Market scorecard

US markets bounced back yesterday, with big tech stocks making pleasing gains. Chipmakers led the charge again, and Nvidia has been up for five days in a row, for an overall increase of 14%. Elsewhere, in the less-exciting "smokestack industries", energy stocks fell due to a drop in oil prices.

In company news, The US Justice Department is back with its absurd suggestion that Google sell off parts of its business to reduce its dominance in the online search market. Google's share price did not budge on the news. Elsewhere, Honeywell rose 2% after announcing plans to spin off its advanced materials division. Lastly, Roblox initially fell 9%, but recovered to only close down 2%, following a statement from feared short sellers, Hindenburg Research, that they are shorting the gaming platform.

In summary, the JSE All-share was down 0.95%, but the S&P 500 rose 0.97%, and the Nasdaq marched 1.45% higher. Nice!

Our 10c worth

One thing, from Paul

On Thursday Tesla will unveil its robotaxi product at an event in Los Angeles. The new vehicle will be called a Cybercab. It will be able to drive itself and be summoned on a Tesla ride-hailing platform. The design might look like the mock-up in the picture here.

It will be interesting to see what technology these cars have on board. They won't have steering wheels or pedals, for starters. They will have lots of cameras and web-connected computing power, but probably won't have radar or lidar systems like the fully electric Jaguar I-PACE cars that Waymo uses. Those cost up to $200 000 each - too expensive for a mass market taxi Tesla has in mind.

Building a large fleet of robotaxis that are available everywhere will be massively capital intensive. So, Tesla hopes to draw in individual car owners who want to make money by putting theirs on the ride-hailing network.

I suspect that Tesla will have to do a deal with Uber. The latter has over 150 million customers around the world, using it at least once a month for rides and food delivery. They've been building that base for 14 years and handled $34 billion in gross bookings in the US last year.

We have plenty of skin in this game. Almost all Vestact clients own Google, the parent of Waymo. About half of our clients own Tesla, and a much smaller group owns Uber. We'll be watching closely on Thursday.

Byron's beats

Sometimes I get the sense that existing clients do not want to add new money to their accounts because they believe that this bull market has to end soon. People who have not yet invested in US equities might also believe it's "too late".

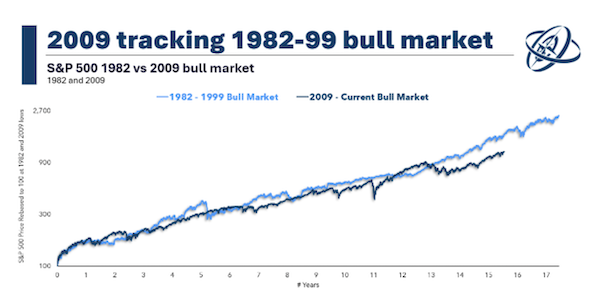

The graph below from the team at Ritholtz Wealth will show you that bull markets can last a very long time. It compares the run-up from 1982-1999 to the one we are currently living through, which started after the great financial crisis reset in 2009. As you can see, the most recent market has actually underperformed the type of returns experienced at the end of the last century.

Prolonged rallies are not unprecedented and I believe there is still a lot to be excited about. Innovation is ongoing, interest rates are coming down and the US economy is in great shape. Markets go up, positive movements should not be a reason to avoid investing.

As the saying goes, the best time to invest was 20 years ago; the second best time is today.

Michael's musings

I recently saw a post on X saying that the Fed's balance sheet has shrunk by $2 trillion. That sounded like a lot, so I checked the Fed's website. It has indeed shrunk from $9 trillion to $7 trillion over the last two years.

When Covid hit in 2020, the Fed went on a massive bond buying spree, mostly US debt. This resulted in their balance sheet ballooning from $4 trillion to $7 trillion in a few months and then further to $9 trillion over the next two years. Having the Fed buy US government debt resulted in more liquidity in the economy and lower interest rates, supporting an economy battered by harsh lockdowns.

Many pundits predicted apocalyptic-type events on the day the Fed stopped buying bonds. Apart from an uncomfortable market correction in 2022, we haven't had much drama. The Fed's balance sheet has quietly shrunk by 22%, and the market is trading at record highs. Onwards and upwards.

Bright's banter

The FDA announced that shortages of Eli Lilly's diabetes and weight-loss drugs, Mounjaro and Zepbound, have been resolved after nearly two years. Eli Lilly made a similar announcement a few months ago, but it took some time for the regulator to agree. The drug maker has assured the watchdogs that production can now meet current and future US demand.

In times of shortage, the US allows competitors to sell non-branded versions of treatments containing the active ingredient, which they call compound drugs. With the shortage officially over, the FDA warned that pharmacies can no longer compound copies of the drugs.

Novo Nordisk, whose similar GLP-1 drugs include Ozempic and Wegovy, is still on the FDA shortage list. This means that many compound drugs are still available. Both Eli Lilly and Novo Nordisk have been ramping up production to meet soaring demand, with Lilly committing $5 billion to boost manufacturing. Despite the resolution, local supply delays may still occur as the medicines are distributed to pharmacies.

Linkfest, lap it up

Accomplishment means many things to different people. Do you know what success looks like in your life? - The cult of blind ambition.

The Union Buildings are an important part of South African history. They were commissioned to mark the unification of South Africa in 1910 - The birth of the Union Buildings.

Signing off

The MSCI Asia-Pacific index fell for the second day, with Hong Kong stocks dropping over 3%. Chinese shares led the decline, as weak economic data and doubts over more stimulus from Beijing hit investor confidence. The CSI 300 Index plunged 7.4%, its biggest drop since 2020, erasing yesterday's gains. We told you so, did we not?

In local company news, Sanlam has finalised its acquisition of Assupol after meeting all the necessary conditions for the deal. Not bad for an acquisition that was announced in February. Now, the South African Competition watchdog needs to do get moving with all the other pending transactions, like the Vodacom/Vuma one, for starters.

US equity futures traded lower pre-market. The Rand is trading at around R17.60 to the US Dollar.

It's Wednesday already. Enjoy the rest of the week.