Market scorecard

US markets ended in positive territory on Friday, with all three major indices closing higher. This was fueled by a stronger-than-expected September labour market report, showing 254 000 new jobs added and a slight drop in unemployment. Both the S&P 500 and the Nasdaq posted weekly gains.

In company news, Rio Tinto is said to be in discussions to acquire lithium miner Arcadium Lithium. If the deal goes through, it would position Rio as the third-largest lithium producer for EV batteries. Elsewhere, Nintendo shares climbed as much as 4.2% after a senior executive from Saudi Arabia's sovereign wealth fund mentioned that they are considering increasing their stakes in Japanese gaming companies.

On Friday, the JSE All-share was down 0.15%, but the S&P 500 rose 0.90%, and the Nasdaq was 1.22% higher. We remain in all-time high territory.

Our 10c worth

One thing, from Paul

If you haven't made the time to do some in-depth reading to figure out how something works, it's easy to think it's a conspiracy.

Here are some examples. If you haven't studied international politics and read some history, you might believe that a secret society runs the world.

If you ignore scientific writing, you might conclude that Covid was a man-made virus that someone spread to cause a global pandemic. You might also believe that vaccines contain microchips that allow corporations and/or governments to monitor and control those who have received it.

If you don't trust engineers, and have never reviewed basic aeronautics, you might think that the moon landings never happened or that some aircraft just crash on purpose.

If you haven't taken the time to research what companies do, what new products they have in development, and how their profit margins are holding up, you may imagine that the stock market is just a giant casino.

If you don't understand inflation, how interest rates are set and how monetary policy interventions affect the real economy, you may be tempted to think that the members of the US Federal Reserve just cut rates because they are Democrats or Republicans, acting in a partisan fashion ahead of an election.

Learning is fun, and liberating. Keep an open mind, and never stop reading.

Byron's beats

Professional traders and investors take economic data releases quite seriously. Some traders even have full-time careers placing bets on market-moving data releases like the latest non-farm payrolls numbers. I was surprised to read how often these figures get revised and then revised again. Here's an extract from Eddy Elfenbein's brilliant newsletter.

"Last week, the government said that it under-reported how well the economy recovered from Covid. Originally, the government said the economy grew in real terms by 5.1% from Q2 of 2020 through the end of last year. Now it says the economy grew by 5.5% over that period. That small-sounding mistake is really a few hundred billion dollars."

He gives a few other examples, one of which is the US labour department recently stating that they over-assumed the number of jobs created by 818 000 in the last year. I loved this one-liner he uses. "In the realm of economic data, few things are as surprising as the past".

His conclusion, which we fully agree with, is to pay more attention to company numbers. They are not revised and give us a much better idea of what is actually happening in the economy. Earnings season starts soon, we cannot wait!

Michael's musings

A client's email system was recently hacked. In this case, the hackers diverted emails sent by Vestact, and then tried to supply our client with fake banking details. Thankfully, no harm was done as the client suspected something seemed weird, and the emails contained numerous spelling mistakes.

In this type of criminal activity, hackers look for users on platforms like Mweb with weak passwords, gain access to their online email platforms and then set up filters to intercept and modify future emails from people sending invoices for payment.

Here are some tips on how to avoid being defrauded.

(1) If you have an email address that is 2 decades old, and your password is 'password' or '123', update it immediately!

(2) When making a large payment to a new beneficiary, verify the banking details before proceeding. Find the contact details for the people you are paying independently; don't trust the contact numbers in the email. Also, it is easy to forge a proof of banking details, so don't trust those PDF, bank-stamped statements. In the case of Vestact, a call or WhatsApp to us will work for confirming.

(3) Be circumspect when making any payments. Your email might be secure, but organisations sending you payment requests may have been hacked.

Vestact takes security very seriously, and we have done all we can do to ensure that our systems are safe. Our bank details will not change. If you have any questions about this topic, let us know. Be safe out there.

Bright's banter

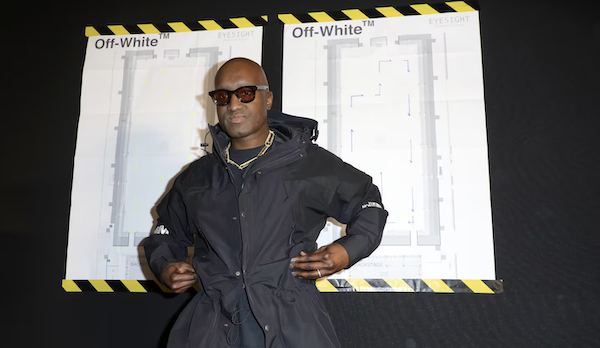

Off-White is facing an uncertain future after LVMH announced it is selling the brand to Bluestar Alliance, a firm known for taking over struggling labels. The deal raises questions about where Off-White is headed, especially since Bluestar often licenses brands for lower price-point markets.

LVMH had big plans for Off-White after acquiring a majority stake in 2021, hoping to build it into a lasting luxury brand. But since founder Virgil Abloh's passing, the label has struggled to maintain its appeal, and efforts to push it further into the luxury space haven't connected with its core streetwear audience.

Now, with the brand underperforming, Bluestar might reposition it for a broader, more affordable market. Bluestar says it's committed to continuing Abloh's legacy, but it's unclear if Off-White will remain a luxury name or shift toward the mass market.

Linkfest, lap it up

People like easy money. This leads to falling for all sorts of financial skulduggery - Ten tips on how to avoid being swindled.

Another Chinese car brand has launched in South Africa. BYD is China's most prominent EV company - Affordable electric sedan goes on sale.

Signing off

Asian markets saw gains, with benchmarks rising in India, Japan, South Korea, and Taiwan. Chinese stocks in Hong Kong surged, hitting their highest level in over two years.

In local company news, Metair is set to acquire AutoZone, South Africa's biggest privately owned auto parts retailer, for R290 million. AutoZone is currently in business rescue.

US equity futures are higher in early pre-market trade. The Rand is trading at around R17.46 to the US Dollar.

We're back to earnings season with notable reports this week including PepsiCo on Tuesday, Delta Air Lines and Domino's Pizza on Thursday, followed by bank reports on Friday from JPMorgan and Wells Fargo.

Have a great week.