Market scorecard

US markets cooled off yesterday after a strong rally that brought them within a whisker of all-time highs. A dip in equities broke what could have been the S&P 500's longest winning streak in 20 years. Nvidia, which had surged nearly 25% over six days, led the losses among megacap stocks, falling 2.1%. No big deal.

In company news, Johnson & Johnson is set to acquire V-Wave for $1.7 billion, to add more heart failure treatment systems to its medical technology division. Elsewhere, Bank of America dropped 2.5% after Warren Buffett's Berkshire Hathaway sold more of its shares. Lowe's cut its full-year guidance, predicting a drop in DIY projects at your home. Lastly, Netflix reached a new intraday record, surpassing $700 per share.

Here's the final lowdown, the JSE All-share closed down 0.02%, the S&P 500 fell 0.20%, and the Nasdaq was 0.33% lower. Sad face emoji.

Our 10c worth

One thing, from Paul

Nike is currently the worst-performing Vestact-recommended stock. It's down 21.5% year-to-date and has halved since November 2021. What a stinker!

Nike did have a good Olympics, and hopefully that will juice sales for the rest of the year. Their "Winning Isn't for Everyone" advertising campaign had huge exposure globally. US viewership of the games in Paris was 77% higher than Tokyo.

Amazing performances by high-profile Nike athletes really helped. Standout stars who received lots of attention on social media were basketballers LeBron James and Kevin Durant, rugby player Ilona Mher, soccer star Sophia Smith (below), sprinter Sha'Carri Richardson, golfer Scottie Scheffler, tennis player Qinwen Zheng, and Botswanan sprinter Letsile Tebogo.

Shares of Nike are a hold. We are hardy investors, that take a long-term view.

Byron's beats

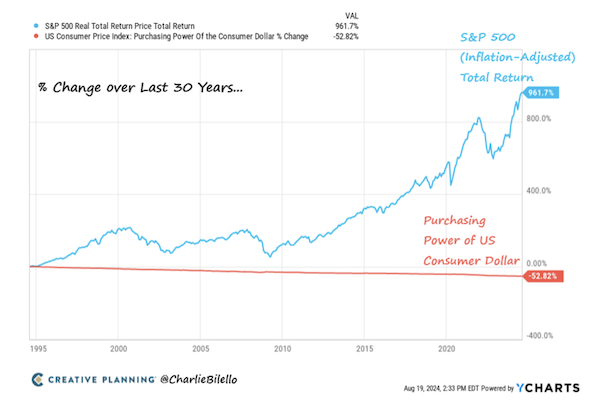

Since 1995, the purchasing power of the US Dollar has dropped by 53%. Over that same period, the S&P 500 is up 962% adjusted for inflation. Cash might be low-risk in the short term, but you are guaranteed to lose out if you hold it for a long time. A guaranteed loss sounds like a high-risk decision to me.

Stocks, on the other hand, can be high risk over the short term, but if you are invested in the right markets, they are very low risk in the long run.

I keep pointing this out because some of our clients label their Vestact portfolios as "higher risk" compared to a few of their other investments. I disagree; owning the biggest companies in the world that are based in the global centre of capitalism, and holding them for a long time, is not a high-risk investment.

Michael's musings

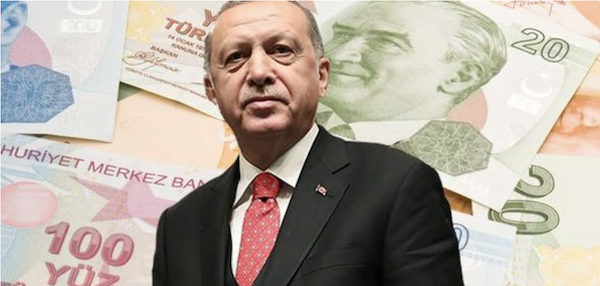

Turkey's central bank kept interest rates steady yesterday - at 50%. Yes, Turkish interest rates are an eye-watering 50%, but that is actually cheap, given that inflation is currently 75%. The country is a prime example of what happens when populist governments meddle in monetary policy.

Turkey's president, Recep Erdogan, believed that lower interest rates are the best way to combat inflation. He bullied their central bank into rate cuts, even as inflation was soaring. It took a sustained period of very high inflation for interest rates to finally move from 8.5% to the current 50%. Imagine being a business trying to navigate rapidly increasing prices coupled with steep interest rate changes.

In January 2020, Turkish interest rates were 11.3%, inflation was at 12.1% and it cost 6 Turkish Lira for a US Dollar. Fast forward to today, things are a mess, and it costs almost 34 Lira to buy one US Dollar.

The ANC has failed at many things, but we can be grateful that they have resisted the temptation to meddle with monetary policy.

Bright's banter

The Dallas Cowboys haven't made it to the Super Bowl in 28 years, but their value as an investment is undeniable. This is similar to the New York Knicks who are the second most valuable basketball franchise, but they haven't won a championship since 1973.

In 1989, Jerry Jones bought the Cowboys for $150 million. Today they've become the first pro sports franchise to surpass a $10 billion valuation, according to Sportico.

In 2023 alone, the Cowboys generated $1.2 billion in revenue, 50% more than the second-placed Los Angeles Rams, setting a new world record for a single season.

On average, NFL teams are now worth almost $6 billion, a 15% increase from last year. These juicy returns have mostly been enjoyed by rich individuals.

Linkfest, lap it up

Would you trust a Chinese car brand? South African consumers say yes - Chinese carmakers outselling Mazda, Land Rover, and Volvo in South Africa.

Hearing a story is a great way to learn something new. Morgan Housel has a few that get us thinking about life and business - Some little ideas.

Signing off

Asian markets are mostly lower this morning. Equity benchmarks fell in Hong Kong, Japan, mainland China, South Korea, and Taiwan, while they rose in India.

In local company news, Coronation has announced it will return approximately R800 million to shareholders through a special dividend of 153 cents per ordinary share. This windfall came after the asset manager won a court case against SARS, which accused it of underestimating taxes related to its Irish subsidiary.

US equity futures are in the green pre-market. The Rand is trading at around R17.83 to the US Dollar.

Farewell.