Market scorecard

US markets closed higher yesterday as tech shares bounced back from a slump earlier in the week. The Nasdaq Composite pushed higher thanks to gains in Nvidia (+6.8%), Alphabet (+2.7%), Tesla (+2.6%), and Meta (+2.3%).

Do you still follow the movements of the old-fashioned Dow Jones Industrial Average (DJIA)? The Nasdaq and Dow have moved in opposite directions in eight out of the last ten trading days, a pattern not seen since a 10-day stretch ending in April 1995.

In company news, Airbus shares dropped 9.4% after it revealed that production challenges will prevent it from meeting its sales and profit targets. Elsewhere, cruise company Carnival surprised analysts with positive quarterly numbers, pushing the stock up by 8.7%.

At the close, the JSE All-share was down 0.85%, but the S&P 500 gained 0.39%, and the Nasdaq bounced 1.26% higher.

Our 10c worth

One thing, from Paul

Nvidia shares are up 160% for the year-to-date. Pretty good right? Investors who hold them are thrilled, but some of them are nervous that it has gone up so much in such a short time.

On Thursday last week, Nvidia hit an all-time high price of $140.76 per share. Then it proceeded to fall by 16% in the next three trading sessions. Horrific! The headlines in major financial publications suggested that a bubble was bursting. AI skeptics were suggesting that the "game was up".

Newsletter writers were noting that the value "lost" by Nvidia was hundreds of billions of dollars and compared the market value wiped out to the capitalisation of other major companies.

Well, in last night's trading session, Nvidia rose by 6.8%. So now the crisis has passed, right? To the moon!

Long-term investors know to focus on what a company sells. How are next year's sales shaping up? Are margins widening or contracting? What's the medium-term earnings outlook? If those are rising, then sit tight and ignore the short-term share price gyrations.

Byron's beats

Earlier in the week Naspers/Prosus released results for the full year ending 31 March 2024. We have over 200 JSE clients who own Naspers, many of whom have large gains on the position.

Naspers/Prosus is an investment holding company. Its largest asset is still the stake in Tencent but they do have a lot of other assets, mostly in the online retail space. We covered Tencent recently so we will look at the rest of business a little more closely.

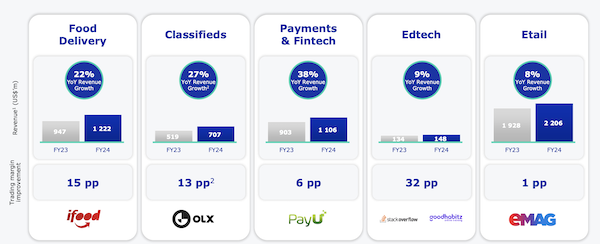

The numbers looked decent. The new CEO, Fabricio Bloisi, seems to be focusing on cost-cutting and making the existing businesses profitable. Ecommerce was profitable for the first time ever, pulling in $38 million from $5.5 billion in sales. Revenues from continuing operations (which excludes Tencent) was up 11%. Classifieds (up 36%) and food delivery (up 22%) had particularly good years. The image below looks at each sector, the associated brands and the trading profit improvements - which is clearly a new priority for management.

All-in-all the rest of the business seems to be in decent shape despite the valuations of those businesses coming down heavily in recent years thanks to interest rate increases.

Naspers/Prosus will probably sell more Tencent shares in order to raise funds for fresh investments and/or to buy back shares. Thanks to these share buybacks and a growth in profits, headline earnings per share for Naspers were up 110%. We still think there is a lot of value to be unlocked here. If you own the shares, keep them.

Michael's musings

Last week, we mentioned that the share price of Gilead Sciences jumped after positive trial results for an HIV prevention drug. I'm surprised that the news hasn't received more attention. Lenacapavir is a twice-yearly injection, which gave 100% protection against HIV in a large trial in South Africa and Uganda. This isn't a cure for HIV, but being able to stop people getting infected is almost as good.

Currently, there are two oral pills that significantly reduce the risk of contracting HIV. The problem though is that it is the pill that needs to be taken daily, and regular refills are needed, which isn't practical for many rural communities. So the option of an injection once every six months, which gives better cover, is a huge win.

The main issue now seems to be the cost of the drug. According to a New York Times article, Gilead charges $42 250 per patient per year for lenacapavir in the United States, where it is approved as a treatment for HIV. The company says that it will sell it at a lower price to mid and low-income countries, but can they go low enough to match the budgets of developing nations' health departments?

It's exciting to see the progress in the medical field.

Bright's banter

Webtoon Entertainment, backed by Naver, is aiming to raise up to $500 million in a US IPO at a valuation between $3 to 4 billion. Webtoons are a significant South Korean cultural export, alongside K-pop and dramas, boosting business for Naver and Kakao Corp.

The Los Angeles-based company is offering 15 million shares at $18 to $21 each. Shares will trade under the symbol WBTN on the Nasdaq Global Select Market.

BlackRock plans to put in up to $50 million as an anchor investor. After the IPO, Naver will retain over 60% ownership, and Tokyo-based LY Corp will keep its stake at about 25%.

Webtoon connects 24 million creators with 170 million monthly active users across over 150 countries. Despite a net loss of $145 million last year, it generated $1.28 billion in revenue.

Companies have raised nearly $20 billion via US IPOs in 2024, up from about $11 billion at the same time last year. So it's been a good year for capital raising if you're planning to list in the US. I wonder why Stripe isn't using this opportunity to list?

Linkfest, lap it up

China currently has a monopoly on rare earth elements. These are used in glass, lights, magnets, batteries, and catalytic converters, just to name a few - Norway discovers Europe's largest deposit of rare earth metals.

Innovation happens when people experiment with outrageous ideas. Green air travel is proving difficult, so researchers are thinking out of the box - Powering planes with microwaves.

Signing off

Asian markets are mostly higher this morning. Benchmarks in India, Hong Kong, Japan, Taiwan, and South Korea moved higher, while those in mainland China declined. The outlook for China's exports is expected to improve, supporting growth in the world's second-largest economy despite a slowdown in consumer spending.

In local company news, Cilo Cybin just became the first medical marijuana company to list directly on the JSE (Alternative Exchange through a SPAC). Meanwhile, Brait reported narrowed losses of R171 million for the March year-end, driven by strong earnings from Premier and a successful turnaround at Virgin Active. Richemont jumped 2% on a Bloomberg article stating that LVMH Chief, Bernard Arnault, has a stake in the company.

US futures are slightly in the green pre-market. The Rand is trading at around R18.23 to the US Dollar.

Today Micron Technology, Paychex, and General Mills report their numbers, while tomorrow it's Nike's highly anticipated quarterly earnings announcement.

That's all for now folks.