Market scorecard

US markets closed up yesterday, with major indices hitting new highs as investors bet on upcoming interest rate cuts from the Fed. This optimism spurred a move into riskier assets. Over the past four sessions, the Russell 2000 outperformed the Nasdaq 100 by nearly 12 percentage points, a milestone not seen since 2011.

In company news, UnitedHealth climbed 6.5% after they posted stronger-than-expected earnings and revenue, and maintained their 2024 guidance. Elsewhere, Bank of America's shares surged 5.3% as the bank reported quarterly results that exceeded Wall Street expectations and projected an improvement in lending income for the second half of the year. In addition, Morgan Stanley rose 0.9% following the announcement of a 41% year-over-year profit increase, driven by higher investment banking revenue. Lastly, Charles Schwab fell 10% after the brokerage reported a decline in bank deposits and net interest revenue, along with a rise in short-term borrowing.

In summary, the JSE All-share closed down 1.25%, the S&P 500 rose 0.64%, and the Nasdaq was 0.20% higher.

Our 10c worth

Byron's beats

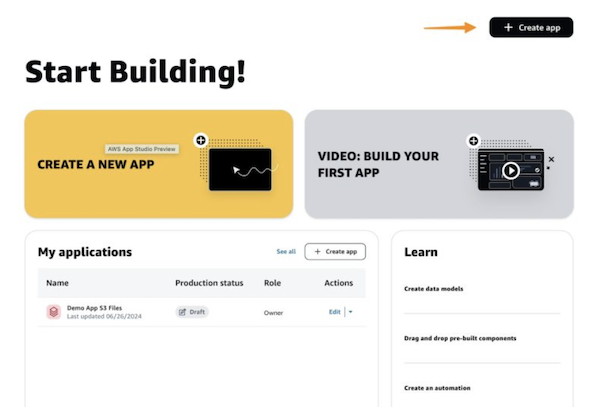

Amazon recently debuted the AWS App Studio, which is a generative AI tool that allows developers to build apps using verbal or written prompts. That sounds pretty amazing. You simply tell Amazon what you want and the AI will write the code.

Naturally, the technology to both build and to host the applications will sit on top of the AWS cloud infrastructure which is secure and reliable.

Imagine all the time saved by not having to code every small detail of an application. I can only assume that developers will pay a lot of money for access to this wonder technology, assuming it works as well as they hope it does. Time will tell.

Michael's musings

It still blows my mind that people in the US wrote 3.5 billion cheques in 2022, down from 19 billion in 1990. Chatting with a few folks who live there, it seems that paying via cheque is easier in many cases than loading their banking details because there are so many different banks around. I suppose it is similar to the Japanese economy being heavily reliant on the fax machine. What is even more foreign to us in South Africa, is that people are happy to post cheques.

Using a cheque is a slow, expensive and unsafe payment method. It is part of the reason that South Africa stopped accepting them as of 1 January 2021, although, many banks stopped issuing cheque books years earlier.

Target, a large US retailer, stopped accepting cheques on Monday, as many shoppers had stopped using it as a payment method already. It seems part of the move is motivated by speeding up check-out times. Can you imagine being at the till, with a long queue behind you, and you need to write out all the details on a cheque. Much easier to tap your iPhone and move on.

Bright's banter

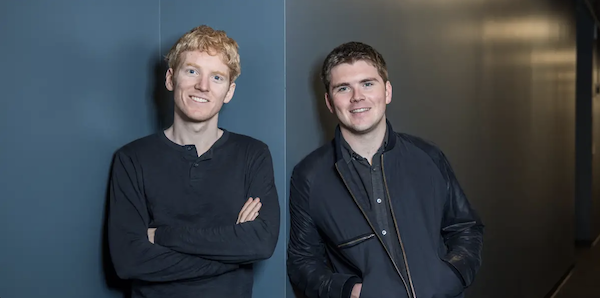

Stripe's valuation has ticked up to $70 billion after Sequoia Capital offered to buy shares from investors looking to cash out. The offer values the shares at $27.51 each, targeting up to $861 million worth from limited partners in its funds from 2009 to 2012.

This move follows a recent valuation of $65 billion in February, up from $50 billion in March 2022 but still well below its $95 billion peak in 2021.

Stripe was founded back in 2010 by the Irish brothers John and Patrick Collison after they dropped out of MIT. The two brothers turned seven lines of code into a business that operates in 46 countries and processes payments in 135 currencies, with clients like Amazon, Salesforce, and Lyft. Today, Stripe competes with PayPal and Adyen in the payments processing space.

Linkfest, lap it up

Tesla Germany has been buying lots of Ikea coffee mugs. The company has bought enough that each employee could have 5 mugs - Some 65 000 coffee mugs have apparently gone missing from Tesla's plant in Germany.

Car dealerships love it when you finance a car. New tech and old tactics have made buying a car a death march of deception - Escape from the box.

Signing off

Asian markets are mostly higher this morning. Benchmarks in Hong Kong, Japan, and mainland China rose, while those in South Korea and Taiwan fell. India is shut for the Muharram/Ashura holiday.

In local company news, luxury giant Richemont reported a 1% increase in sales, reaching EUR5.3 billion for the quarter ending in June. While most regions saw growth, Asia Pacific experienced an 18% sales contraction. This was due to a significant 27% decline in China, Hong Kong, and Macau. Higher sales in South Korea and Malaysia could only partially offset the drop.

US equity futures edged lower pre-market. The Rand is currently at around R18.09 to the US Dollar.

Today, ASML and J&J report their quarterly numbers. J&J has been lackluster for the last few months. Hopefully a strong set of numbers this afternoon will see the share price come to life again.

Have a good one.