Market scorecard

US markets closed slightly lower on Friday, but the major indices still held on to their third consecutive week of gains. Both the Nasdaq Composite and the S&P 500 were weighed down by a decline in semiconductor stocks like Broadcom (-4,4%), Nvidia (-3.2%) and Micron Technology (-3.2%). Year-to-date, the S&P 500 is up 15.2% and the Nasdaq Composite is up 19.8%.

In company news, Hertz Global jumped 16% after the car rental company increased the size of a bond issuance programme to $1 billion. Elsewhere, Sarepta Therapeutics' stock soared 30% after the FDA expanded approval for its Duchenne muscular-dystrophy gene therapy to include patients aged 4 and older.

On Friday, the JSE All-share closed down 0.38%, the S&P 500 eased 0.16%, and the Nasdaq fell 0.18%.

Our 10c worth

One thing, from Paul

I'm back in Johannesburg this morning, after a week away in central Europe, travelling with some of my adult children. We visited the mountains of Austria, and the Bavaria region in Germany.

When I was away, I was working for a few hours each day, both early and late. I can do that, because (1) I have fantastic colleagues, (2) I can work online from anywhere and (3) I have tolerant family members.

It helps that I really enjoy my work. I like replying to client queries, and keeping up with general market and company-specific news. Some people need to get off-grid in wild places with no internet connectivity; I prefer to stay in the zone.

The picture below is a place on the Eisbach channel in central Munich, frequented by surfers. A good thing to have seen!

Byron's beats

Sometimes we are asked by clients, who already own all our favourite stocks, if perhaps we have any other shares to recommend. There are loads of quality companies listed in the US. The truth is, you cannot own them all. If you spread yourself too thin, you increase the chances of owning a dud as opposed to cracking the next 10 bagger.

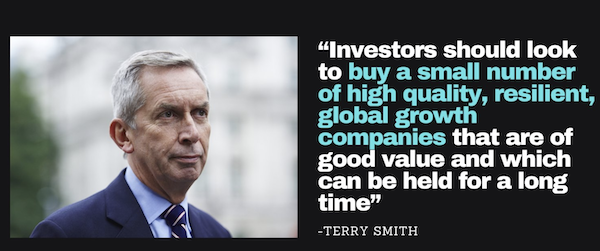

Many legendary investors including Charlie Munger, Warren Buffett, Bill Ackman and Terry Smith insist that it is better to buy a small number of quality stocks and apply all your time to following them.

Our model portfolio currently has 15 stocks. We do not plan on expanding that list any time soon.

Michael's musings

On Friday, Bright highlighted the fact that Nike has struggled recently, and that the company will need to up its game if it is to compete successfully against a slew of newer athleisure brands. I'm a fan of the ON brand, the shoes stand out and look comfortable, although I don't own any yet. Time will tell if the company has what it takes to become a truly global contender, and if they will still be relevant after this fashion cycle.

Interestingly, two other reports about Nike were also released on Friday. Oppenheimer, the investment bank, put out a research note placing a $120 price target on Nike, 24% higher than the current level. They reinstated Nike as a top, mega-cap pick across the firm's Consumer Growth & eCommerce coverage.

The second Nike report was from Barron's, the financial publication, which also forecast a turnaround in fortunes for the shoemaker.

Nike reports its results on Thursday. The theory is that the current Nike share price already reflects a lot of bad news. So if the update is not too negative, traders should react positively. Looking ahead, the Olympics in Paris in July should be a nice boost to Nike sales. Added to that, the company plans to launch a new range of shoes, which almost always gets consumers excited.

We like the athleisure industry and expect continued sales growth across the industry, and Nike is the leader. This also isn't the first time that Nike has faced tough times or competition from upstarts. It is a stock that we are watching closely, but it isn't the time to be reaching for your sweat towel.

Bright's banter

Golden Goose has postponed its Milan IPO, citing market instability due to the European Parliament elections and a snap election in France. Known for its trendy $500 worn-looking sneakers favoured by celebrities like Taylor Swift, Golden Goose have a targeted market cap of up to EUR1.86 billion ($2 billion).

Despite the IPO book being four times oversubscribed, the political turmoil, especially France's far-right gains, led to the decision. Permira, the private equity firm that owns Golden Goose, decided to wait until conditions improve. A little disappointing because they had spent around 10 months preparing for the listing.

Golden Goose was founded 25 years ago by Alessandro Gallo and Francesca Rinaldo, was bought by Permira for just under $1.4 billion before the pandemic.

The company has been doing well, with 2023 sales up 18% to nearly $630 million and adjusted EBITDA up 19% to $214 million. Golden Goose's customisable sneakers are popular among young shoppers, and the brand sees growth opportunities in Asia and the Middle East.

I think they should go ahead and list on the NYSE and forget Europe.

Linkfest, lap it up

Disney has a legacy of over 100 years. The company's stories appeal to multiple generations - Copyrights are ending on some of its earlier characters like Mickey Mouse.

This sport is still riding the pandemic boom. Chess is more popular than ever - Chess.com has built an empire like no other.

Signing off

Asian markets are mostly down this morning. Benchmarks fell in India, Hong Kong, mainland China, and South Korea, but rose in Japan. Bond markets rallied in most parts of the East as investors sought out safer assets.

In local company news, Coronation won its long-standing tax case against SARS, with the Constitutional Court ruling in its favour. This victory means that Coronation will issue a special dividend to its shareholders from the cash it had set aside for the potential tax fine. Good news! Coronation's shares closed up 3.6% on Friday.

US futures are in the red pre-market, but that's just an indication, so early on a Monday.

The Rand is trading at around R18.03 to the US Dollar.

Start the week strong!