Market scorecard

US markets rallied on Friday, closing out the month of August on a positive note. A late surge in the final 10 minutes of trading sent all eleven sectors of the S&P 500 into the green, helping the broad market index to a fourth consecutive month of gains. For the record, it's up 19.1% for the year to date, which is very satisfactory.

Data out on Friday showed that the core personal consumption expenditures (PCE) price index increased mildly, so a Fed rate cut in mid-September is now a foregone conclusion.

In company news, Intel was the biggest gainer (+9.5%) in the S&P 500 on a report suggesting a new turnaround plan could be in the works. Pfft, good luck with that. Elsewhere, Ulta Beauty fell 4.0% after the cosmetics giant smudged its full-year forecast.

On Friday, the JSE All-share closed down 0.58%, the S&P 500 flipped up 1.01%, and the Nasdaq also ended 1.13% higher.

Our 10c worth

Michael's musings

On Wednesday night, Nvidia released their quarterly results - probably the most anticipated of any company on the S&P 500. There were videos on social media of people gathering at bars in Manhattan, but instead of watching their favourite sports team, they were watching Bloomberg to hear about how much the company had grown. The stock closed at $125.61 on Tuesday, but is down about 5% since then at $119.37, which is weird because the company smashed expectations.

For the quarter, Nvidia reported $30 billion in revenue, up 122% from a year earlier. The all-important data centre division grew by a staggering 155%! Overall growth was diluted by the now much smaller gaming division. Earnings per share came in at $0.64, an increase of 152%. Nvidia is sitting on $35 billion in cash, which it plans to mostly use on share buybacks, as the board authorised a $50 billion share repurchase program.

All this impressive growth means the market has very high expectations for Nvidia. The share currently trades at a forward PE of 42, meaning the market forecasts another doubling of profits in the next few years. The tech titans have announced tens of billions in capex spending, so Nvidia won't have a demand problem over the next two years. The real question is what will happen once their customers are done with this round of capex. Will Nvidia still have the demand to justify this market cap? Will the big tech companies refresh their hardware or will other companies take up the slack?

Nvidia argues that demand won't be an issue for years to come. New AI models will need 10-40 times the current computing power, which will require the use of chips not even created yet. If Nvidia still has a massive technological lead two years from now, the company will be the only game in town.

As shown in Paul's piece below, Nvidia has tremendous profit margins. Some argue that the margin is vulnerable to competition, but Nvidia disagrees. The company's message to customers is, 'save more by spending more on Nvidia chips'. Having the fastest and most energy-efficient chips around saves money. Nvidia also estimates that the return on investment of their most expensive chips is less than 1 year - for every $1 spent on an Nvidia chip today, it can generate $5 in revenue over the next four years.

Nvidia is a high-risk holding that is currently delivering the required level of top-line growth to justify its share price.

One thing, from Paul

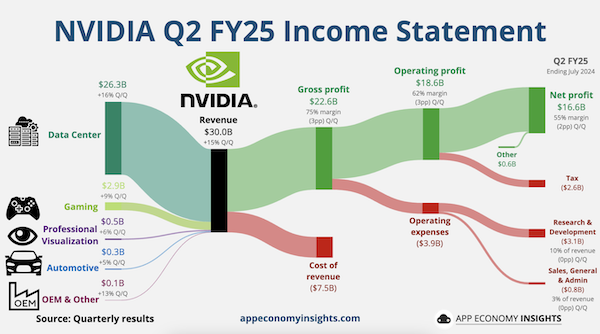

A Sankey diagram is a visualisation used to depict a flow from one set of values to another. They are often used to depict the financial results of large companies. By showing revenues on the left, costs in red falling out the bottom and resulting profits in green on the right, you can quite easily see how a business is doing.

Consider the delicious chart of Nvidia's recent quarterly results below. That big green profit tube is an absolute unit. It looks like a giant vegetable!

To echo Michael's comments above, the major observations are as follows. (1) Most of the revenues come from the data centre business, and everything else is very small, other than gaming. (2) Expense items like cost of revenue, operating expenses and tax are pretty trivial. (3) Net profit is huge, at a gross margin of 55%.

We recommend that investors hold on to the Nvidia shares that they own already.. Those who don't own them, can buy them at current levels.

Bright's banter

Apple and Nvidia are in talks to invest in OpenAI as part of a new fundraising round that could value the ChatGPT creator at over $100 billion. Thrive Capital is leading the round and Microsoft is likely to increase its shareholding.

Microsoft's involvement continues its role as a major investor in OpenAI, having invested $13 billion since 2019 for a 49% share of the AI startup's profits.

Apple's investment in OpenAI would be unusual, as it typically does not invest in outside companies. However, it highlights their commitment to ensuring access to advanced AI technologies amid fierce competition.

Both Apple and Nvidia have been increasing their investments in AI; Apple internally and Nvidia by backing many AI startups. This development comes as Apple is set to launch its next-generation iPhones on Monday, with new AI tools expected to be a major highlight.

Linkfest, lap it up

Influencers have now outpaced traditional media. Independent creators get more eyeballs from their specific demographic - We're living in a new age.

Massive infrastructure is needed to power AI services. Developers are getting creative about where to build data centres - The history and future of server farms.

Signing off

Asian markets are mostly lower this morning. Stocks fell in China as factory activity contracted for a fourth straight month in August. The latest sales figures showed a worsening residential slump.

In local company news, clothing retailer Truworths reported 3.6% increase in full-year sales to R21.4 billion. The UK unit, "Office," stood out, growing by 21.8% in Rands and contributing R6.8 billion in revenue.

US markets are shut for Labor Day, so expect a quiet day for global markets. The Rand is trading at around R17.90 to the US Dollar.

Ok, it's September now, so officially Spring. It's time to be optimistic and friendly, go for it.