Market scorecard

US markets drifted around yesterday, looking a bit lost, before closing lower. Weaker-than-expected job openings data suggested that the labour market is weakening quite quickly, so the probability of a 50 basis point rate cut this month has risen.

In company news, Nippon Steel rebounded after a three-day losing streak, on news that Joe Biden plans to block its $14.1 billion bid to acquire US Steel. In response, US Steel shares plummeted 17%. Elsewhere, the Nordstrom family plans to take their department store chain private in a transaction worth $3.8 billion. Finally, the biggest gainer in the S&P 500 was Tesla (+4.2%). It's not clear why that happened, but you should buy an electric car.

In short, the JSE All-share closed down 0.29%, the S&P 500 fell 0.16%, and the Nasdaq was 0.30% lower. Boo!

Our 10c worth

One thing, from Paul

There's a big fight going on at Volkswagen, one of Germany's largest corporations. The picture below shows a crowd of angry workers, represented by their labour unions, facing off against a team of executives in suits, at the AGM yesterday in a massive factory hall in Wolfsburg.

The bosses say that Volkswagen needs to shut down factories because European car sales have been anaemic since Covid. Productivity is low and wages are high. They've been hurt by competition from Tesla and other Chinese-built EV imports. People have been using public transport and delaying car purchases. They made 9 million vehicles in 2023 but actually have the capacity to turn out 14 million.

The union reps aren't having it, naturally. CEO Oliver Blume was heckled when he argued for the cuts. They say that "workers shouldn't have to suffer for management blunders". Many held up signs or chanted "we are Volkswagen. You are not"

Well, they are wrong. The company belongs to its shareholders. I'm impressed at the way that shareholder capitalism forces companies to become efficient. Unlike governments and state-owned enterprises, publicly-owned corporations have to change or die. Making losses is not an option.

This does not mean that it's a good time to buy Volkswagen shares. The stock price is down around 15% this year, and 70% since 2021, but could get cheaper still.

Michael's musings

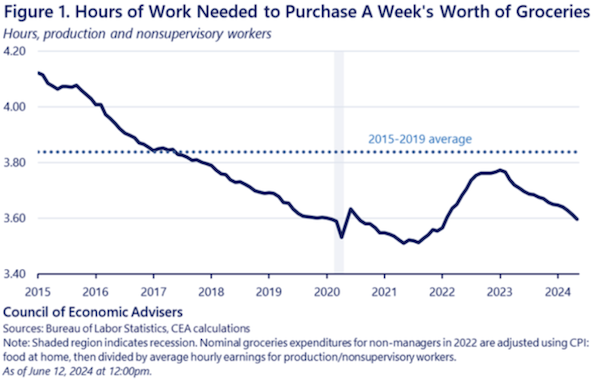

A good way to measure society's progress is to check the economic outcome of each hour worked. As society advances, the average person should be able to buy more things with fewer hours worked. Arguably, the ultimate sign of a wealthy society is growing leisure time for its population.

Have a look at this great graph shared by the guys from the Animal Spirits podcast - What is Wealth? Visit the link, they have found many interesting graphs.

Unsurprisingly, when global inflation spiked in 2022, the average person's purchasing power dropped. It's worth noting that wages eventually responded to the new price level in the economy, and workers won back their purchasing power. The reversion took time though, which is why volatile inflation is a bad thing for lower-paid workers.

Technology is making society more efficient, which means for every hour worked, we as a society produce more, which in turn allows people to be paid more. I would be interested to see a similar graph for South Africa.

Bright's banter

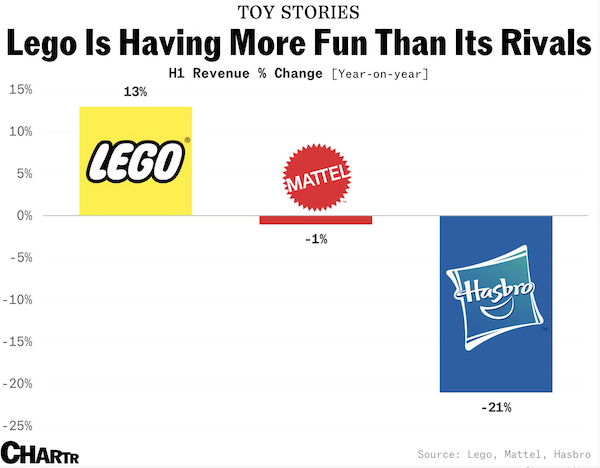

Danish company Lego is the world's largest toymaker. They just posted record-breaking first-half sales of 31 billion Danish kroner ($4.65 billion) and a 26% rise in operating profit to Danish kroner 8.1 billion.

This growth is even more impressive given that the broader toy market has been in decline, with industry giants like Mattel and Hasbro reporting sales drops of 1% and 21%, respectively.

Despite being over 90 years old, Lego's appeal remains strong, with its iconic sets, like Lego Star Wars, still performing well 25 years on. The company is also expanding its product range, launching around 300 new sets in the first half of 2024, including popular lines like the Botanical Collection, which has resonated with older consumers. They are also investing in digital partnerships, including a lucrative collaboration with Fortnite and Nike.

Lego emphasises its eco-friendly initiatives, with 30% of the resin used in the first half of 2024 coming from a blend of recycled or renewable sources. This company gives off good vibes.

Linkfest, lap it up

Millennials started their careers in weak labour markets. They lagged Gen Xers and Boomers, but new data suggests they have surpassed both - Retirement looking good for millennials.

Investors can learn a lot from sports. Have you read the essay titled "Winning the loser's game" by Charlie D Ellis? - More lessons from tennis.

Signing off

Asian stocks recovered partially from Tuesday's selloff, with the MSCI Asia Pacific Index climbing 0.5%. Taiwan's Taiex index looks best (+1%), thanks to a minor rebound in chipmaker stocks. We like that country, it should be fully independent from China.

In local company news, Woolies has reported a 16.8% drop in headline earnings per share for the 53 weeks ending in June. Market conditions remain challenging in both South Africa and Australia, but online sales have perked up. Woolies has done a lot of things right lately, but unfortunately, it takes forever to turn around a big retailer.

US equity futures are slightly lower pre-market. The Rand is trading at around R17.87 to the US Dollar.

In the words of Mr Spock, live long and prosper.