Market scorecard

US stocks edged higher yesterday, as a Donald Trump presidency is seen as a good thing for markets. The assassination attempt on Trump has boosted his chances of winning the White House, with betting markets saying his odds are now over 70%.

The S&P 500 hovered near its all-time highs, while the Russell 2000, representing smaller companies, added 2% yesterday. Trump Media surged 31%, and conservative video network Rumble rose 21%. Trump's improved odds boosted oil producers, gun makers, and private prisons. We could be witnessing the return of the Trump trade. He might be good for markets, but his brand of politics is bad for global cohesion.

In other company news, Apple reached a new high after being named a top pick at Morgan Stanley, while Nvidia fell. Goldman Sachs Group gained 2.6% as it reported a profit surge, but plans to slow down buybacks. Lastly, BlackRock saw $51 billion in client inflows to its long-term investment funds in the second quarter, bringing the firm's total assets under management to a record $10.6 trillion, solidifying its position as the world's largest money manager.

Yesterday, the JSE All-share closed up 0.57%, the S&P 500 rose 0.28%, and the Nasdaq was 0.40% higher.

Our 10c worth

Byron's beats

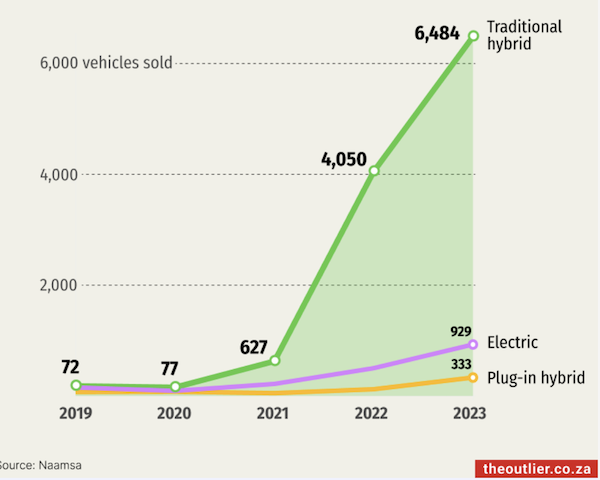

South Africa does not yet have the infrastructure to support the ownership of electric vehicles. If you only drive to work and back, you can make it work by recharging at home. But going on road trips would be very difficult. For this reason, hybrid cars have become quite popular. These cars run on a battery at lower speeds, and then get charged by braking and the petrol engine when the car is going fast, meaning there is no need to plug in and charge.

According to The Outlier, nearly 6 500 hybrid vehicles were sold in South Africa last year. Take a look at the imagine below. As you can see, electric vehicle sales have been dismal so far.

I expect this will change as the infrastructure improves. In my opinion, full electric is the future and SA will have to embrace it sooner or later.

Michael's musings

As China's growth slows and the country becomes a bit more isolated on the global stage, companies are turning their focus to India to be the next major driver of revenue growth. In the case of Apple, that is happening already. Bloomberg reported yesterday that Apple's India revenue is up 30% over the last year.

The growth is coming off a small base, sales went from $6 billion to $8 billion, which is still well short of the company's $72 billion in revenue from China. India is a massive market, with around 700 million smartphones, and Apple only accounts for 3.5% of the phones in use. That sounds like an opportunity to me.

Apple has shifted its focus to India by opening up company-run iStores, instead of relying on third parties. They are also manufacturing more iPhones there. I'm sure that Apple's advertising spend in India is exploding too. Given the size of the market, Apple could easily grow revenue by 30% in the country for the next decade.

Bright's banter

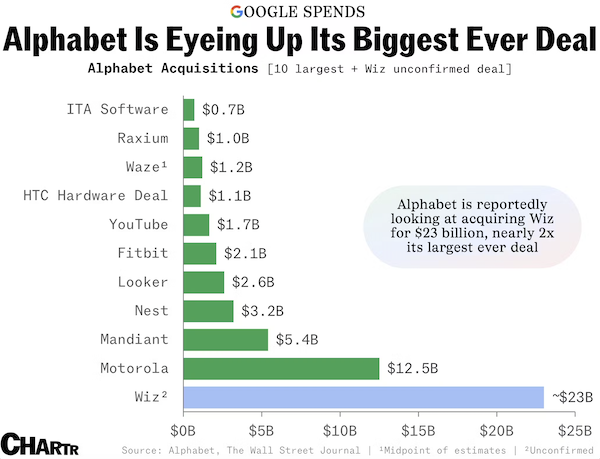

Alphabet is in advanced talks to buy cybersecurity startup Wiz for around $23 billion, which would be its largest acquisition ever. This acquisition comes amid intense antitrust scrutiny on Alphabet and aims to boost its cloud computing efforts, where it lags behind competitors.

Wiz, founded in 2020 by Assaf Rappaport and colleagues, has seen its valuation soar, raising $1 billion earlier this year at a $12 billion valuation. The company, which provides cloud cybersecurity software, hit $350 million in annual recurring revenue in 2023 and is backed by major VC firms like Sequoia Capital and Andreessen Horowitz.

If the deal goes through, it would provide a rare exit for investors in a tough IPO market. Wiz's founders previously sold their startup Adallom to Microsoft in 2015 for $320 million before launching Wiz.

Alphabet, valued at over $2 trillion, has been more conservative in acquisitions compared to its peer Microsoft. Notable past deals include Motorola Mobility for $12.5 billion in 2012, Fitbit for $2.1 billion in 2021, and Nest Labs for $3.2 billion in 2014. Alphabet has been expanding its cybersecurity business, including a $5.4 billion purchase of Mandiant two years ago.

In cloud computing, Alphabet is a distant third behind Amazon and Microsoft but is investing heavily, with cloud revenue growing 26% last year and the unit reporting its first operating profit.

Linkfest, lap it up

Have you heard of the Wallenberg family? In the 1970s, 40% of Sweden's industrial workforce was employed by one of their companies - From banking to global industrial dominance.

Apple has always been very protective of its ecosystem. EU regulators took exception to the fact that only ApplePay can access the NFC hardware on the iPhone - Apple reaches deal with EU regulators to open up mobile payments system to rivals.

Signing off

Asian markets are mostly higher this morning. Benchmarks in India, Japan, mainland China, South Korea, and Taiwan rose, while those in Hong Kong fell. There's still some uncertainty lingering in the air with regards to potential Sino-US trade wars as Trump gained in the polls.

In local company news, The Bell family's investment holding company IA Bell (AIB) made an offer to buy all of the shares it doesn't already own in the heavy equipment designer, manufacturer, and distributor of Bell Equipment, and delist the company from the JSE. Bell shares popped 46% on the news as the deal valued the company at around R5 billion. Elsewhere, Sasfin shares also surged 45% yesterday after the company dangled R1 billion to buy minority shareholders.

US equity futures edged higher pre-market. The Rand is currently at around R18.21 to the US Dollar.

Today, UnitedHealth, Bank of America, Morgan Stanley, and Charles Schwab report their quarterly numbers.

Happy Tuesday.