Market scorecard

The Fed went big yesterday, cutting US interest rates by half-a percentage-point. After the announcement the S&P 500 hit a new all-time high, briefly, before retreating and ending the day slightly lower. In his comments at the press conference, Jay Powell declared that inflation had been vanquished, and while the job market is cooling, the economic outlook is still very positive. Hurrah, we are out of the woods!

In company news, Google closed up 0.3% after securing a legal victory against the European Union, overturning a $1.7 billion fine for the way it runs its online advertising business. The biggest loser in the index was ResMed (-5.1%), the maker of medical devices to treat obstructive sleep apnoea, on an analyst note citing future competition from Eli Lilly's GLP-1 medication.

At the end of an exciting day, the JSE All-share was down 0.38%, the S&P 500 fell 0.29%, and the Nasdaq lost 0.31%. The good news was largely priced in.

Our 10c worth

One thing, from Paul

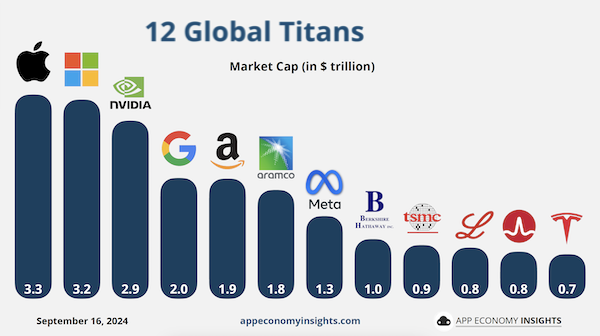

The chart below shows the 12 most valuable companies in the world, ranked by their market capitalisation. Which ones do you own in your portfolio? If you are a Vestact client, you most probably own 8 of them, or perhaps 9. If you've been a client for many years, you've owned them since before they were on this list.

The 9th stock is Berkshire Hathaway. It's not a fully-fledged recommended holding of ours, but it is owned by 79 slightly more conservative clients.

The three that you don't own are Aramco (a dirty oil company mostly owned by the Saudi state), Taiwan Semiconductor (listed in Taipei, and we prefer Nvidia) and Broadcom (also a chip designer, and we prefer Nvidia).

We enjoy answering client emails, so if you'd like to discuss our picks, send us a message.

Byron's beats

As a parent with young kids, I find the idea of my children going on social media one day quite daunting. I was pleased to see that Instagram announced some security updates to accounts for teenagers (under 18) which gives parents more control over messaging and content.

I am not a fan of governments interfering in people's lives, because clumsily-designed regulations usually have unintended consequences. However, this change was initiated by Meta themselves, who believe that account protections for their 100-million plus teen accounts will improve user experience, prevent harm, and keep them on the platform.

Instagram head Adam Mosseri said, "I think over the long run, it's going to be in our interest as a business to earn more trust from parents. Parents, at the end of the day, they get to make the decisions".

I agree as a parent and as a Meta shareholder.

Bright's banter

Apple has introduced "Apple Intelligence," a personal AI system for iPhone, iPad, and Mac. To handle more complex tasks, they've developed Private Cloud Compute (PCC), a cloud-based system designed for private AI data processing. What sets PCC apart is its focus on privacy - user data remains encrypted and out of reach, even from Apple.

PCC tackles common issues with cloud AI security by offering stateless data processing, strict privacy controls, and no privileged access for admins. It also safeguards against targeted attacks and ensures transparency, allowing security experts to verify the system. Essentially, PCC combines Apple's high-security standards with the flexibility of cloud computing for AI.

In summary, Apple will continue to prioritise the security of your data in the age of AI, regardless of the language model you use on your devices.

Linkfest, lap it up

Joe Rogan is an influential figure. The podcaster and comedian has turned Austin into a haven for very-online males - If you go to Texas, try to catch a show at the Comedy Mothership.

SpaceX astronauts safely returned to Earth. The team managed to accomplish a few world firsts - The awe-inspiring history of spacewalks.

Signing off

Asian markets rose this morning on rate-cut enthusiasm. Stocks in Singapore were poised for their highest close since 2007, driven by the city-state's real estate investment trusts (REITs). Have you been there? It's a wonderful place.

In local company news, Grindrod reported a half-year profit of R485 million, thanks to higher chrome export freight volumes. They announced plans to acquire the remaining 35% stake in Terminal de Carvao da Matola (TCM) from the Vitol Group for R1.36 billion.

The Rand is trading at around R17.53 to the US Dollar. This afternoon the SARB will announce a change in South African interest rates and hopefully, they will be brave and cut by 50 basis points too. Our inflation came in at 4.4% yesterday, lower than our target of 4.5%. Let's go!

US equity futures are edging higher. We are looking for a solid follow-through from yesterday's shift, thank you very much.

There is more to come. Have a prosperous day.