Market scorecard

US markets were quiet yesterday with the S&P 500 edging up, and the tech-focused Nasdaq slipping back. Banks traded higher, fuelled by hopes of a soft economic landing which outweighed concerns about profit margins. We will be treading water until tomorrow, when the Fed will make its call.

In company news, Apple dipped 2.8% after an analyst warned that initial demand for the iPhone 16 Pro model was lower than expected. Elsewhere, Intel is up 8% pre-market as it scored a major win, securing up to $3.5 billion in federal grants to produce semiconductors for the Pentagon. They also unveiled a plan to spin off their foundry business and struck a new agreement with Amazon AWS. The company is in deep trouble, so this is a bounce from very depressed levels.

In summary, the JSE All-share eked out a 0.04% gain, the S&P 500 rose 0.13%, and the Nasdaq fell by 0.52%.

Our 10c worth

One thing, from Paul

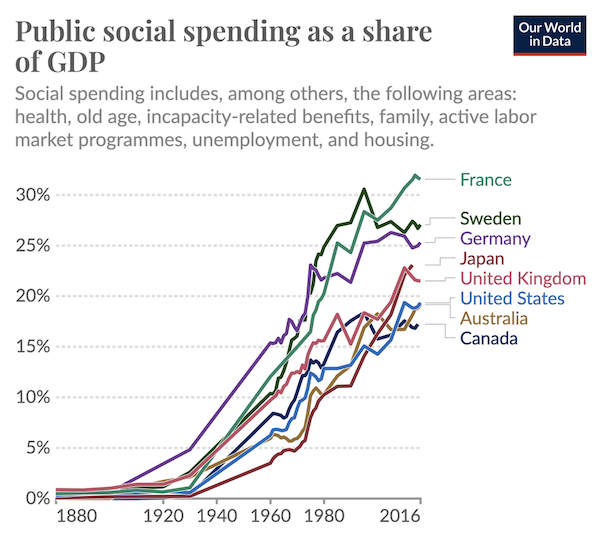

Public social spending in rich countries has risen in the last 100 years from around 1% of national income to around 25%. The chart below from Our World in Data, shows the trend quite starkly.

Note that social spending includes primary, secondary and tertiary education, healthcare, old age pensions, unemployment insurance and housing assistance. Those are the big ones.

Of course, this public largesse is funded by taxpayers. Personal income taxes target high earners, who typically contribute far more money than they draw out of the system. Modern states also collect an enormous amount of cash from corporate taxes. Consumption-based levies like VAT, fuel surcharges and sales taxes bring in the rest.

Deficit spending is a huge problem. Most countries spend more than they bring in, and waffle about capital projects, while allowing un-budgeted overruns on social services. Politicians just want to be popular and give things away, they don't care about overall debt to GDP issues, or fiscal sustainability.

The good news is that the rate of growth of spending on social services has slowed. There is a limit to what's affordable and appropriate in every country. In many cases, private sector providers do a much better job.

Byron's beats

I was in San Francisco recently and saw the self-driving Waymo cars whizzing around. I can't wait for driverless cars to go mainstream. Your time is finite, so being able to do other things while you get driven around in your own vehicle will be valuable.

Safety is the main concern. Waymo has started releasing all their safety statistics on their site. After 22 million passenger-only miles, they are building a sizeable database that should be taken seriously.

I am not surprised that the Waymos were safer than human drivers on every metric. If you still need convincing, take a look for yourself.

Michael's musings

Last week, JP Morgan announced that it would impose an 80-hour workweek limit for its junior investment bankers. Since Covid, most of Wall Street's big investment banks have been tweaking their employment policies to reduce burnout and ensure they can attract top talent.

In JP Morgan's case, they already have a policy in place that bankers get one weekend off every three months. That's not very generous!

Bloomberg columnist Matt Levine chatted about the topic last week - Bankers' hours are still pretty bad. He gives some good insight into the industry as a whole, including how AI can do a lot of the work of junior bankers. His main point is that bankers work these long hours so that they can get an intimate understanding of the industry and their clients very quickly. Effectively getting five years worth of experience, in only two years.

I don't think companies need to regulate the hours worked by the top 1% of society. If people want to work long hours, they will. In this case, employees are being paid very well to be there, and they are trying to one-up their colleagues.

As Levine points out, Bank of America put limits in place, along with self-reporting of hours worked. What happened is that junior bankers just underreported the hours worked to HR, but their team still knew all the time spent in the office.

Bright's banter

Mark Zuckerberg appeared on the "Acquired" podcast and spoke about his evolving perspectives on taking responsibility for Meta's issues. He's been reflecting on the value of apologies, especially when they haven't yielded the expected results.

Over the years, Zuckerberg had taken public-wide responsibility for several major crises, such as election interference and privacy violations but he now questions this approach. In his view, some criticism is politically motivated.

Zuckerberg notes that Meta's strategic direction, capital spending plans and cost management efforts always attract intense scrutiny. He's determined to focus more on long-term initiatives like AI and mixed reality, signalling a pivot from the crisis management mode of the past few years.

I enjoyed this conversation. Check it out on your podcast player: Acquired - Mark Zuckerberg.

Linkfest, lap it up

People are living longer than previous generations. Birth rates are also falling, meaning it makes sense for society to work longer - China raises its retirement age.

Pets are part of the family. Urban populations have fewer children - Dog strollers outsell baby strollers in South Korea.

Signing off

Asian markets are down this morning, with Japanese stocks leading the MSCI Asia-Pacific index lower. Appliance manufacturer Midea Group made a splash on its Hong Kong stock market debut, jumping 9.5% after raising $4 billion.

In local company news, African Rainbow Capital wrapped up its June year-end with an 8.5% boost to its intrinsic net asset value per share, reaching R12.38. The standout performers in its portfolio were Tyme Bank and transport specialist Linebooker, which both broke even. GOtyme expanded to 3.6 million users in the Philippines.

US equity futures are slightly in the green pre-market. The Rand is trading at around R17.64 to the greenback.

All the best