Market scorecard

US markets closed slightly down on Friday after initially gaining almost 1%. Despite this dip, the S&P 500 remained close to its record high, buoyed by a near $6 trillion increase in market capitalisation among its constituents in 2024 - the largest first-half gain on record. With half of 2024 behind us, the S&P 500 has risen 14%, matching last year's standout start, driven largely by the continued surge in AI stocks. Notably, Nvidia has contributed 30% of the S&P 500's total return.

Positive inflation data was the reason for the strong open earlier in the day. The personal-consumption expenditures (PCE) price index increased by just 2.6% in May compared to the same month last year, matching economists' expectations.

In company news, Nike closed down sharply in its largest one-day fall on record after reporting a rather pedestrian revenue outlook for the current financial year. Meanwhile, the biggest US banks have been announcing higher payouts to investors after comfortably passing the Federal Reserve's annual stress test earlier this week.

On Friday, the JSE All-share closed up 0.93%, but the S&P 500 fell 0.41%, and the Nasdaq sagged by 0.71%.

Our 10c worth

One thing, from Paul

Shares of Nike fell 20% on Friday after the company said it expects sales to decline in the year ahead. The athleisure market leader reported earnings per share of $1.01 for the quarter, compared to the 83 cents that analysts expected. But its revenue fell short and the management team was not sufficiently positive about the near-term future.

Nike's lifestyle (sneakers) business has struggled due to weak demand. There has been a delay in launching new running shoe models. Sales in China have been poor. As we've noted recently, there is more competition from traditional rivals and upstarts. Bloated stock inventories remain a problem.

Can Nike stage a comeback? CEO John Donahoe said 2025 would be a "transitional" year for the company. The company's founder Phil Knight was supportive in a statement released on Friday: "I have seen Nike's plans for the future and wholeheartedly believe in them."

Nike is a powerful company, with 83 700 employees, much-loved brands, and over $10 billion in cash on its balance sheet. The company is drifting, not in real trouble. It can afford to re-invest in product innovation and marketing at the major sporting events taking place in Europe this summer.

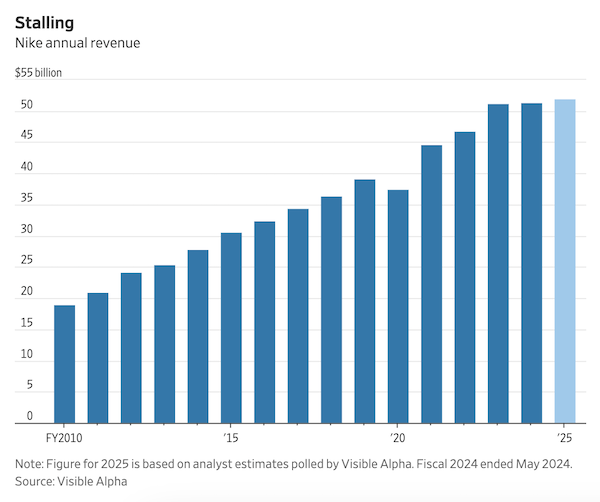

We want our portfolio companies to display dynamic top-line growth. Consider the chart below from the Wall Street Journal, which shows how well the company performed by that metric, from 2010 onwards. We started buying them for clients in 2011. The blips before and after Covid-19 are evident. The problem with the current period is also clear, and explains the market's negative reaction.

We can't throw out our holdings every time they go through a tough patch. Nike's turnaround could take a while though, and some of you may be keen to sell out. If so, let us know. I'm going to be holding on to my personal stake.

Michael's musings

I have a solar geyser at home, which is great except when it is overcast. Then it needs a boost from the backup electric circuit, which I can control electronically. My question is, how long should it be set to get that extra energy? Too little, and I'll end up with cold water at the end of my shower, but too long, and I'm just wasting electricity.

What makes this judgement call very tricky is that the margin between success and failure is so close. If I get the geyser water heat correct, I can then put my water mixer on 50% hot and 50% cold, and have a hot, long shower. If I get the geyser temperature wrong, then the mixer sits at 70% hot, meaning that I use up my lukewarm water very quickly, and end when the water is cold.

The same model can be applied to retirement savings. Each family will have a golden number - a level of savings that means they never have to worry about money again. If they fall short, even by a little bit, they'll be eating into capital over time, and the growth of their investments won't keep up with the annual spending.

Here's a simplistic scenario, which assumes that you invest in USD (with Vestact, of course). If there's no inflation and the market returns a steady 7% per year and you draw down $70 000 a year for living expenses in your retirement, how will that go? If you entered that scenario with $800 000, after 20 years, you would have nothing left. Not great if you are planning on retiring at 60, and then living past 80.

However, if you entered that scenario with $1.1 million, which is probably the equivalent of working for another 3 or 4 years, you are significantly better off. After 20 years, you would have $1.2 million. Thanks to living off of the growth of your money, and not needing to touch the original capital, your money actually grows.

Those are massively different outcomes, but with quite similar starting points.

Bright's banter

Revolut, one of Europe's top challenger banks, is planning to sell $500 million worth of existing equity, with help from Morgan Stanley. This move is to provide liquidity for employees and early investors since the IPO market is currently slow.

The sale could value Revolut at over $40 billion, up from its $33 billion valuation in 2021. Revolut's revenue surged 45% in 2022 to GBP922 million ($1.2 billion), and it's estimated to hit GBP2 billion for 2023. However, a shareholder purchase by Schroders recently valued the company at just $25.7 billion.

This step is similar to what Stripe did last year, raising $6.5 billion to let employees sell some shares because of twitchy equity markets. When a company does such things it's usually a sign that they should stop messing around and list on the public market.

With so many customers, Revolut would probably attract many retail investors.

Linkfest, lap it up

New weight-loss drugs help people feel full, and eat less. The human body is complicated, but GLP-1s seem to do the trick - You will never need to diet again.

Each generation has defining moments that shape their views on life and money. The oldest people can recall the great depression or WWII, so they save the most - Millennials (born after 1981) will be the richest generation in history.

Signing off

Asian markets are mostly higher this morning. Benchmarks in India, Japan, South Korea, and Taiwan saw gains, while mainland China slipped. Hong Kong is observing the Special Administrative Region Establishment Day, so those markets are shut. China's factory activity contracted for a second month in June.

In local company news, Nampak closed 8.1% higher on Friday, bringing its year-to-date returns to 51%. This surge followed the release of its half-year numbers, which showed the packaging manufacturer had returned to profitability.

US futures edged higher pre-market. The Rand is trading at around R18.01 to the US Dollar. Our new bloated cabinet was announced at 10pm last night. Let's hope that they can work together for the good of the country. All-in-all, the election of 2024 had a moderately positive outcome, in our view.

The first round of voting in France showed that Marine Le Pen's far-right party will struggle to win an outright majority in the French election. This development has eased investor concerns that Europe's second-largest economy was headed for a more radical policy shift. The UK election is on Thursday. It's all happening at the moment.

Have a good week.