Market scorecard

US markets finished higher yesterday thanks to a strong showing from tech stocks. The S&P 500 reached its 44th record for 2024. Apple rose 1.7%, Broadcom gained 2.9% and Amazon climbed 1.3%. The only sector that struggled was utilities.

In company news, DocuSign shares have climbed more than 11% over the last five trading days following the news that it will join the S&P Midcap 400 Index tomorrow. Elsewhere, Tesla had a record-breaking quarter for China shipments, with deliveries from its Shanghai factory increasing for the third straight month, surpassing those of rival BYD.

Izolo, the JSE All-share was down 0.18%, the S&P 500 rose 0.71%, and the Nasdaq was 0.60% higher.

Our 10c worth

Byron's beats

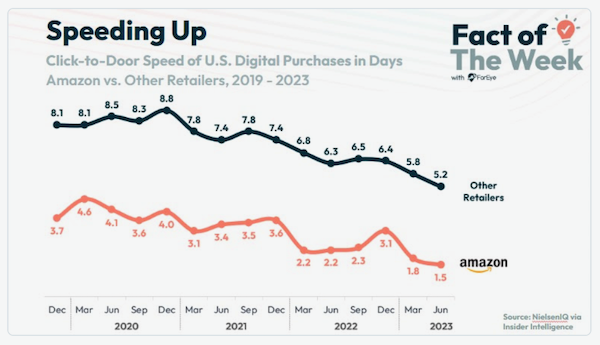

The image below shows the average days it takes online retailers to deliver their orders versus Amazon. The gap between Amazon and the rest is just incredible. It is a true testament to the logistics juggernaut that Jeff Bezos and his team have built over the years.

We often talk about quality businesses having large competitive moats. The ability to deliver four days faster, on average, than your competitors is a wide moat, filled with crocodiles and piranhas. It will take potential competitors a lot of investment in infrastructure and skills to close that gap.

Most of Amazon's profits come from its cloud services and advertising. I am looking forward to the day when the online retail segment starts printing cash. I predict that time is not far away.

Michael's musings

Here is something fun for a Thursday. A new research paper in the US has pinned the rise of income inequality on changes in dating habits. The paper finds that people look for partners with similar income, education, and skills. Basically, the rich stay rich because they marry other rich people.

Interestingly, the paper finds that the rise of women studying and working is the main factor behind this trend. Previously, men looked for a wife who could manage domestic life, and women looked for a man who could provide. Now, both women and men are looking for someone at least their equal. People are dating more in their income bracket than ever before.

The researchers estimate that about half of the rise in income inequality between 1960 and 2020 can be attributed to this change in spousal preferences. Who would have guessed that the rise of women's rights would contribute to income inequality? I thought the rich had always married each other?

You can read the paper here - Marriage market sorting in the US.

Bright's banter

The founder and CEO of Raising Cane's is a legend. Instead of chasing venture capital money, he took out a small business loan, started a chicken finger and fries joint, expanded it, and now, 28 years later he's paying himself $200 million a year in dividends.

Raising Cane's was founded in 1996 by Todd Graves and Craig Silvey in Baton Rouge, Louisiana. Silvey sold his share of the partnership shortly after the second restaurant opened.

Graves' vision was to create a quick-service restaurant focused on fresh, never-frozen chicken fingers, secret sauce, and friendly service. Graves, a Louisiana State University graduate, developed the concept for the restaurant while writing a business plan for a class assignment. Initially, the idea was rejected by multiple banks, but Graves eventually secured funding from a Small Business Administration loan.

Graves owns 90% of Raising Cane's, meaning he's getting the bulk of the dividends. Raising Cane's has been paying out about 20% of its operating cash flow in dividends over the last few years, which works out to around $915 million from 2020 to 2022.

This year, the company is on track to hit $4.6 billion in revenue, potentially bringing in $619 million in cash flow and a $124 million dividend payout, with Graves taking home almost all of it.

While running a fried chicken chain might not sound as flashy as building the next big AI company, by keeping most of the equity and avoiding too much outside investment, Graves has kept control of the business. He's now worth $9.5 billion, making it to the Forbes 400 list.

Linkfest, lap it up

Hacking into most things is surprisingly easy. Penetration testers found a flaw in a Kia web portal that allows you to track, unlock doors and start the engine remotely - Hacked and tracked due to a simple bug.

Some humans want to leave earth one day. Why not start planning ahead? - NASA Is going to give the moon a time zone.

Signing off

Asian markets are up today, with Chinese stocks gaining after officials introduced a new liquidity tool to help institutional investors buy shares. TSMC posted a solid 39% rise in quarterly revenue, beating expectations and calming concerns that AI hardware spending is starting to slow down. We can't see the moves as Taiwan markets are closed for National Day.

In local company news, sneakerheads will be disappointed to learn that local sneaker brand Drip Footwear has gone into liquidation. This has led to the closure of all 14 stores and the dismissal of its employees. The liquidation follows a court ruling related to an unpaid R20 million debt owed to advertising agency Wideopen Platform.

US equity futures traded lower pre-market. The Rand is trading at around R17.62 to the US Dollar.

Tonight is the big Tesla Robotaxi launch. How soon can Tesla start producing these new vehicles? US Consumer price data, due later today, is expected to show a drop in inflation, which could support the Fed's plans to ease rates.

Have a good sunny Thursday, the Jacarandas are finally out in Johannesburg and summer is definitely here.