Market scorecard

The US stock market continued its upward trend last week, while treasuries recovered their losses for the year after new economic data bolstered expectations that the Federal Reserve will cut rates in September. On Friday, around 80% of the stocks in the S&P 500 rose, pushing the index back above the 5 600 mark, following a dip in the previous session. Smaller companies outperformed the larger megacap stocks, which resulted in their best week of 2024 so far.

Wells Fargo dropped 6% due to higher-than-expected costs impacting its results. JPMorgan Chase saw a 1.2% decline in its shares after reporting lower income. Citigroup's profit increased, but the bank set aside more provisions for potential losses in its credit card business, causing its shares to fall by 1.8%.

In other company news, Alphabet is in talks to acquire cybersecurity startup Wiz in a $23 billion deal, its largest purchase on record. Elsewhere, Ericsson reported strong second-quarter results, with sales and profitability exceeding expectations. The boost came from increased licensing revenue and successful cost-cutting measures.

On Friday, the JSE All-share closed up 0.73%, the S&P 500 rose 0.55%, and the Nasdaq was 0.63% higher.

Our 10c worth

Byron's beats

From time to time, I like to share a publication that I find helpful and interesting. I am currently really enjoying the email updates from a site called Brilliant Maps. They are generally not finance-orientated, although occasionally, there are ones with some interesting economic data.

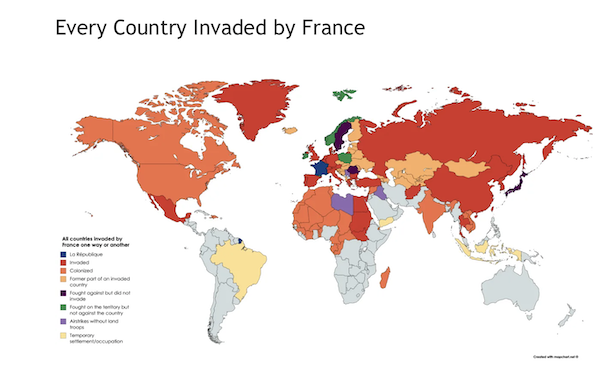

I personally enjoy the maps which tell stories of the past. Like the one below which points out every country that has been invaded by France. Fascinating.

If you love maps, like I do, go to the site and subscribe to the newsletter. They send one or two a week.

Michael's musings

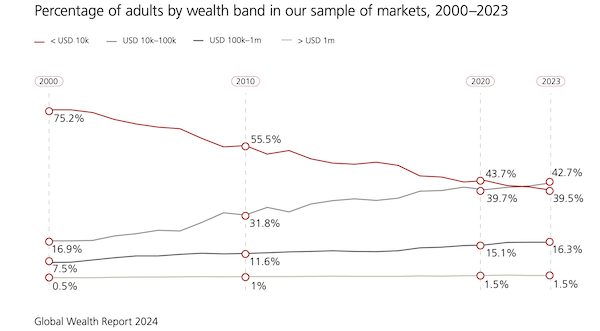

UBS recently released its annual Global wealth report. A key finding is that global wealth levels are increasing, and more importantly, the number of poor people is decreasing. Look how that red line below has dropped!

"Overall, global wealth has risen steadily since 2008, throughout recessions and financial crises: the only wealth band that is in constant decline is the lowest, while all others are steadily expanding."

Having more people with greater spending power is a good thing for share prices. It is also a good thing for society. The report notes that in faster-growing regions, wealth inequality tends to increase, which makes sense. They also note that even though wealth inequality increases in those regions, the overall society is still better off. In other words, it is much better to be poor in a fast-growing economy than a stagnant one with low inequality.

South Africa is a bit of an exception. Our inequality has got worse and our growth has been terrible. If I had to guess, having too many tenderpreneurs has only been good for a select few, but very bad for fostering economic growth. I'm hoping that our GNU and the NPA start to put more corrupt officials in jail.

Bright's banter

Shift Up, a game developer, saw its stock jump 18% on its first trading day in South Korea following an IPO that raised 435 billion won ($320 million), marking the largest IPO for a gaming firm in the country in nearly three years. The shares closed at 71,000 won, with the company selling nearly 7.3 million shares at the top of the marketed range of 60,000 won each. The IPO drew significant interest, with demand for 226 times the available shares.

This IPO is the first significant offering by a South Korean gaming developer since Krafton's $3.8 billion IPO in 2021. Shift Up, backed by Tencent Holdings as its second-largest shareholder, plans to use the IPO proceeds to diversify its game portfolio. Founded in 2013 by Hyung-Tae Kim, Shift Up is known for games like "Goddess of Victory: Nikke" and "Stellar Blade."

The IPO is the second-largest in South Korea this year, following HD Hyundai Marine Solution's $553 million offering. Listings in South Korea of at least $300 million have averaged a 62% gain on their first day over the past five years.

Shift Up reported a profit of 107 billion won last year, a significant turnaround from a loss of 7.1 billion won the previous year. Analysts highlight the company's strong intellectual property, diversified platforms, and highly successful titles as key growth drivers.

Linkfest, lap it up

We have a gambling problem. Mobile devices are making it much easier to be addicted to wagering - Smartphones and ubiquitous gambling go hand in hand.

Remember Moneyball? Similar tactics are being used in watersports - Number theorist Ken Ono is teaching Olympians to swim more efficiently.

Signing off

Asian markets are mixed this morning. Benchmarks in India and mainland China rose, while those in Hong Kong, South Korea, and Taiwan fell. Markets are shut in Japan as they observe Sea Day.

In local company news, Brait has managed to secure a restructuring loan from RMB and Standard Bank for three more years as part of its recapitalisation efforts. This comes as the company prepares to sell its stakes in Virgin Active health clubs and New Look clothing.

US equity futures are flat again pre-market. The Rand is currently at around R17.98 to the US Dollar.

This week, we're expecting earnings reports from some major players: Goldman Sachs, BlackRock, UnitedHealth, Bank of America, Morgan Stanley, ASML, TSMC, Netflix, and Intuitive Surgical.