Market scorecard

US markets edged higher yesterday, while treasuries fell and the US dollar gained strength after some stronger-than-expected jobs data. Semiconductor stocks, including Broadcom (+1.9%) and Nvidia (+1.6%), performed well.

US companies hired more than expected last month, which contradicts other signs of a cooling labour market. All eyes are now on Friday's nonfarm payrolls report for more clues on the state of the economy. Fed officials will be watching closely too.

In company news, Tesla dropped 3.5% after missing third-quarter delivery expectations, with challenges stemming from fewer subsidies in Europe, increased competition, and rising consumer interest in hybrids over EVs. On the other hand, Salesforce gained 3.2% after Northland Capital Markets upgraded the stock to "outperform" and raised its price target to $400 from $270.

Izolo, the JSE All-share was up 0.57%, the S&P 500 delivered a marginal 0.01% gain, and the Nasdaq was 0.08% higher. Those are some tiny moves, lol.

Our 10c worth

Byron's beats

When you own a portfolio of around 15 stocks, the chances of them all doing well at the same time is small. Especially if they operate in different sectors and geographies.

One of our stocks which has been through a really tough period is Nike. Recently axed CEO John Donahoe followed a path that, in hindsight, has not worked. He pushed the company to sell directly to clients through a smartphone app, or at Nike concept stores. Admittedly, we heartily endorsed that strategy in this newsletter. Unfortunately, Nike alienated third-party sellers who punted other shoe brands instead.

New product innovation slowed, and their competitors made gains. With volatile demand during and after the Covid pandemic, inventory management was poor.

The quarter that ended in August was weak, with numbers coming out on Tuesday evening. Despite a profit beat, sales decreased 10.4% from this time last year. Footwear sales declined by 10% (despite Paul's best efforts), apparel dropped 9% and equipment was also 15% lower. Not good.

CFO Matt Friend said that sales momentum in the current quarter is looking positive after a successful Olympics marketing campaign and a push for newness and innovation.

Nike is not a business that is in trouble. They still have fantastic margins of 45.4%, an incredible brand and operate in a sector which we feel has room for growth. Most of the negativity has been factored into the share price and we would like to give new CEO Elliott Hill (below) an opportunity to turn this business around. We will hold.

One thing, from Paul

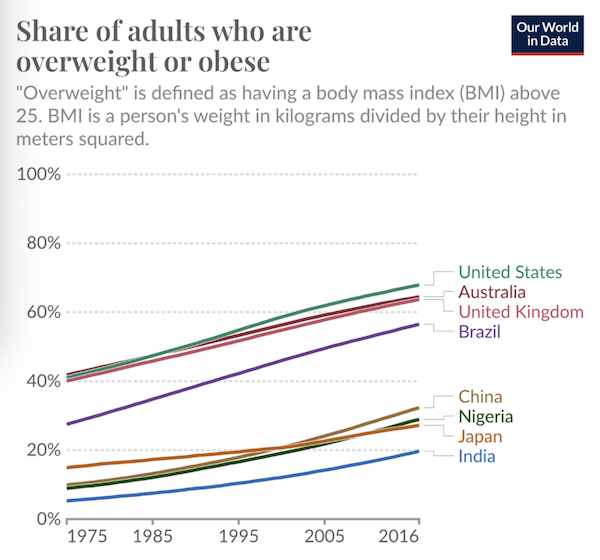

According to researchers at Our World in Data, obesity rates have increased dramatically across the world over the last 50 years. They looked at the national stats from the World Health Organization from 1975 up to 2016.

The chart below shows the change in the share of adults defined as "overweight" or "obese". The rates are higher in rich countries where high-calorie foods are readily available, but are also climbing steadily in poor countries.

This means that the market for GLP-1 weight-loss drugs, like Zepbound from Eli Lilly, is constantly expanding. Obesity is causing a global health crisis, and health insurers (what we call "medical aids") will soon be lining up to pay for their members to be on ongoing treatment.

If you haven't added Eli Lilly to your portfolio yet, now would be a good time to do so.

Michael's musings

South Africa needs more startups to grow and become big, established players in our economy. There have hardly been any new listings on the JSE over the past eight years.

The main reason that we have no startups is our stagnant economy. When there is no growth in GDP, there is very little space created for new entities. Another issue is that South Africa doesn't have dedicated startup legislation, particularly now that section 12J tax incentives have been reversed. The need for a cohesive policy to assist startups to thrive in South Africa has resulted in the private sector creating a body to champion the cause.

They are focusing on improving South Africa's integration with the global village. This includes making it easier to get hold of special skill visas and more importantly, in my opinion, trying to remove the limitations that exchange controls put on our businesses. Exchange controls limit the ability of local companies to expand beyond our borders and it makes it difficult for international companies to invest into new startups.

Have a look at what the new body has been doing over the last four years - South African startup act movement.

Bright's banter

Apple is gearing up to launch a new iPhone SE and upgraded iPads early next year. The iPhone SE, codenamed V59, will ditch the home button for an edge-to-edge screen design, resembling the iPhone 14.

This update will help Apple compete in the budget smartphone market, especially against Android rivals in China. The SE will also feature Apple Intelligence AI tools, aligning it with the iPhone 16 and iPhone 15 Pro models.

The updated iPad Air models will have internal improvements and new versions of its Magic Keyboard. A new iPad mini could also debut by the end of 2024. All will feature the M4 chip.

In our rapidly changing world, it is important for Apple to continuously innovate.

Linkfest, lap it up

Have you tried "Golden Lettuce"? Scientists genetically engineered them to have 30 times more vitamins - The yellow leaves are packed with beta-carotene.

Don't book an international holiday for your next trip. Stay local - South Africa's best heritage hotels.

Signing off

Chinese shares in Hong Kong dropped sharply today, with the Hang Seng Index falling 3.1%, ending a strong 13-day rally. Japanese stocks gained as the yen weakened. Mainland Chinese markets are still closed for Golden Week.

In local company news, Woolworths has given CEO Roy Bagattini an open-ended contract. Bagattini took over in 2020 after previously working at Levi Strauss, and seems to be doing a good job.

US equity futures are modestly lower in pre-market trade. One US Dollar will cost you about R17.41 this morning.

Have a pleasant Thursday.