Market scorecard

Stocks pulled back yesterday, after briefly reaching all-time highs. The S&P 500 exceeded 5 500 soon after the market open, but lost momentum as the day wore on. The tech sector cooled off with the Nasdaq Composite declining after a seven-day winning streak. Megacaps like Nvidia (-3.5%) and Apple (-2.2%) led the losses.

In the past three months, the ten largest stocks in the index by market capitalisation, primarily tech giants, have achieved a median gain of 17%. Meanwhile, the rest of the stocks that make up the index have experienced a decline of 1.3%, according to Bloomberg data.

In company news, Gilead Sciences closed up 8.5% after its experimental twice-yearly injection completely prevented HIV cases in women and adolescent girls in Africa, marking the first successful large trial of this promising new drug regimen. Elsewhere, MGM Resorts was 2.9% higher after launching online betting with live dealers at two of its Las Vegas resorts, a first for a casino operator on the iconic Strip. Lastly, Honeywell has agreed to purchase aerospace and defence company CAES Systems from private equity firm Advent International for $1.9 billion.

Yesterday the JSE All-share closed down 0.79%, the S&P 500 eased 0.25%, and the Nasdaq fell 0.79%. Dammit.

Our 10c worth

One thing, from Paul

Whoa, It's Friday again and time for my weekly advice column. Maybe I should start taking questions, like an agony auntie?

Ryan Holiday says "The fewer opinions you have, the happier you'll be. If you do have to have opinions about things that don't really matter, hold them lightly and in good humour."

That seems right to me. It's fine to be controversial and noisy, but it can be tiresome for those around you. So, present your theories with a laugh and be prepared to be told off, because you may be dead wrong. Use your ears, not just your mouth.

Byron's beats

In Ben Evans' latest newsletter, he lays down some criteria for what he believes will make generative AI and ChatGPT work. Firstly, the software needs to be embedded in a system that has lots of information about the user. Social networks, search engines and mobile operating systems all tick that box.

Then it needs to be run on small power-efficient devices paid for by the users. For example, an iPhone. Building massive offsite servers is very expensive. If the users are paying for the device, then the business model is viable.

Lastly, for an AI business model to work, the energy requirements also need to be absorbed by the mass market. Again an iPhone ticks this box. Currently, when a user asks AI to do something, a data centre uses a relatively large amount of energy to generate an answer, which gets expensive, particularly if the AI service is being offered for free.

This is Ben's conclusion: Apple is perfectly poised to offer this decentralised AI model through its massive network of devices, which all use the same operating system.

Apple spelled out its generative AI plans at the recent WWDC, which has been widely covered in this newsletter. We are very excited to experience and use the added features when it is launched towards the end of the year.

Michael's musings

Netflix started by renting out DVDs through an online website and then progressed to being the king of streaming. Their online model decimated Blockbuster's physical store business. Netflix's latest new venture is to move from online, back to the physical. I love it how industries go full circle.

Netflix's two new gigantic in-person experience venues are called Netflix Houses. The irony is that they will be built in former department stores, which had to close down due to online competition. These Netflix Houses won't be theme parks but more an immersive experience into the world from hit Netflix titles. This might include things like having high-tea on the set from Bridgerton.

Netflix's goal is to use these destinations to build fan loyalty and excitement for their shows and characters. My assumption is that tickets will be affordable to drive traffic, and that this won't be a major profit centre for Netflix. If these Netflix Houses become popular, they may become a money spinner, similar to Disney resorts.

Bright's banter

I read a very detailed report by Business of Fashion on the rise of sportswear challenger brands, and here's my takeaway on the matter.

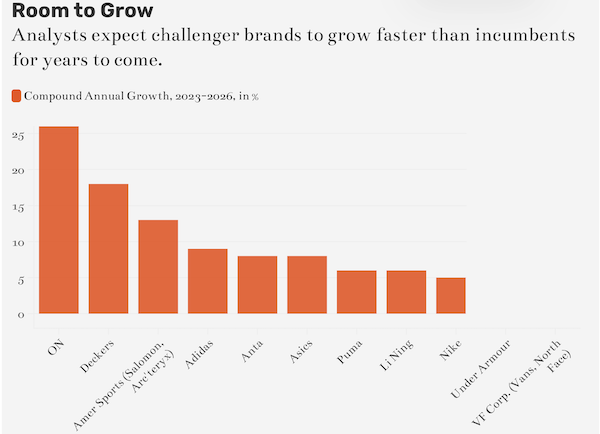

Nike and Adidas still dominate the sportswear market, but they're facing serious competition from newer brands like On, Hoka, Arc'teryx, and Salomon. These up-and-comers are quickly gaining ground, and the market is splitting into two camps: the established giants like Nike, Adidas, Puma, and Under Armour, and the challengers like Lululemon, On, and Hoka.

In 2020, major brands held 80% of the market. Now, their share is down to 65%. Challenger brands grew at an average annual rate of 29% from 2021 to 2023, off a small base, while incumbents only managed 8%. This trend is set to continue, with challengers projected to grow at 11% annually from 2023 to 2026, compared to 5% for the big names. As you can see, the sportswear market as a whole is growing nicely.

Despite some struggles, Nike and Adidas are still massive players, with Nike's revenue at $51 billion, more than double Adidas'. But the gap is closing. These challengers are expanding by opening their own stores and entering major retailers. Salomon, for example, is capitalising on the growth of its SportStyle brand, and just opened its first SportStyle store in Paris.

I'm bullish on these newer brands, but they may not all continue to thrive. For the record, Asics' stock is up over 128% from January, On's stock has risen 56% year-to-date, and Deckers (Hoka's parent company) is up 47% this year. In comparison, Nike's shares are down 10%, Puma is down 12%, and Under Armour is down 20%. Adidas is an exception, with its stock up 21% due to popular sneakers and a strong recovery after ending the Yeezy partnership.

Linkfest, lap it up

Newsletter writers get a lot of feedback from readers. Writers who reveal intimate information might give their audience the wrong idea - 'I consider you my friend'.

Necessity is the mother of invention. Due to graphite supply concerns, scientists are experimenting with new ways to produce batteries - Researchers turn wool and hair offcuts into graphite for lithium power cells.

Signing off

Eastern markets are mixed today. Mumbai, Sydney, and Tokyo edged higher, while Hong Kong, Shanghai, and Seoul ebbed. There is no stock market in Pyongyang, where Putin and Kim had a sleepover two nights ago.

In local company news, Sirius Real Estate acquired Beaumont Industrial Estate for GBP25 million and an industrial building in Wembley for just under GBP6.3 million. Both properties are nearly fully occupied, offering a yield of about 9.2%. Meanwhile, Transnet has been ordered to pay R8.5 billion to Sasol and TotalEnergies for breaching a 1991 agreement on setting pipeline tariffs for crude oil transport. With what monies?

US futures are slightly higher pre-market ahead of what is known as triple-witching derivatives-expiration day. In short, there will be a surge in volume on US markets as futures contracts are rolled over. The Rand is holding steady at R17.96 to the greenback.

TGIF!