Market scorecard

US stocks started well yesterday, but ended in the red. The first week of earnings season hasn't wowed investors unfortunately. Indices are close to record highs, so we need some blowout numbers to sustain the strong performance from the first half of the year.

In company news, Tesla braked hard, falling 7.8% after reporting weak profits. Car sales were slow, but their services and battery sales are accelerating. In contrast, Spotify boomed by 12.0% after announcing its second consecutive quarterly profit. Alphabet declined by 2.2% after-hours, even though its Google search and YouTube revenue beat expectations.

Here's the lowdown, the JSE All-share closed up 0.27%, the S&P 500 fell 0.16%, and the Nasdaq slipped just 0.06%.

Our 10c worth

One thing, from Paul

Does reading the Vestact newsletter make you feel like investing with us? I hope so. The best salesperson never looks like a salesperson.

Hopefully our views are not stereotyped or predictable. We aim to explain complicated things in simple ways.

The quirkier our content, the more daily notes you'll read. We aim to keep you entertained and leave you feeling full of energy. After reading these messages, we want you ready to leap up and run around the block, not go back to bed.

Byron's beats

There are many great infographic newsletters out there at the moment that cover international news and events. One of my more recent subscriptions is The Outlier, which covers mostly South African data.

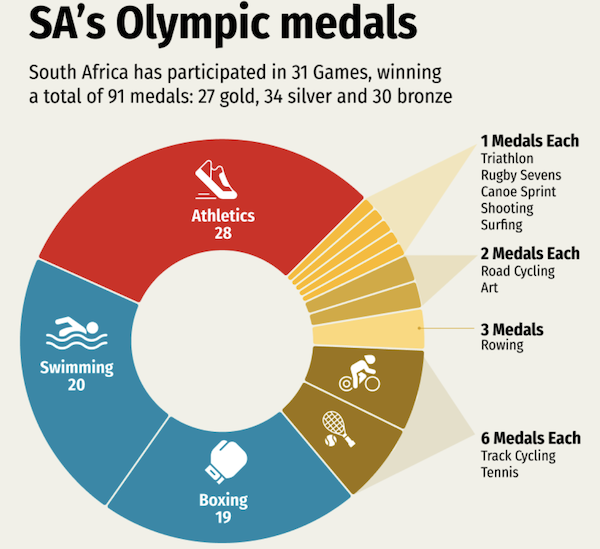

Take a look at the cool graphic below which looks at all the medals South Africa have won at The Olympic Games since 1912. I like how they have broken down the different events into a pie graph.

Go subscribe to their free newsletter here, you won't be disappointed.

Michael's musings

Universal basic income is a concept that has been gaining traction over the last few years. The idea is that with the rise in overall wealth, society can afford to pay everyone over the age of 18 some sort of basic income.

The money would ensure that no one lives below the poverty line. It could also help spur a boom in the creative industry. More people might become artists because they don't have to worry about where their next meal is coming from.

The rise of AI could displace many jobs and make business more productive so it makes sense that Sam Altman and OpenAI have been part funders of the research. This study pointed towards positive societal outcomes. The biggest issue remains finding ways to fund a full-scale program. You can read about the results here - The largest randomised basic income experiment in the US to date.

Bright's banter

Cybersecurity startup Wiz has declined a $23 billion takeover bid from Google's parent company, Alphabet. They are opting instead to pursue an IPO. Co-founder Assaf Rappaport acknowledged the challenge of wizzing on such a generous offer but emphasised the company's commitment to achieving $1 billion in annual recurring revenue and going public.

The deal would have significantly surpassed Google's previous largest acquisition, and doubled Wiz's current $12 billion valuation. Their cloud-based security solutions make it a strong competitor against industry giants like Microsoft and Amazon.

Antitrust issues and investor concerns influenced Wiz's decision to forgo the deal. This move comes amid increased scrutiny on big technology companies, with the (annoying) Justice Department pursuing antitrust lawsuits against Google for its search engine and digital advertising businesses.

Linkfest, lap it up

The internet used to be a fun place to wander about. Over-optimisation is slowly killing the creativity - How much content slop can you tolerate?

Nike has released a new advert ahead of the Olympics. This one is a cracker - Winning isn't for everyone.

Signing off

Asian markets are mostly lower this morning. Equity benchmarks dropped in Hong Kong, India, Japan, mainland China, and South Korea. Taiwan's stock market is shut due to Typhoon Gaemi.

In local company news, Cashbuild reported full-year results with a 3% increase in revenue. Meanwhile, property owner Vukile received a EUR8.10 per share cash offer for its 28.7% stake in Spanish mall operator Lar Espana Real Estate Socimi. Kumba's half-year results showed a 26% drop in headline earnings due to faltering metal prices.

US equity futures are lower pre-market, thanks to those post-earnings stock declines. The Rand has weakened to around R18.41 to the US Dollar.

Today we'll see earnings reports from Thermo Fisher Scientific, Chipotle, IBM, and ServiceNow. None of those are in our portfolios, but they are still important companies.

That's all. Now go for a run around the block.