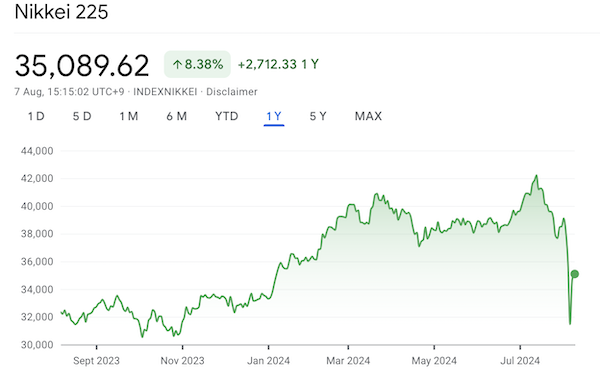

Market scorecard

Yesterday was one of those frustrating days when the market opened nicely in the green but faded to close in the red. Some weaker-than-expected earnings didn't help sentiment in an already skittish market.

In company news, the server company Super Micro dropped 20% due to contracting profit margins and slowing growth. The company also mentioned that they only expect Nvidia's new generation Blackwell GPU chips to ship in significant volumes next year, a little later than expected. Those comments resulted in Nvidia shares dropping 5%. Elsewhere, Warner Bros Discovery is down 10% in after-hours trade as it writes off $9 billion in value linked to its cable and satellite TV networks. The stock is down 72% since it merged in early 2022, not great considering that its CEO, David Zaslav, is regularly near the top of CEO compensation lists.

In summary, the JSE All-share closed up 1.18%, but the S&P 500 flopped by 0.77%, and the Nasdaq slipped 1.05% lower.

Our 10c worth

One thing, from Paul

Vestact-recommended biopharma company Amgen had second quarter results out on Tuesday. They were largely in line with market expectations, other than a very modest shortfall on profits. They made $4.97 per share instead of $5.00, I kid you not.

Revenues were up nicely, by 20.2% year-on-year, to $8.4 billion, thanks to a big acquisition in late 2023. Without the addition of the Horizon products, sales rose 5%.

Amgen makes a wide range of crucial drugs for treating cholesterol, psoriasis, inflammation, arthritis, cancer and other rarer, unfortunate conditions. Sales of most of their products were fine, with a surge from both Prolia and Repatha, which was especially pleasing. If you want to know what those two drugs do, email me. Or Google it.

The Amgen share price has done well in the past year (up about 25%) thanks mostly to a new product in their pipeline called MariTide. The full name is Maridebart cafraglutide - lol, thanks for asking.

MariTide, is a "multi-specific molecule that inhibits the gastric inhibitory polypeptide receptor (GIPR) and activates the glucagon like peptide 1 (GLP-1) receptor". In short, MariTide is a once-a-month injection for weight loss, that is dramatically effective, and acts very quickly.

A phase 2 study of MariTide is ongoing in obese adults with, or without, type 2 diabetes. The results so far have been fantastic. They are moving on to the final, phase 3 study shortly.

If all goes well, MariTide will go on sale in 2027, and become a blockbuster. That would make them a third entrant to the obesity drug market currently dominated by Eli Lilly and Novo Nordisk.

We always tell you that investing requires patience. Holding Amgen shares is a good example of what we mean.

Byron's beats

The great Japanese carry trade crash of Monday 5 August 2024 was fascinating and will be studied for many years to come. It caused the Nikkei to plunge by 12%, its second worst day in history. Then, it recovered by 10% the next day. For a large and mature stock market like the Nikkei, this kind of volatility is almost unthinkable.

Here's how it happened. Large institutions were borrowing Japanese Yen, a usually very stable currency, at next to zero interest rates, sending it to the US and buying dollar-denominated bonds at yields of between 4 and 5%. An easy way to make money with very little risk. It sounds like a sure thing.

But that is what happens when easy money is made in markets, it get's crowded and the risk of a bubble popping event starts to increase. There is no such thing as a free lunch. Last week the Bank of Japan increased rates by more than expected and the Yen spiked higher.

If you are using USD to pay back Yen-denominated loans, those borrowings suddenly became a lot more expensive. Everyone ran for the exits at the same time and the rest is another piece of stock market history. If you avoided that nonsense and it all passed you by, well done, you lived to tell the tale.

Michael's musings

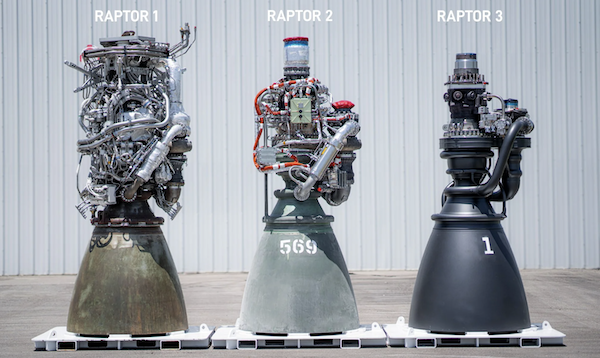

Consider the picture below that compares SpaceX's original Raptor 1 engine to the recently announced Raptor 3. I was astounded at how much Elon Musk and his team of engineers have been able to do in less than a decade. They have managed to take a very complicated design and refine it into something simple.

The Raptor 1 engine produced 185 tons of thrust and weighed 3.6 tons. By comparison, the latest version produces 280 tons of thrust and only weighs 1.7 tons. Wow. A saving of two tons per engine becomes very significant when considering the Starship is equipped with 39 of them.

Humanity is getting ever closer to Mars.

Linkfest, lap it up

Mozambique borrowed money to build fishing patrol boats. They issued 'tuna bonds' but the funds never resulted in any fishing - Mozambique to recover $825 million from fraud.

Google recently announced some new hardware. There is an upgrade to the Nest smart thermostat and a new TV streaming device - The Google TV Streamer might be the Apple TV 4K rival we've been waiting for.

Signing off

All Asian markets have been bobbing between red and green this morning. US initial jobless claims data out this afternoon should give fresh direction to global markets. Next week is the big release of US CPI, which will most likely set the tone of markets for the rest of August.

In local company news, Glencore announced that it won't spin off its coal mining business, as previously considered. The global view of 'dirty' assets like coal has softened recently. Spinning off the division won't reduce the amount of coal mined each year, so they might as well keep the mines, and use the cash to finance the broader Glencore empire. In other company news, MTN announced last night that the group will report a large half-year loss on 19 August. Part of the problem is the plummeting value of the Nigerian Naira. The shares are up 5% this morning.

US futures are pointing to the market opening very marginally higher, but that could change when US economic data is released at 14:30 SA standard time. The Rand is holding steady at $/R18.35.

If you are in South Africa, enjoy the Women's Day long weekend. We will be back in your mailbox on Monday morning.