - Make your country less attractive.

It can be tough to know if an old painting is original or fake. Investors rely on experts to certify original paintings - The Van Gogh Museum identifies 3 fakes, including one they certified as original in 2011.

Signing off

Asian markets are mixed today. India, Japan, and South Korea are seeing some gains, with Hong Kong up a solid 3%. Meanwhile, mainland China slipped 1.9%, giving back most of yesterday's progress as traders wait for more clarity on possible fiscal stimulus from Beijing.

In local company news, a UK court found Sibanye-Stillwater liable for around R21 billion in compensation to UK private equity firm Appian Capital Advisory. This follows Sibanye's decision to back out of a deal in 2022 to purchase Appian's shares in Atlantic Nickel and Mineracao Vale Verde, the companies that own the Santa Rita nickel and Serrote copper mines in Brazil.

US equity futures edged higher pre-market. The Rand is trading at around R17.49 to the US Dollar.

Earnings season is here with banks JPMorgan, Wells Fargo, and Bank of New York Mellon kicking things off in style tonight.

Enjoy the weekend.