Market scorecard

US markets inched forward last night, closing at another all-time high, with financial shares leading the gains. Jerome Powell's remarks to Congress confirmed that the Federal Reserve will cut interest rates this year. All 24 stocks in the KBW Bank Index gained, with JPMorgan, Citigroup, and Wells Fargo each rising by at least 1.5%. Among megacaps, Tesla (+3.7%) and Nvidia (+2.5%) shone.

In company news, Danish brewer Carlsberg has agreed to acquire London-listed soft drinks maker Britvic for GBP3.3 billion (approximately $4.23 billion). This move is part of Carlsberg's strategy to expand its presence in the non-alcoholic beverage market and reduce its dependence on beer sales. Elsewhere, BP Plc cautioned that "significantly lower" refining margins and a writedown on the value of a plant in Germany would dent future profits.

In summary, the JSE All-share closed down 0.20%, the S&P 500 rose just 0.07%, but still up for the sixth consecutive session, and the Nasdaq was 0.14% higher.

Our 10c worth

One thing, from Paul

The Wall Street Journal ran a feature article this week about Vanguard, the index-fund titan. It was not very complimentary.

Vanguard was founded by Jack Bogle in 1975 and now has assets under management of over $9 trillion. They invented the low-fee S&P 500 index-tracking mutual fund. Investors added $202 billion to Vanguard funds in 2023, and inflows are on track to beat that number this year.

Vanguard has had great products for 50 years, but terrible customer service. They consistently rank at the bottom of the list of large financial institutions in terms of the quality of their websites and apps, the efficiency of their call-centres, and the responsiveness of their email contact addresses.

Their new CEO, Salim Ramji (pictured below), plans to accelerate projects to improve tech and train staff. Their excuse to date has been their ingrained culture of keeping costs low.

The first prize is to have great products, low fees and excellent staff, but that's hard once a corporation gets very large.

Byron's beats

There are 3 critical investment edges you should have to beat the market, according to an investment blog I read. Informational: You know something others don't. Analytical: You understand data and identify trends. Behavioural: You can stay calm when others panic.

I would say the last two edges are by far the most important. Identifying strong and durable growth trends and investing accordingly is crucial for success. That needs to be coupled with a good temperament. You won't do well if you select the right stocks but sell them in a market downturn, or during a short-term pullback.

The first edge on that list is a tough one because knowing something others don't is basically impossible in the US-listed environment, unless you have insider information which is illegal. Frankly, I don't think it is necessary to know things that others don't. It may even be an unnecessary distraction.

Identifying trends early and having the stomach to ride the volatility is a good two-part recipe for success.

Michael's musings

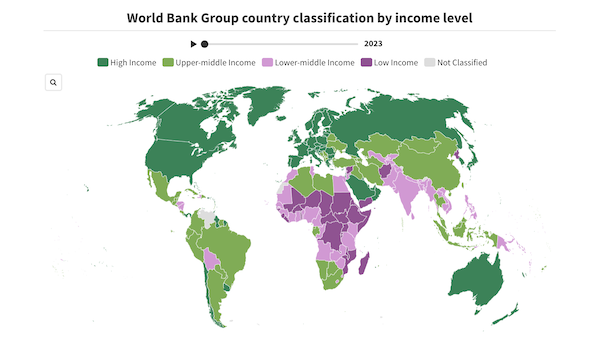

The World Bank just released its list of country classifications by income level, using a simple methodology. They take all the economic activity happening within the borders of the country, known as gross national income (GNI), and divide it by the number of people living there. This formula gives you the GNI per capita and is a way of determining whether the residents of a country are rich or not.

Interestingly, both Russia and Ukraine moved up the ranking, not down. In Ukraine's case, a combination of infrastructure spending and people leaving the country (population is down 15% since the start of the war), resulted in the GNI per capita increasing from the lower-middle-income to the upper-middle-income bracket.

The Russian economy has been on an absolute tear recently. Last year, GNI per capita increased by 11.2%. All the military spending has underpinned the economy, but other sectors have contributed too, trade (+6.8%), the financial sector (+8.7%), and construction (+6.6%). It seems global sanctions haven't done much. The war is now in its third year, things have normalised, and companies who fled Russia have been returning, or their gaps have been filled by others.

You can read the report here - World Bank country classifications.

Bright's banter

Hon Hai Precision Industry, also known as Foxconn, reported strong June-quarter sales driven by its expanding AI server business. The Taiwanese company posted June revenue of NT$490.7 billion ($15.1 billion), with a quarterly total of NT$1.55 trillion, up 19%. This outperformed analysts' expectations of a 13.8% rise.

Hon Hai's shares have more than doubled this year, reaching new highs in June, buoyed by the AI boom. The company's revenue growth from AI servers and data centre equipment is helping offset declining demand for consumer electronics.

AI momentum is great for Taiwan, highlighted by the success of the latest Computex event, attracting major US chipmaker CEOs.

Linkfest, lap it up

How long should it take for one to heal from grief? This man writes about his decade-long journey to recovery - In search of a nonexistent cure.

Data is central to our world. Researchers in Japan and in the UK managed to send 402 terabits per second along fibre optic cables - Four-fold improvement in data rate record.

Signing off

Asian markets are mixed this morning, as usual. Benchmarks in India and Japan cooled off, while Hong Kong, mainland China, South Korea, and Taiwan rose slightly. Baidu shares jumped up 11% in Hong Kong, driven by the increasing popularity of its robotaxi service, Apollo Go, in China.

In local company news, Zeder has agreed to sell its Applethwaite Farming Business, a major part of its fruit operations, to Vredenhof Beleggings for R190 million. Elsewhere, the Reserve Bank took a nearly R1 billion writedown on its stake in African Bank, after valuing the entire business at about R7 billion. That's been a long clean-up operation.

US equity futures are marginally higher in pre-market trade. The Rand is currently at around R18.14 to the greenback.

That's all from us. All the best.