Market scorecard

US markets experienced another broad decline on Friday, undermined by a global technology outage that shut down airports, banks and disrupted businesses worldwide. Most sectors in the S&P 500 fell, resulting in the index's worst week since April. The "Magnificent Seven" group of megacap stocks ended the week about 5% lower. In a general selloff, the market leaders often get hit hardest, due to profit-taking.

In company news, CrowdStrike shares dropped 11% after an update caused widespread outages for millions of Microsoft Windows users. Their CEO later confirmed that it wasn't a hack, but a problem with a version update. More on that tomorrow. Elsewhere, Eli Lilly closed 1% up after Mounjaro received regulatory approval in China as a weight loss drug, less than a month after a similar therapy from Novo Nordisk was approved. That country is heavily affected by obesity, and competition there will be fierce.

On Friday, the JSE All-share closed down 0.51%, the S&P 500 fell 0.71%, and the Nasdaq was 0.81% lower. Bruising!

Our 10c worth

Byron's beats

On Thursday evening, Netflix released good-looking results which beat both revenue and earnings guidance. Most importantly they smashed net paid subscriber estimates of 4.7 million. The actual number came in at 8.1 million new subscribers, which is just phenomenal given that some think that the streaming industry is now ex-growth. Global subs have risen to an eye-popping 278 million.

This business has matured and is making some solid profits. Net income was $2.15 billion for the quarter, with operating margins of 27%. The only real negative was forward guidance for subscribers, which they think will slow down next quarter as the tailwind of their password-sharing clamp-down starts to fade.

The company is not sitting still. Their content creation machine is still churning out hits. They have launched a beta version of a new TV homepage in order to maintain their lead in show recommendations. The advertising business is also growing nicely; 45% of all new sign-ups are opting into the ad tier. They have great infrastructure and algorithms to recommend the right shows, and I am sure they can do the same with adverts.

All this innovation, along with a consistent flow of good content, has resulted in the ultimate compliment, an increased engagement of existing subscribers. They also seem to be growing in the right regions, India was their second biggest country for paid net additions.

Netflix is a well-run business operating in a very competitive sector. We are holders of the stock.

One thing, from Paul

I was away last week on a family holiday in Cortona, Italy. It was hot and dusty there, full of olive trees, stone treasures and wonderful restaurants. Just epic! The locals make gestures from the elbows.

As it happened, it was a rather newsy 7-day period. In quick succession, Donald Trump got shot at, Biden got Covid, riots disrupted the Copa America final in Miami, SpaceX and Tesla announced plans to quit California, riots in Kenya brought the country to a standstill again, Bangladesh is going up in flames, Israel is bombing the Houthis, Trump said Taiwan should get lost, a CrowdStrike computer glitch took down most of the world's IT systems, and finally, Biden quit the race.

Vladimir Lenin, once said, "There are decades where nothing happens; and there are weeks where decades happen". A good line, even if he was one of the worst humans that ever lived.

The right strategy in times like these is to do nothing. Long-term investment success requires a cool hand and a steady temperament. The best way to view world events is with calm detachment. Don't get worked up, and maintain your sense of humour. In the long-run, these events are not really that important. Progress is ongoing.

Michael's musings

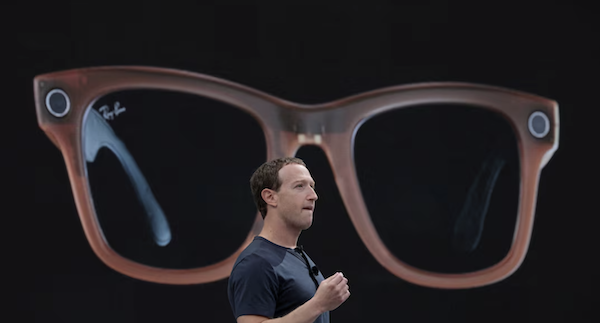

Last week, the Wall Street Journal reported that Meta was in talks to buy up to 5% of EssilorLuxottica, the company that owns leading sunglass brands like Ray-Ban. A few Vestact clients have been long-term holders of their shares, even before the merger of Essilor (French, lens maker) and Luxottica (Italian, frame designer).

Meta and Ray-Ban have been working together for a few years developing smart-glasses, so the tie-up makes sense. The first generation product launched in 2021 and the more successful second generation arrived in October 2023. The rumours are that the third generation of their smart-glasses will come out in the middle of 2025.

With the rise of AI, using 'smart' headgear makes more sense. Meta's competition is Apple's Vision Pro, which appeals more to an indoor setting. I can easily envisage people buying stylish AI-powered Ray-Bay glasses. The forecast is for society to do more things on screenless devices. Imagine something along the lines of calling an Uber, ordering supper from Sixty60 and turning your apartment's central heating on, all from your glasses. Also, taking photographs of daily activities is a breeze.

Bright's banter

Athletes are shifting away from traditional endorsements with giants like Nike and Adidas, seeking independence with smaller brands that align with their values instead. While landing a deal with these big names used to be a goal for many, recent changes in the industry have led some to feel disillusioned.

Brands like Nike have tightened their focus on only the most marketable athletes, leaving those with smaller payments or restrictive contracts. This has opened the door for startups to step in. Athletes like Isaac Okoro, who signed with Holo Footwear, appreciate the chance to create their own signature shoes and even receive equity in the company.

New footwear manufacturer Fctry Lab, founded by former Adidas-Yeezy innovator Omar Bailey, is also gaining attention. Bailey is creating custom cleats for NFL players, allowing them to design footwear tailored to their specifications. Jalen Ramsey's JR 1 cleats have already made waves in the league.

Moreover, brands like Sokito are attracting athlete investors, offering eco-friendly soccer cleats made from sustainable materials. With nearly 50 athlete shareholders, Sokito gives players a voice in design decisions - a rarity with bigger brands.

As athletes recognise their value and seek unique partnerships, there's a growing market for startups that can provide personalised, purpose-driven deals. This trend could lead to more innovative products that resonate with individual athletes, reflecting their personal styles and values.

Linkfest, lap it up

In large corporates, it can be easy to just coast. This employee took it to a new level - Man skipped work for six years, and was only found out when he was nominated for a long service award.

Ships are avoiding the Red Sea route. Middle Eastern conflict is making it impossible for cargo ships to travel - In Africa, they have to endure perilous weather.

Signing off

The market outlook today is murky. How might a Trump vs. Harris contest for the US presidency affect markets? Elections in that country are always close, and there are 107 days to go. US equity futures have edged lower pre-market.

Asian markets are mixed this morning. Benchmarks in Hong Kong and India rose, while those in, Japan, mainland China, South Korea, and Taiwan dropped. Chip-related stocks and other tech companies continue to be under pressure.

In local company news, after a couple of delays, Fourways Mall owner Accelerate Property Fund eventually released financials that showed a 0.8% drop in rental income, citing rising interest rates, inflation, and load-shedding as the main culprits.

The Rand is currently at around R18.29 to the US Dollar.

Tomorrow is a big day for US earnings releases, with Google, Tesla, and Visa reporting numbers.

Have a productive week.