Market scorecard

US markets got out of the wrong side of the bed yesterday and ended deeply in the red. Shares of chipmakers were the worst affected, maybe because they've gone up the most in 2024. Both major indices dropped over 2%, marking their worst start to September since 2015.

The sell-off was probably due to a disappointing US manufacturing report, which heightened fears of an economic slowdown in the world's largest economy, prompting a broad risk-off sentiment among investors.

In company news, Molson Coors was the top performer in the S&P 500, up 5.4% for no particular reason. Over in Europe, Volkswagen is weighing the possibility of shutting down factories in Germany, a move that would be a first in the company's 87-year history, and a big risk to a three-decade-old agreement with workers. Elsewhere, Boeing shares dropped another 7.3% after Wells Fargo downgraded the company to a sell-equivalent rating.

At the end of a tough day, the JSE All-share was down 1.59%, the S&P 500 flopped 2.12% lower, and the Nasdaq lost 3.26%. Ouch.

Our 10c worth

One thing, from Paul

Are the share prices of stocks "right"? What does it mean if a company's shares trade normally, in line with the overall market for months, then either screams higher, or falls in a heap? Does that mean that the market was "wrong" before?

In my view, it's best to assume that at any given moment in time, the prices of large, liquid, listed stocks are about right, given the presence of lots of buyers and sellers, all the widely known risks, and the rough estimates of future earnings suggested by their management teams. In other words, markets are mostly efficient, and usable information about their prospects is already baked in.

Stocks are never too cheap or too expensive, they are always just right on the day. If you have an alternative theory, the market is right and you are wrong.

That does not mean that a company's prospects can't change. They usually do, and often by a lot. In hindsight, all stock prices are wrong.

Michael's musings

Yesterday, Stats SA announced that the local economy grew 0.4% quarter-on-quarter for the second quarter this year. Does that sounds okay? If you are like me, these frequently updated stats don't mean all that much, I want to know how we did compared to a year earlier. By that measure, our economy is only 0.3% bigger. That's weak.

In the middle of 2023, our economy shrank, and we have only now recovered that lost ground. In fact, our economy is only fractionally bigger than it was before Covid hit. A shockingly sad statistic.

The good news is that all signs point toward some good growth numbers in the quarters ahead: (1) There is optimism that the GNU will be mildly effective, resulting in increased capital expenditure. (2) The two-pot retirement system comes into effect this month, which should see a surge in short-term consumer spending as people scramble to access some of their retirement savings. (3) Fuel prices continue to come down, giving consumers more money to spend on other items. (4) Interest rates will be cut on 19 September.

Our economy desperately needs growth. A few good quarters will make people believe again, which should then spur on more even growth.

Bright's banter

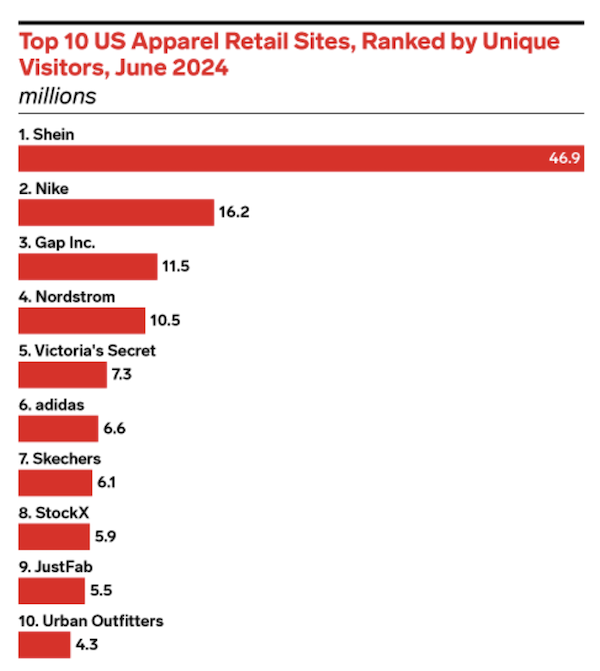

Shein dominated the US apparel retail market in June, leading with 46.9 million unique visits according to Comscore.

Its popularity in the US has been fuelled by aggressive advertising campaigns. Shein spent between $300 million and $400 million on marketing and customer acquisition in 2023, as estimated by Bernstein analyst Robin Zhu.

Interestingly, data from Tinuiti in March 2024 indicates that Shein shoppers are less likely to finalise an apparel purchase compared to Amazon shoppers. It's worth noting that Comscore's data does not include unique visits to Amazon since it's not exclusively an apparel retailer.

I'm glad to see Nike doing well at number two on the list, ahead of big retailers like Gap, Nordstrom, Victoria's Secret and Adidas.

Linkfest, lap it up

China is investing heavily in energy generation. The country leads the rest of the world in capacity addition - 11 new nuclear reactors under construction.

Buying a new iPhone is exciting. It's a pain when you need to wait for it to download all the new updates before it works - Try out Apple's new in-the-box iPhone updating machine.

Signing off

Asian markets are looking horrible this morning. The MSCI Asia-Pacific index is down over 2% and chip giants like TSMC and SK Hynix fell at least 4% each.

In local company news, Pepkor has announced its acquisition of Shoprite's furniture business, which includes over 400 stores across Southern Africa, in a deal valued at up to R4 billion. Shoprite's furniture business has an interesting history, starting in 1997 when the retailer purchased OK Bazaars' 187 stores and 22 Hyperamas for just R1.

US equity futures are lower again in pre-market trade, but not by much. The Rand is back at around R18 to the US Dollar.

Let's hope things go better today.