Market scorecard

US markets pulled back from their all-time highs as concerns over tighter US restrictions on chip sales to China triggered a selloff in the semiconductor industry. Major players like Nvidia, Advanced Micro Devices, and Broadcom led the decline, causing the closely watched semiconductor index to drop by 6%. As a result, ASML fell over 10%, despite reporting strong orders for the remainder of the 2024 financial year.

In company news, EssilorLuxottica has reached an agreement to buy the streetwear label Supreme from VF Corp. for $1.5 billion in cash. This acquisition adds another lifestyle brand to the French-Italian eyewear giant's portfolio, which already includes well-known names such as Ray-Ban and Oakley.

In short, the JSE All-share closed down 0.83%, the S&P 500 fell 1.39%, and the Nasdaq was 2.77% lower.

Our 10c worth

Bright's banter

Johnson & Johnson jumped 3.7% on a tough day for markets after reporting second-quarter numbers that beat revenue and profit expectations. Second-quarter sales came in at $22.4 billion reflecting a 4.2% year-on-year gain. Adjusted earnings for the quarter were $2.82 per share, 11 cents above analysts' estimates.

Drug sales slightly exceeded forecasts, while medical device revenue fell short. Darzalex (multiple myeloma treatment), Tremfya (psoriasis treatment) and prostate cancer drug Erleada, all outperformed analysts' projections in the second quarter.

Investors are concerned about declining sales of Stelara, an anti-inflammatory drug soon facing cheaper competition in the US and Europe, and ongoing litigation over claims that the company's talc-based baby powder caused cancer. CFO Joe Wolk acknowledged these challenges but expressed confidence in the company's ability to manage them and continue growing even after Stelara loses patent exclusivity.

J&J now expects to generate operational sales of $89.4 billion in 2024, up 6.4% from last year, boosted by recent acquisitions. These include the $13 billion purchase of Shockwave Medical, the acquisition of Proteologix in June, and the experimental eczema treatment NM26 from Numab Therapeutics in July.

To address the talc litigation, J&J has proposed a settlement plan to pay around $6 billion over 25 years. Plaintiffs have until July 26 to vote on the deal, and J&J needs at least 75% of claimants to approve it. The company is cautiously optimistic about the settlement's approval after two previously failed attempts.

Since splitting from its consumer health division last year, J&J is left with its higher-margin pharmaceutical and medical devices businesses. The company has spent nearly $35 billion on acquisitions in the past 18 months and plans to continue pursuing strategic deals to expand its pipeline.

We remain positive on the long-term prospects of the newly streamlined J&J, which is now fully focused on life-saving drugs and medical devices. The divestment of the low-margin retail business has removed a significant drag on this pharmaceutical giant, allowing it to concentrate on its core strengths.

Byron's beats

A prospective client recently asked me: "If you publish your holdings on your brochure, what value add do I get by paying your fee?" It is a good question. In fact, we are even more transparent than that; we have all our recommended shares on our website, and our daily newsletter is free.

Here was my answer. "Half our job is to help clients pick stocks, the other half is to hold their hands throughout the journey, especially the tough times. If you were doing this on your own, it would have been very tempting to have sold Meta or Nvidia when they went down more than 50% in 2022. We are a springboard for your thoughts and emotions. We also directly tell clients when it is time to sell a stock, we do not make those recommendations public. Getting into the market is the easy part, staying the course and knowing when to sell is the hard part, and that is where our expertise really counts."

There may be a few of you reading this right now who do "borrow" our ideas and use a cheaper platform. We don't mind, but you are still missing out on a lot of advice and service.

Michael's musings

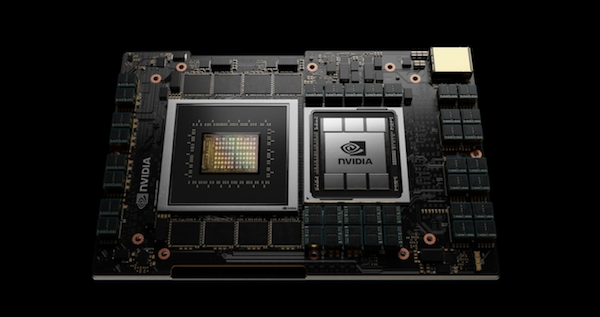

The surge in the Nvidia share price has been incredible to watch. They make the best chips around, and customers can't get enough of them, which allows Nvidia to charge massive profit margins. I recently saw two articles highlighting the lengths that customers will go to get their hands on Nvidia chips.

Andreessen Horowitz, a leading US venture capital firm, revealed that they have stockpiled Nvidia chips worth a couple hundred million dollars. The idea is to give the startups in their portfolio access to these chips. It is a great way to give their companies an advantage over the competition, who will probably be hamstrung by limited access to Nvidia chips. Having the stockpile also gives Andreessen Horowitz more bargaining power when it comes to investing in new startups.

Another article spoke about the black market in China for Nvidia's latest chips. The US has placed restrictions on what chips can be sold to China. It means that the only chips in China now, have been smuggled in, and trade at a massive premium on the black market.

As long as buyers keep going to extraordinary lengths to get their hands on Nvidia chips, the Nvidia share price should continue to do well.

Linkfest, lap it up

Are you a benefit or burden? Relationships are complex and humans are unpredictable - Are you taking more than you give?

Mount Everest has a trash problem. Clean-up efforts this year have cleared 11 tons so far - Mount Everest is littered with frozen garbage, including a few bodies.

Signing off

Asian markets are mixed this morning. Benchmarks in Hong Kong, India, and mainland China rose, while those in Japan, South Korea, and Taiwan continued to fall as the darling chipmaking tech companies took a dive - Tokyo Electron crashed 9.4% and SK Hynix fell by 4.3%.

In local company news, Seriti Green's R4.8 billion wind farm in the Mpumalanga coal belt is set to be completed by mid-2026. The first phase of the 155MW Ummbila Emoyeni wind energy facility is currently under construction and expected to be finished by mid-July 2026. Upon completion, it will be the largest wind farm in the country at 900MW, supplying 75% of the power requirements for Seriti's coal mines. Ironic but we like it.

US equity futures are in the green pre-market. The Rand is currently at around R18.26 to the greenback.

Today, TSMC, Netflix, and Intuitive Surgical report their quarterly numbers. Investors will want to see how Netflix's advertising efforts are progressing.

Happy Mandela Day, if you are in a position to do so, go do something positive.