Market scorecard

US markets closed lower yesterday, with quiet trading on Wall Street in late summer, heading into a long weekend. Nine out of the eleven sectors in the S&P 500 ended the day in negative territory. Don't fret, the overall index has still gained 18% year-to-date, and the tech-focused Nasdaq is up 19%.

In company news, Berkshire Hathaway has joined an exclusive club of companies with a market value above $1 trillion, just in time for Warren Buffett's 94th birthday. Elsewhere, Nvidia delivered very impressive results but the share price fell 7% in late trading. They projected third-quarter revenue of $32.5 billion, slightly above analysts' estimates of $31.9 billion. Finally, CrowdStrike had good results and said its outlook remains strong even after causing a global IT outage last month. Its shares initially surged on the positive news but later gave up those gains.

At the end of normal Wednesday trade the JSE All-share closed down 0.63%, the S&P 500 fell 0.60%, and the Nasdaq was 1.12% lower.

Our 10c worth

One thing, from Paul

We write a lot about companies in this newsletter and their prospects for further top-line growth. We don't typically profile their CEOs.

For example, we have owned Visa shares since 2012 and we go on at length about their brilliant business model, and the way that they (and their competitor Mastercard) have moved humanity from cash payments at the point of sale, to electronic payments with cards, phones and other interfaces online.

Since 2012 Visa has had four CEOs. We've never made a fuss about any of them. That's because Visa is such a good business that it doesn't really matter who runs it.

For the record, they were Joseph Saunders (2007-2012), Charles Scharf (2012-2016), Alfred F. Kelly Jr. (2016-2022) and Ryan McInerney (2023-present).

The late, great Charlie Munger, Warren Buffet's partner at Berkshire Hathaway, once said "betting on the quality of a business is better than betting on the quality of management. In other words, if you have to choose one, bet on the business momentum, not the brilliance of the manager."

Byron's beats

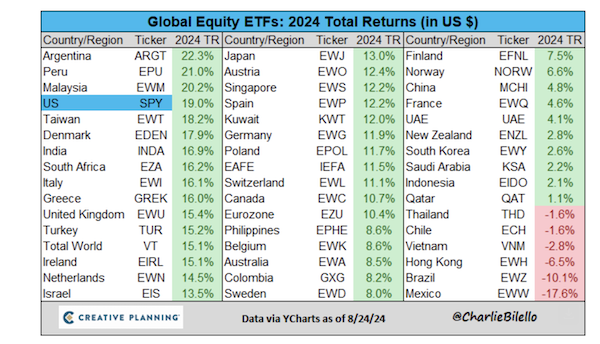

So far this year, the JSE is the 8th best-performing stock market on the planet. Our overall index is up about 16% in USD which is good going. Argentina is the best-performing country, partly thanks to their pro-business president, Javier Milei, who took the helm at the end of last year.

Having a buoyant stock market has so many positive knock-on effects for an economy. People are richer and therefore spend more. The wealth effect is real. Private companies start exploring the option of listing. A hot IPO market can make a lot of money for the general financial sector as well as provide liquidity for shareholders of those businesses, generally at better prices than in the private realm.

After many years of poor performance, it is great to see the JSE gather some momentum. Long may it last. Below is a table showing the returns of all the main stock exchanges this year so far. The mighty S&P 500 is in fourth place, up 19% (now 18% after dropping yesterday).

Michael's musings

Going into our elections earlier this year, the average yield on 5-10-year RSA government debt was just over 11%. International markets were a bit worried that the election would result in a populist government with little regard for financial prudence. When a country seems more risky, the yield on their sovereign debt goes up.

Since the election, the average yield has dropped from 11% to around 9%. The cheapest and easiest way to stimulate an economy is through confidence. The outcome of the voting was much better than many expected, and there is renewed hope that the GNU will get stuff done. As a result, international investors are willing to accept lower yields to hold South African debt. It also helps that global interest rates are poised to start dropping.

South Africa's annual interest bill on government debt is large. So, being able to issue new debt at cheaper prices is good news for all involved.

Bright's banter

Kioxia, the Japanese chipmaker that spun out of Toshiba's NAND flash memory business, is gearing up for a big IPO on the Tokyo Stock Exchange. It was taken private by Bain Capital in a $18 billion carve-out back in 2018 and has had a rough time since then, sustaining losses.

If everything goes as planned, Kioxia could achieve a market valuation north of $10 billion, making it Japan's biggest IPO this year - eclipsing even Tokyo Metro's expected $4.5 billion valuation.

Kioxia's financials are looking up, they posted a record profit of 70 billion Yen ($479 million) in the second quarter, putting them on track for about 300 billion Yen annually.

The Japanese stock market has performed strongly this year. The IPO might be priced at a discount compared to giants like Samsung and Western Digital, so it's likely to attract significant interest. Plus, the Japanese government's new tax-protected investment scheme should encourage more retail investors to jump in.

Linkfest, lap it up

Inequality is declining. Evidence shows ordinary citizens in the Western world are now richer and more equal than ever - The great wealth wave.

Apple is launching new products in ten days from now. The updated range is expected to have built-in AI capabilities - Analysts forecast $4 trillion market cap on Apple's AI play.

Signing off

Asian markets declined this morning, mirroring the downturn in Western markets. The MSCI Asia-Pacific index dropped by as much as 0.6%. Chipmakers were among the hardest hit, with TSMC down 2% and SK Hynix down 6%.

In local company news, Bidcorp reported strong financial results, exceeding expectations and boosting its share price by 4.5%. For the year-end, revenue increased by 15% to R225.9 billion, with earnings also rising 15%. The UK, New Zealand, and Australia were the standout regions for the food group, contributing significantly to its impressive performance.

US equity futures are slightly higher pre-market. Let's see where Nvidia and CrowdStrike actually trade when the cash market opens. Today, Dell, Autodesk, and Lululemon report their quarterly earnings.

The Rand is trading at around R17.80 to the US Dollar.

Enjoy your day.