Market scorecard

US markets ended higher last night as traders gained confidence that the Federal Reserve will start to ease interest rates in September. A lower-than-expected rise in the US producer price index drove the rally. The tech sector led the gains, with standout performances from Nvidia (+6.5%), Tesla (+5.2%), Broadcom (+5.1%), and Meta (+2.4%).

According to CME data, interest-rate futures implied a 55% chance of a half-a-percentage-point cut in September. Chances of a quarter of a percentage point are much higher.

In company news, Starbucks saw its largest one-day gain ever, jumping 25% after announcing the replacement of CEO Laxman Narasimhan with Chipotle's CEO, Brian Niccol. In contrast, Chipotle's stock dropped 7.5% on the news. Meanwhile, Home Depot shares rose 1.3%, despite the company lowering its outlook for comparable store sales, citing the impact of high interest rates on home-improvement spending.

In summary, the JSE All-share closed up 0.49%, the S&P 500 rose 1.68%, and the Nasdaq charged 2.43% higher. Lovely!

Our 10c worth

One thing, from Paul

Some people are techno-optimists, expecting that all the world's problems will be solved by computer engineers. Others are downright sceptical of that claim. A small group is anxious that technology is actually making life worse, and may blow up the planet.

I'm in the first group, of cheerful optimists, always keen to see what technologists come up with next. Although I will acknowledge that progress is not always clear, and that there will be complications and setbacks along the way.

These fundamental beliefs will inform the way that you feel about a new trend, like artificial intelligence (AI). I think it's brilliant, and I'm happy to see the capital spending by tech firms on AI data centres. But grumpy pessimists sneer and call it "fancy autocorrect".

Decide for yourself by reading this recent blog post by Ethan Mollick which summarises the major advances in AI in the last 21 months, including nice examples.

He singles out these areas of significant progress: (1) image and video generation, (2) sound and music making, (3) text and report writing in business and academia, (4) corporate chatbots.

Byron's beats

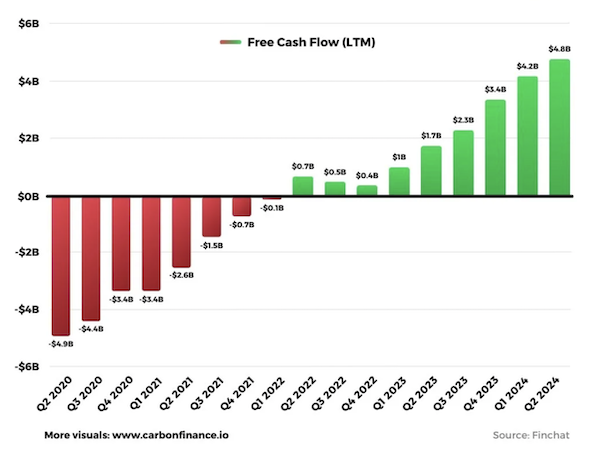

Dara Khosrowshahi has transformed Uber from a money guzzler into a cash cow over the last four years. Take a look at the image below from Carbon Finance (another cool email subscription service) which illustrates Uber's free cash flow from 2020 to the most recent quarter of 2024.

Khosrowshahi took the CEO position at Uber in 2017 from maverick founder Travis Kalanick. In hindsight the timing was perfect. The pioneering company needed a crazy genius in the beginning, to withstand pushback from taxi associations around the world and to bulldoze through a tough regulatory environment.

Once that very expensive goal was achieved in many areas, it was time for a more mature head to cut costs and focus on profits. Which is exactly what has happened.

We have 29 Uber shareholders in our client base, who have enjoyed the ride. Lovely to see.

Michael's musings

Amazon is making it easier for its US customers to shop while scrolling social media apps. The e-commerce company announced a partnership with TikTok and Pinterest, where Amazon customers will be able to buy items directly through the respective platforms.

If a user sees something that they like on TikTok, they can tap, and buy it. Simple. There is no need to click through multiple links, to try to find what you are looking for. The linked accounts will allow US users to see real-time pricing, Prime eligibility, delivery estimates, and product details.

For Amazon, the goal is to remove as many barriers as possible to the shopping experience. For TikTok and Pinterest, they will receive a referral fee every time someone clicks through. It is a win-win, and a win for consumers.

Bright's banter

On Holdings reported on a stellar second quarter yesterday. It had record sales of 568 million Swiss Francs, up 27.8% from last year, driven by strong demand across all channels. Gross profit margin increased to 59.9%, with net income hitting 31 million Swiss Francs. Yes, they're profitable!

Wholesale sales surged 29%, and direct-to-consumer sales rose 30%, bolstered by successful new store openings in key cities like Paris and Hong Kong, and the impressive performance of its newly-launched mobile app.

Noteworthy product launches, including the Cloudrunner 2 and On x Loewe Cloudtilt 2.0 sneakers (my personal favourite), fuelled this growth, with the latter being named a top product on Lyst's quarterly ranking.

Regional performance was robust, particularly in Asia-Pacific, where sales soared an eye-popping 73.7%. Apparel sales jumped 63%, showing strong momentum in this growing category.

Given these positive trends and strategic brand initiatives, On reaffirmed its full-year outlook, anticipating net sales of 2.3 billion Swiss Francs.

Linkfest, lap it up

Microsoft and Palantir are teaming up. The companies will provide cloud and AI capabilities to the US defence and intelligence departments - You can't put a price on national security.

Mental health is very important. In the last decade, it has worsened in high school students but things appear to be turning - Some signs of hope in youth mental health.

Signing off

Asian markets are mixed this morning, lol what else is new? The MSCI Asia-Pacific index is up for the fourth consecutive session. Equity benchmarks gained in Japan, South Korea, and Taiwan, but fell in Hong Kong and India. Mainland Chinese stocks declined after data revealed that bank loans to the real economy contracted for the first time in 19 years.

In local company news, Santam reported that its half-year profit is anticipated to increase by up to 45% when it announces its interim financial results at the end of the month. This is interesting considering that short-term insurers have faced some adverse trading conditions, including floods. They've probably been hiking premiums.

US equity futures are edging higher in pre-market trade. The Rand is at R18.13 to the greenback.

Today we'll see earnings reports from Cisco and UBS, and an important US consumer price index release.

Let's hope that the good times continue.