Market scorecard

US markets dipped on Tuesday as investors shifted focus from tech giants to smaller companies. The Nasdaq has now dropped 9% from its peak. Major tech stocks like Nvidia (-7.0%), Qualcomm (-6.7%), Broadcom (-4.5%), and Tesla (-4.1%) were among the biggest losers. Ouch.

In company news, Microsoft shares slipped 2.7% after-hours as its cloud unit Azure grew slightly slower than expected (still, by 29% year-on-year, very good). Elsewhere, Merck shares slid 9.8% after the drugmaker lowered its earnings forecast for the year. Finally, Procter & Gamble shares declined 4.8% following a sloppy sales report from the maker of Tide detergent and Pampers diapers.

At the end of the day, the JSE All-share rose 0.23%, but the S&P 500 lost 0.50%, and the Nasdaq stumbled by 1.28%.

Our 10c worth

One thing, from Paul

Tesla had quarterly results out a week ago, and they were patchy, to say the least. This is a stock that hit an all-time high above $400, and is now trading around $225 per share.

Demand for Tesla's current range of electric cars is waning, in line with most producers in the EV sector. EV sales growth has been slowing steadily for three years. What's going on, and why are we still holding on to this one?

We own Tesla shares because we want to be invested in next-generation energy and transportation systems. In addition to having an all-electric, fully-global EV production system that churns out profits at decent margins, Tesla is also a market leader in batteries, robots, software and robotaxis.

Tesla's engineering and marketing teams will roll out a new lower-priced Model 2 car soon, which should spur further buying. Owning 5% of the global car market would be achievable.

Tesla's energy infrastructure business should continue its strong run. Self-driving software can be sold to other car companies, in addition to being deployed in a fleet of semi-autonomous cars, in partnership with a company like Uber. The value of these latter divisions will probably be the main driver of the Tesla share price in years to come.

One more thing. Elon Musk seems to be wasting a lot of his time on Twitter (sorry, X) complaining about illegal immigration, transgenderism and federal debt levels, and campaigning for Donald Trump. That's not great at all, obviously, we'd far rather he was running the company. But he does have a great track record as an industrialist.

We have 400 clients who own Tesla shares, at various entry levels. Some have long-term profits and others have (unrealised) losses on the position. Provided it's not too large in your portfolio, it's a good one to hold, and see how this turns out.

Byron's beats

Over the last few weeks the markets have been a bit rough. If you are new to equity investing, it may have come as a bit of a surprise to see these wild swings. As Paul mentioned recently, you need to be mentally prepared for markets to fall because it happens regularly, swiftly and without advance warning.

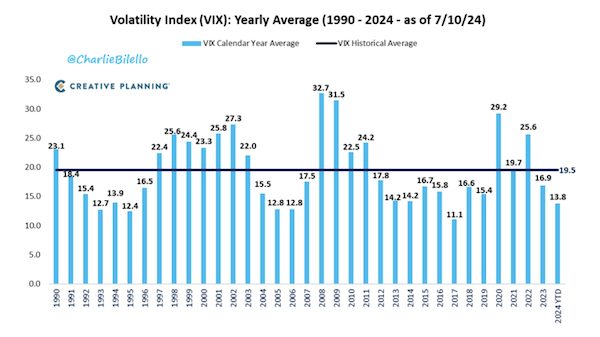

Take a look at the image below from Charlie Bilello, which shows the average volatility of the US market since 1990. You will notice that 2024 has been a lot quieter than usual. Market volatility is the norm and the calm markets we have had so far this year are atypical.

We enjoyed it while it lasted. The market may calm down again or it may not. As always, we will take things as they come.

Michael's musings

Apple and Google have a good working relationship. For example, Google pays Apple around $20 billion a year to be the default search engine on Apple devices. In return, Apple uses Google Cloud for all of its online storage.

Yesterday, Reuters reported that Apple used Google's tensor processing unit (TPU) chips to train some of the AI functionality coming to Apple devices in October. The decision is notable because they didn't use Nvidia chips and because it probably means that Apple will be more entrenched in Google's ecosystem.

From my understanding, companies use these less powerful, non-Nvidia chips for more basic AI activities. The Nvidia chips are too expensive and too difficult to get hold of to use for anything but very high-end processing.

Given Apple and Google's relationship, it is interesting that Apple has opted to use OpenAI for some of its on-device functionality instead of Google's Gemini. Some analysts speculate that Apple, in time, will give users the option of which AI engine they want to use.

Bright's banter

"Deadpool & Wolverine" crushed box office expectations this past weekend, raking in $211 million in North America alone and breaking several records along the way. The film also grossed almost $440 million worldwide in just three days.

This latest Marvel movie scored the 8th biggest opening weekend of all time, dethroned "Despicable Me 4" as the top debut of 2024, and set a new record for an R-rated movie.

While it may not always win over critics, Disney-owned Marvel's deliberate effort to connect the Deadpool threequel and other projects with earlier content through in-jokes, easter eggs, and cameos has proven commercially wise. This approach strengthens its lead as the biggest franchise of all time.

Since "Iron Man" debuted in 2008, the Marvel Cinematic Universe has evolved into a blockbuster powerhouse, releasing 34 films in 16 years with a total global box office gross exceeding $30 billion as of this weekend.

Linkfest, lap it up

GLP-1 weight-loss drugs have a long list of benefits. Here's another one - Semaglutide-based medicines reduce tobacco cravings.

How smart are domesticated pets? After centuries of selective breeding, they really get us - Dogs might have evolved to read your emotions.

Signing off

For some reason, Asian markets are on a tear this morning. Equity benchmarks ripped higher in Hong Kong, India, Japan, mainland China, and South Korea. Only Taiwan ebbed. Samsung reported its fastest pace of profit growth since 2010.

In local company news, Shoprite posted a 12% bump in annual sales, hitting R241 billion, thanks to 292 new store openings. Their Checkers Sixty60 on-demand platform also did well, with online sales jumping 58.1%.

US equity futures are edging higher pre-market. The Rand is trading at around R18.30 to the US Dollar.

Today, companies like Mastercard, Meta Platforms, and Arm Holdings are set to release their quarterly earnings reports.

Over and out.