Market scorecard

US markets ended slightly lower last night, after a choppy session. Oil prices remained volatile after their biggest one-day surge in nearly a year, on fears of damage to export facilities in the Persian Gulf. Most sectors of the S&P 500 were in the red but a few big cap tech stocks bucked the overall trend.

In company news, Nvidia gained 3.3% after CEO Jensen Huang said in an interview that demand for the company's new Blackwell chips is "insane". Tesla fell 3.6% after announcing a recall of over 27 000 Cybertrucks due to issues with their rearview camera. Finally, Spirit Airlines has been in talks about bankruptcy after its merger with JetBlue Airways fell through.

At the end of the day, the JSE All-share was down 0.75%, the S&P 500 fell 0.17%, and the Nasdaq was 0.04% lower. NBD.

Our 10c worth

One thing, from Paul

Fridays are my advice-giving days. But Paul Skallas, known as @LindyMan on Twitter, notes that there is too much advice going around these days. That's him in the picture below.

"Advice used to be difficult to attain. Today we're drowning in it. In a world overflowing with advice, the challenge isn't finding guidance - it's filtering it. The more advice we're exposed to, the harder it becomes to distinguish what's truly valuable. The internet has unleashed the Advice-Self-Improvement Complex."

He suggests five things to remember when encountering advice online, or in a self-help book. (1) Consider the counter-advice. (2) Remember that experts only matter sometimes. (3) Make sure that you are not being trolled. (4) Check if you are really just fishing for validation. (5) Ask yourself if you are the right audience for this advice.

You can read more about Skallas and the Lindy effect here, in the New York Times.

Byron's beats

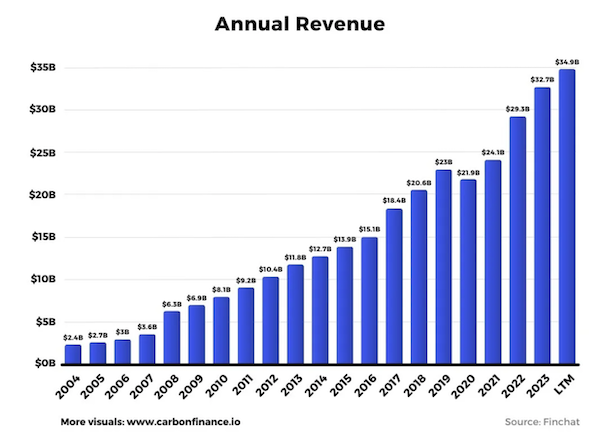

Since listing in 2008, Visa is up 1 620%. That means it's given investors an average annual return above 20% for 16 years. It has been an incredible investment. We have been happy holders of the stock for the majority of their listed journey.

According to Carbon Finance, the company had revenues of around $2.4 billion in 2004. Today, their annual revenue is around $35 billion. Take a look at the image below of their sales growth over the years.

Currently, the Department of Justice is investigating them for monopolising the debit card market in the US. Usually, when the DOJ comes after a company, it means that they are doing incredibly well. We are not deterred, and we plan to hold this stock for at least another 16 years.

Michael's musings

LVMH and F1 signed a 10-year deal this week, rumoured to be worth at least $100 million a year. That big payment is so LVMH's TAG Heuer brand can replace Rolex as the official watch brand at the races. Some of LVMH's other products will also feature at F1 events. The trophies might be transported in Louis Vuitton trunks and the winners will likely be spraying Moet, Dom Perignon, or Veuve Clicquot champagne around on the podium.

The joint statement said that the new sponsorship deal will also include 'hospitality, bespoke activations, limited editions and outstanding content'. It sounds like we could expect things like an F1-themed Hublot watch or racing stripes on Tiffany jewellery.

Liberty Media bought the F1 commercial rights in 2017, and since then the flagship motor racing series has come a very long way. Back then, ESPN was paying $5 million a year to broadcast the whole F1 season in the US. In 2019 that increased to $90 million. Now LVMH is paying more than that as a co-sponsor. You have to assume that ESPN will be paying much more than $90 million in 2026 when the TV broadcasting deal comes up for renewal.

Bright's banter

OpenAI just closed a $6.6 billion funding round, giving the AI company a massive $157 billion valuation. Thrive Capital led the raise with a $1.3 billion investment, and Microsoft chipped in $750 million, boosting its total stake in OpenAI after already investing $13 billion. Other big names like Khosla Ventures, Fidelity, and Nvidia participated, making this one of the largest-ever private capital injections.

The funds will help OpenAI push AI research and expand its computing power. OpenAI is now the second most valuable private company, ahead of SpaceX and behind ByteDance. The company is expected to generate over $10 billion in revenue next year.

Despite competition from firms like Anthropic and Google, OpenAI continues to lead, with 250 million weekly active users on ChatGPT and over a million business users.

Cofounder Sam Altman will receive a 7% stake now that they're converting into a for-profit company. His share will be worth around $11 billion, making him one of the richest people on the planet.

Linkfest, lap it up

There's a nuclear energy revival underway. It's thanks to demand from new AI datacentres - This is how nuclear micro-reactors work.

We deserve flying cars. Air taxis would be nice - Toyota invests $500 million.

Signing off

Asian markets are mostly in the green this morning. Benchmarks rose in India, Japan, and South Korea as Hong Kong led the gains, but dropped in Taiwan.

In local company news, Spar Group has named Moegamat Reeza Isaacs as CFO, taking over in January 2025. He was previously at Woolworths. Elsewhere, property developer Balwin expects headline earnings per share to decline by up to 59% for the half-year. It's tough out there.

US equity futures are in the green pre-market. There will be monthly jobs numbers out one hour before the start of live trading in New York.

The Rand is at R17.45 to the US Dollar this morning.

Have a great weekend, and enjoy the time off. We'll be back on Monday.