Market scorecard

US markets closed higher again yesterday, despite some mid-day fluctuations. A rise in big tech pushed the Nasdaq Composite up by half a percent with Tesla (+4.8%), Amazon (+3.9%), and Apple (+2%) flexing their muscles. The S&P 500 hasn't declined by 2% or more in the last 338 days, marking the longest such streak since 2018.

In company news, Micron Technology took an 8% hit in late trading after its 2024 revenue outlook fell short of expectations. Elsewhere, Amazon's surge pushed its market capitalisation past $2 trillion for the first time, making it the fifth US company to hit that milestone. Meanwhile, FedEx delivered a 15% jump to its shareholders after reporting stronger-than-expected sales.

In summary, the JSE All-share closed down 0.41%, but the S&P 500 rose 0.18%, and the Nasdaq was 0.49% higher. Nice work!

Our 10c worth

One thing, from Paul

Here at Vestact, we read broadly. If you visit our Rosebank office in the afternoon, you'll notice the silence, with us sitting at a very large communal desk reading on our Apple MacBooks.

A few decades ago, the average investor had one source of information - the local business newspaper. These days, the internet is a firehose of company research, market news, political commentary, and opinion pieces, so we have to be snobby about quality.

We are constantly scanning for fresh insights to share with you in this newsletter. That includes saving and rereading articles that might contain an interesting angle on a well-known topic.

After many years of this practice, we've become quite adept at seeing trends early, and selecting good investments. We'll keep it up.

Byron's beats

Rivian automotive is a New York-listed electric-vehicle manufacturer that has faced a lot of challenges recently. Tesla defied the odds by achieving scale and profitability; but Rivian has been operating at loss. Since listing at the end of 2021 in a very favourable market its share price plunged from $125 to $12 two days ago.

On Tuesday evening, Volkswagen (VW) announced that they would give Rivian a much-needed cash injection. The announcement described a joint venture which would receive $1 billion from VW with a potential $4 billion to come. The Rivian share price initially jumped 50% pre-market but only closed up 23% yesterday. Amazon is also a shareholder in Rivian, so that helped Amazon close above the $2 trillion market cap for the first time last night.

The deal makes sense for both parties, Rivian has built up a pretty decent brand and the cars really look great. The old legacy automakers have struggled to convert existing production plants in order to manufacture EVs. VW can leverage off of what Rivian has already built and they will get access to their software. Rivian of course gets the cash they so badly need. Rivian is not a stock we would recommend as it is too small but we will watch it with interest.

Michael's musings

The biggest threat to Amazon's online shopping empire is the presence of newcomers, such as Shein and Temu. These companies might not offer same-day delivery, like Amazon, but their products are usually much cheaper. Many consumers prefer saving 20%, even if it means waiting two weeks for their items to arrive.

According to a report by news site The Information, Amazon is going to launch their own version of direct shopping from Chinese suppliers. Amazon's new online catalogue will feature unbranded fashion, home goods and other items that can be delivered in nine to 11 days directly from Chinese sellers.

This move makes sense because Amazon already has a huge user base, and giving them more options keeps those clients happy and coming back. Added to that, Amazon are the kings of logistics, which will probably give them an advantage over Shein and Temu. Lastly, the Amazon brand is trusted.

Bright's banter

Ferrari is gearing up to enter the electric supercar market. Their first EV will be priced at EUR500 000 ($535 000), much higher than its current average of around EUR350 000. The first model is expected by late 2025, with a second already in development.

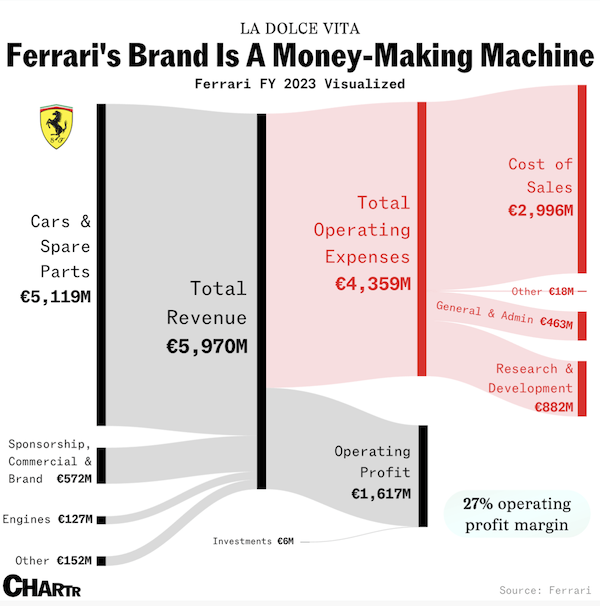

This move is risky for Ferrari, which is known for its roaring engines. However, Ferrari's margins are impressive, with a 27% operating profit margin last year, on par with luxury giants like LVMH and Hermes, so they have room to experiment.

For comparison, VW and Mitsubishi have around 7% margins, Ford nearly 3%, and Porsche targets 20% (rookie numbers). Ferrari plans to keep these strong margins with the high price tags of its EVs, but scaling production from 14 000 cars in 2023 to 20 000 annually for the new models will be a challenge.

Besides car sales, Ferrari made over $600 million from sponsorships, commercial deals, and branding last year, thanks to a relatively strong Formula 1 performance. The infographic below shows how the prancing horse makes its money.

Linkfest, lap it up

Hey, can I have your username? Despite it being against the rules of most social media platforms, the practice is widespread and lucrative - How these transfers happen in practice.

When Elon Musk bought Twitter, he said that he wanted to turn it into a supper-app. He is one step closer to making that happen - X Payments nears launch.

Signing off

Asian markets are mostly down this morning. Benchmarks in India and Taiwan saw gains, while those in Hong Kong, Japan, mainland China, and South Korea declined. The MSCI Asia-Pacific is on course for its first loss in three days.

In local company news, Rainbow Chicken made its debut on the JSE yesterday following a successful unbundling from RCL Foods. The latter might need to consider a new name. Elsewhere, De Beers sold $315 million worth of rough diamonds in its fifth sales cycle of the year. This figure is down from the $383 million in the fourth sales cycle and significantly lower than the $456 million sold during the same cycle in 2023.

US futures are slightly lower in pre-market trade. The Rand is trading around R18.15 to the greenback. Today, Nike reports its earnings after market close and we are hoping for the best.

Well done to the Proteas for making their first ICC tournament final, we back you boys!