Market scorecard

US markets ended lower yesterday as the war in the Middle East worsened. Iran launched about 180 missiles at Israel, some of which evaded their defence systems, and a response is expected. Bonds, oil, gold, and the US dollar all gained. The tech sector had the toughest day, with Apple and Nvidia both dropping around 3%.

In company news, Nike fell 5.9% in after-hours trading following a revenue miss for the quarter, even though they smashed profit estimates. A new CEO is at the helm, and they are in recovery mode. Elsewhere, Kering (owner of Gucci) dropped 2.9% after Goldman Sachs downgraded it to "sell," which pulled down much of the luxury sector along with it.

In summary, the JSE All-share eked out a 0.08% gain, but the S&P 500 sagged by 0.93%, and the Nasdaq tumbled 1.53%.

Our 10c worth

One thing, from Paul

Chinese markets are currently closed for their Golden Week celebrations. That follows a heroic period of gains on the main bourse in Shanghai, with stocks up 25% in six days. This was in reaction to some pretty significant fiscal and monetary stimulus interventions by the authorities in Beijing.

Bloomberg's columnist John Authers (pictured below) had this to say:

"While the impact on China's asset prices is instantaneous, these reforms are far from the silver bullet to deal with endemic economic woes. The lag in transmission means the measures - which include interest-rate cuts, liquidity and support for the stock market, a 20-basis-point reduction in the seven-day reverse repo rate, a 50-basis-point decrease in the reserve requirement ratio, and an average drop of 50 basis points on rates on existing mortgages - will take some time to bear fruit in the real economy."

We own Naspers shares here in Joburg portfolios, and they move with the quoted price of their biggest asset, Tencent. We also own shares in global multinationals that are trying to make profits in China, with mixed success. We do not invest directly in Chinese stocks.

It's definitely a positive for the global economy if China's economy prospers, but I'm sceptical about this recent "sugar rush" recovery off very depressed levels. Anti-capitalist sentiment and excessive regulation have grown under Xi Jinping. Until there is regime change in that country, we will stay away.

Byron's beats

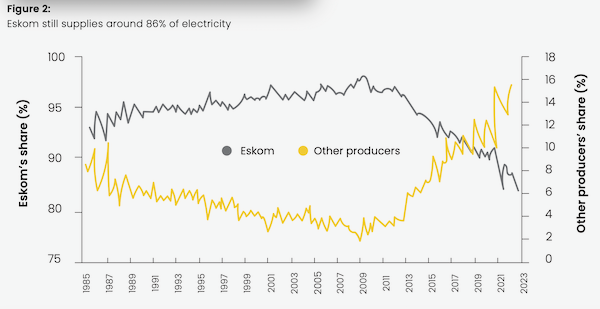

Many of us have taken a keen interest in how South Africa will deal with it's energy crisis. The sketchy supply of electricity and the soaring prices Eskom wants to charge make it essential to stay well-informed on the topic.

The team at GoSolr have made a number of very informative presentations which are free to view on their website. Here's the latest one titled Light Paper July 2024. It summarises the state of solar in South Africa as well as the regulatory challenges faced by the industry. The regulation also impacts pricing, tariff increases and how Eskom plans to manage the grid - all covered in detail.

Section 3 of the report looks at Eskom's shift to renewables and Section 4 is how solar can save you money. I hope you find this helpful.

Michael's musings

German GDP is expected to contract by 0.1% this year which is not great for a country considered to be Europe's growth engine. There are many factors at play when a country's economy stagnates, and one of them is lower productivity rates from employees.

A recent example is the issues Tesla are having at its German manufacturing plant. In August, 17% of employees were on sick leave, including around 200 workers who have been on sick leave since January. That's significantly higher than the 5.2% of German automotive workers in 2023 who were off work due to illness.

Tesla managers are now making house visits to sick employees. When people are off work 3 times more than the national average, there could be foul play going on. Two-thirds of them are probably not ill at all.

Similarly, I was speaking to a Europe-based acquaintance recently about their new job. I asked about their leave policy, and they told me they got 25 days of annual leave and 10 days sick of leave, so 35 days in total. It is almost as if sick leave was expected to be taken.

South Africans have a good work ethic, and if you choose to work abroad, that will be noted, and considered to be an asset.

Bright's banter

The return of Noam Shazeer to Google marks a major moment in the race to dominate AI. Shazeer was the co-author of the pivotal AI research paper "Attention is All You Need," but he left Google in 2021 after the company refused to release a chatbot he had developed.

He started his own company, Character.AI, which struggled despite its initial promise. Google recently stepped in, paying around $2.7 billion for the right to license Character.AI's technology and rehire Shazeer.

He has rejoined his former colleague Daniel De Freitas to lead research and oversee the development of Gemini, the next iteration of Google's AI platform. Google co-founder Sergey Brin emphasised that the company is now pushing the boundaries of AI deployment faster than ever before.

Linkfest, lap it up

Solar power is always surprising to the upside. Even its biggest fans seem to underestimate its capabilities - You gotta love the sun.

Ice in our polar regions is melting faster than expected. Scientists are experimenting with pumping seawater over artic ice to make it thicker - Plan to refreeze Arctic sea ice shows promise in first tests.

Signing off

Asian markets are mostly lower this morning. Benchmarks fell in India, Japan, and South Korea. Taiwan is closed for trading due to yet another storm. This one is called Typhoon Krathon.

In local company news, Capitec reported a 36% jump in headline earnings to R6.4 billion for the half year to August, thanks to lower credit losses and solid growth in non-lending income. Management seems to be doing a great job at keeping those credit impairments in check.

US equity futures are slightly lower in pre-market. The Rand is trading at around R17.34 to the greenback.

It's Wednesday again. Enjoy the day and stay safe, if you can.