Market scorecard

US stocks notched a third straight week of gains, despite a sluggish Friday. The S&P 500 has had its best first three quarters since 1997 with a 20% rise so far in 2024. We are pleased to be fully invested.

In company news, Dell fell 4.9% on Friday after ordering its employees to come back to the office 5 days a week. Elsewhere, Brazilian authorities fined Elon Musk's social media platform, X (Xhitter?), $1.9 million. Finally, Nvidia shares dropped 2.1% after reports that China is encouraging local firms to avoid using its chips.

On Friday, the JSE All-share was up 0.29%, the S&P 500 fell 0.13%, and the Nasdaq dropped 0.39%.

Our 10c worth

One thing, from Paul

I'm very keen to get to Japan in 2025. I've never visited that country, despite planning a trip in May this year. I didn't get there because of visa timing issues.

The Japanese economy is doing well, thanks to a big boom in inbound tourism this year (see the chart below). A record 3.3 million foreigners travelled to Japan in July, led by China and other Asian nations, according to data from the Japan National Tourism Organization. Americans made up about 8% of inbound tourists in that period.

The Japanese yen has been getting cheaper in recent years, which encouraged overseas tourists to head there. Spending in Japan by non-residents is up about 40% since before the pandemic. That accounts for about 10% of the increase in the country's GDP over the same period.

Byron's beats

Keep working hard at your career and your hobbies, because the lessons you learn along the way will be with you forever. I loved this quote from author and philosopher Derek Sivers.

"Mastery is the best goal because the rich can't buy it, the impatient can't rush it, the privileged can't inherit it, and nobody can steal it. You can only earn it through hard work. Mastery is the ultimate status."

We often say that great things take time, effort and consistency. Mastering a skill is no different, but once you have it, it is priceless.

Michael's musings

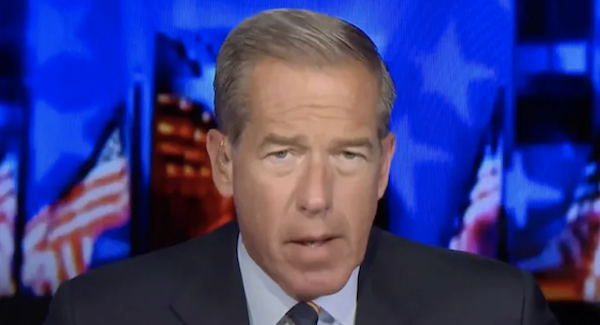

Amazon's Prime Video service is in the process of increasing its live sporting content, taking on traditional cable companies. Now the company is opening a new front in the war for consumer eyeballs. Reports are that Amazon will do its first live news broadcast, hiring veteran anchor Brian Williams to host special coverage of election night.

As Amazon's advertising business takes off, it makes sense to expand into new media formats. Broadcasting the news could prove tricky though. Which side of the political divide would Amazon's reporting land? Too far left or right would be a mistake, but being unbiased in the middle might not appeal either.

Amazon has the money to experiment. If news takes off, it will expand Prime Video's moat and Amazon has an extra avenue for advertising. Sounds like a good idea.

Bright's banter

European luxury stocks have made a comeback after a tough year, thanks to China's recent stimulus efforts. In the past week, companies like Hermes (+16.5%), Richemont (+18.2%), and LVMH (+19.2%) have jumped higher. This has been the best week since 2012 for the Europe textiles, apparel, and luxury goods index.

China's stimulus gave the sector a much-needed boost because Chinese shoppers are key to driving sales for high-end goods. While stocks like Kering, Burberry, and Hugo Boss have struggled, their lower valuations are now drawing in investors.

A number of our clients hold LVMH, while quite a few own Richemont, so it's great to see this China-driven rebound benefiting these luxury companies.

Linkfest, lap it up

To grow an economy you need electricity. China is surging ahead and building new power stations of all energy types - The largest producers of wind power by country.

Airbnb is struggling. The company is underperforming sector peers like Hilton, Marriott, and Booking Holdings - Is Airbnb losing its edge?

Signing off

Hong Kong and mainland China continued their record-breaking rally, surging for a ninth consecutive day. Over the past week, Hong Kong's index has risen by 15%, while mainland China's CSI 300 has soared by 21%. For context, the CSI 300 had dropped more than 45% from its 2021 peak until mid-September, but it's now on track to enter a technical bull market.

In local company news, PSG Financial Services expects its earnings to rise by about 30% at the halfway point of the year, thanks to strong local and offshore markets. The firm had R23 billion in net client inflows, with assets under management growing 15% to R407 billion.

US equity futures are up pre-market. The Rand is looking very perky at around R17.08 to the US Dollar.

Have a prosperous week.