Market scorecard

US markets closed in positive territory again yesterday, still enjoying the afterglow of recent rate cuts. The S&P 500 hit another all-time high, thanks to gains in major tech names like Nvidia (+4.0%), Uber (+3.6%), Salesforce (+2.4%), and Netflix (+2.4%). Other sectors like financials, utilities, and the energy sectors lagged behind.

In company news, Visa dropped 5.5% after the US Department of Justice filed a lawsuit, accusing the company of stifling competition to maintain its dominance in the debit card market. Oh for goodness sakes! Another annoying lawsuit from the Feds that will go nowhere. Elsewhere, copper miner Freeport-McMoRan gained 7.9% after the desperate-looking Chinese government announced new economic stimulus measures.

On Monday, the JSE All-share was up 1.13%, and yesterday the S&P 500 rose 0.25%, and the Nasdaq was 0.56% higher.

Our 10c worth

One thing, from Paul

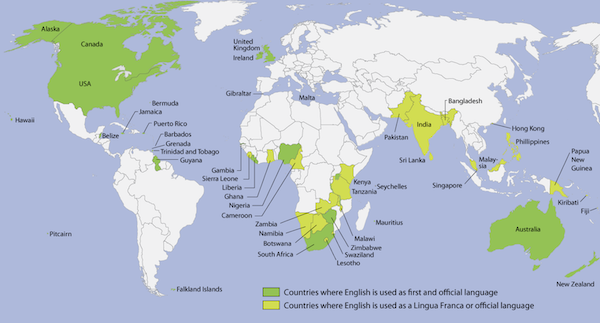

The three most important countries in the world are the USA, the UK and India. The first is the world's leading economy, and where we invest. The second is our former colonial ruler, and where many of our children end up working. The third is the globe's most populous nation and also a capitalist-oriented democracy.

I know that some people here in South Africa have a different view. They love China, Russia and Cuba because they are committed socialists. Many on the left fancy the idea of a centrally managed, state-dominated economy. Politicians of this persuasion want to beemperors, like Xi Jinping. In my opinion, that's a dead end.

Most importantly, the USA, UK and India are English speaking, and so are we. Winston Churchill once said "The enjoyment of a common language is a supreme advantage in all British and American discussions."

We should orient our foreign policy and trade relations towards closer alignment with those three countries. In the next GNU, after the 2029 election, the ministers in those positions may be more amenable to that idea than the current lot.

Byron's beats

Here's a great example of how effective share buybacks can be if you remain patient and hold a stock for a long time. Larry Ellison, the founder of Oracle, used to own 20% of the company. Since 2012, Oracle's number of outstanding shares have declined by 44% from 5.1 billion to 2.8 billion due to consistent share buybacks.

Thanks to the lower number of shares in issue, Ellison's stake in the business has grown to 41.3%. I am sure he gained a few extra shares from compensation along the way but essentially his stake in the business has doubled without him adding a cent.

Many of the stocks Vestact clients own have very large share buyback schemes. Your stakes in these businesses are slowly growing, even if you are not adding to that position in your portfolio. This is a wonderful outcome.

Michael's musings

Many studies have been done on ageing and what we can do to slow the steady march of bodily decay. There are a few key factors linked to longevity, particularly for those over 80: (1) healthy eating, (2) regular exercise, (3) active social life, and (4) good genes.

A recent study from the Edith Cowan University in Australia says that travel could also help slow the ageing process. That makes sense because traveling is a social activity, generally involving lots of walking to see the sites.

Fangli Hu, the study's principal researcher said: "Environments, especially beautiful landscapes like forests or beaches, can help us reduce stress and boost our mental well-being and promote physical activity. Exposure to other tourists, locals or even animals can improve our mood and enhance cognitive function."

Do you want to live longer? Then go book a holiday to a part of South Africa you haven't visited before.

Bright's banter

Art and luxury-goods sales business Christie's is acquiring LA-based car consignment firm Gooding & Company, marking its largest deal in over two decades. The acquisition aims to diversify Christie's offerings as its art sales have declined, dropping 22% year-over-year to $2.1 billion in the first half of 2024. Gooding founder David Gooding will remain president, and the company will continue operating from its LA headquarters.

The deal comes as the classic car auction market faces oversaturation, with too many cars and far fewer buyers. For example, Monterey Car Week 2024 saw an 8% decline in sales to $371 million.

Christie's is looking to expand Gooding & Company globally and grow it beyond its family-run roots.

Linkfest, lap it up

The rise in flexible working has changed traffic patterns. By one global measure, we now spend less time stuck on the roads - 'Rush' hour isn't what it used to be, working 10-to-4 is the new normal.

The US is experiencing a historic boom in small business formation. This makes sense as entrepreneurship is in their DNA - Pandemic fuelled surge in company registrations continues.

Signing off

The MSCI Asia-Pacific index is up again today, with Chinese stocks in Hong Kong and on the mainland posting their biggest gains in seven months. This came after the People's Bank of China Governor, Pan Gongsheng, introduced new policy measures to lift the struggling economy and improve market confidence. The rally was led by banks, property developers, and brokerage firms.

In local company news, Primary Health Properties, a UK-based company that joined the JSE last October, has now been included in key South African market indices. Elsewhere, Trellidor shares jumped 3.5% on Monday after the security company announced it expects earnings to surge more than ninefold compared to last year, thanks to strong results from its UK division.

US equity futures are slightly lower pre-market. The Rand is trading at around R17.32 to the US Dollar.

It might feel like a Monday, but you are already halfway through this week. Have a good one.