Market scorecard

US markets squeezed into the green again yesterday, and the S&P 500 reached its 35th all-time high for the year. The index has remained remarkably stable, not dropping by more than 1% in a day since April. The Nasdaq also performed well, with Super Micro Computer, Intel, and AMD all up by over 4%.

In company news, Eli Lilly agreed to buy speciality drug company Morphic Holding for $3.2 billion. Morphic has promising drugs to treat bowel inflammation, and its stock rose 75% after the announcement. In other news, over 2 600 Boeing 737 jets registered in the US will need their oxygen generators inspected. Corning shares jumped by 12% after the company, known for making glass for TV screens and smartphones, increased its sales guidance.

At the close, the JSE All-share was down a tiny 0.02%, the S&P 500 eked out a 0.10% gain, and the Nasdaq was a more respectable 0.28% higher.

Our 10c worth

One thing, from Paul

As you know, the broad-market S&P 500 is at all-time highs. Some say that this move is suspect, because it's largely attributable to a small group of mega-caps that have flown higher. They are the usual suspects, Apple, Nvidia, Microsoft, Google, Amazon and Meta. Sometimes Tesla and Eli Lilly are added to that list. If you don't own these shares, you'll have badly underperformed the index.

Active fund managers with a "value bias", who are uncomfortable owning tech stocks and anything else that has gone up a lot recently, are moaning that this is a "dreadful market for stock pickers." Other sceptics, who don't want to do any work, just advocate giving up and buying the whole market, by loading up on S&P 500 index trackers.

Here at Vestact, we are feeling very pleased with ourselves, because we have picked stocks, and those have turned out to be the right ones.

Of course, this year's success is now in the past. We aren't taking a victory lap, because in this business you are only as good as your last 6 months of portfolio performance. We've crushed the last year and a half, but had a terrible 2022.

The real challenge is to position ourselves well for the next five years. Which stocks will lead the S&P 500 to a new, much higher level in 2030? Those are the ones we need to be accumulating now.

In my view, most of the current market leaders will still be in that top pack, plus a few other companies that are about to lift off, we are always on the lookout for those.

Byron's beats

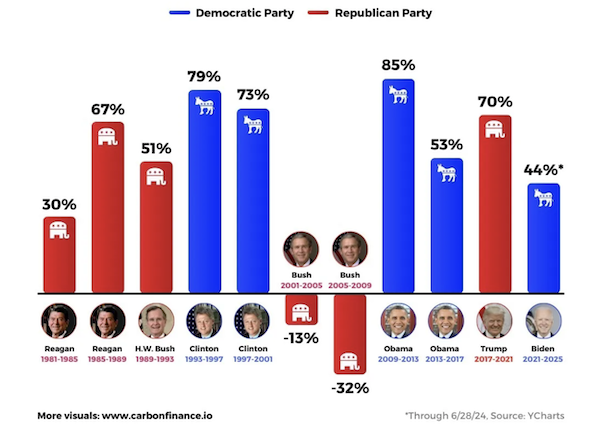

The build-up to the US election in November is starting to dominate the headlines. We often get asked by clients how the outcome might impact markets. The graphic below from Carbon Finance looks at the performance of the stock market under each president since Ronald Reagan's election in 1981.

As you can see, the market has done well under both Democrats (blue) and Republicans (red). Ironically, the Dems have done better than the business-friendly Republicans, returning on average 9.8% per annum versus 6% from the Republicans since 1957.

Of course global disasters will happen regardless, poor George Bush had 9/11 and the housing bubble under his tenure. Trump had Covid.

It's quite obvious that the real leadership talent in the US prefers to run companies and not pursue political office. I would suggest you don't make any serious long-term investment decisions based on this election outcome.

Michael's musings

We really like the GLP-1 weight loss theme for a few reasons. Who doesn't want to lose a bit of weight? There is also the added benefit that health insurance companies are willing to pay for these treatments, to cover a growing list of ailments. It makes sense; reducing obesity will reduce obesity-linked health problems.

Last week, new research found that people on GLP-1 drugs had a lower chance of getting certain cancers. I was skeptical of the finding at first because finding a link between a drug and cancer requires a large patient sample size and a long time period. The research was based on an analysis of the electronic healthcare records of roughly 1.7 million patients with type 2 diabetes who were prescribed a GLP-1 drug, metformin or insulin between 2005 and 2018.

GLP-1 drugs have been around since 2005 as a treatment for diabetes. It is only recently that they have been repurposed for weight loss. It means that we have 20 years of data to work with, particularly when looking at long-term side effects.

There are ten obesity-associated cancers that GLP-1s were found to reduce the risk of getting. They are esophageal, colorectal, endometrial, gallbladder, kidney, liver, ovarian, and pancreatic cancer, as well as meningioma and multiple myeloma. You can read the research results here - Obesity-Associated Cancers in Patients With Type 2 Diabetes.

I didn't know that obesity was linked to certain types of cancers. It is great news that society has a drug that can help reduce mortality rates related to the disease.

Bright's banter

Jay-Z has taken an equity stake in Wristcheck, an online marketplace for pre-owned luxury watches, as part of a recent $5 million funding round.

Founded in 2020 by Austen Chu, Wristcheck authenticates watches through Swiss-trained watchmakers and has raised about $13.6 million to date from backers including Alibaba Entrepreneurs Fund and Gobi Partners GBA.

Chu expressed excitement about Jay-Z's investment, highlighting the rapper's influence on watch culture.

Jay-Z's involvement follows other celebrity investments in watch trading platforms, such as Cristiano Ronaldo and Charles Leclerc with Chrono24, and Kevin Hart, John Legend, and J Balvin with Bezel.

I wonder if they know how hard it is to run a Craigslist for used watches, especially in this environment of superfakes?

Linkfest, lap it up

Tesla has made it onto a list of cars Chinese officials are allowed to buy. The Chinese market is vital for Elon Musk's company - Beijing authorises Tesla.

Life at the bottom of the top can be brutal. This guy was once Ireland's number one tennis player - The loneliness of the lower ranks in pro-sports.

Signing off

Asian markets are mixed this morning. Benchmarks in Hong Kong and mainland China fell, while India, Japan, South Korea, and Taiwan rose. Information technology and semiconductor-related companies led the gains in the MSCI Asia-Pacific index.

In local company news, TymeBank announced a leadership change yesterday. CEO Coenraad Jonker will transition to a new role as executive chair focusing on overseas expansion and Karl Westvig will take over the corner office.

US equity futures are flat pre-market. The Rand is currently at around R18.13 to the US Dollar.

It's freezing in Joburg, but the sun is out, so help is on the way! Have a good one.