Market scorecard

US equity and bond markets were closed for the Juneteenth holiday, which marks the end of slavery in America, in 1865. Locally, the JSE all-share index closed higher as the market responded to the inauguration of President Cyril Ramaphosa. What really matters now is his cabinet announcement, and who will be leading key portfolios.

In company news, Amazon announced an additional EUR 10 billion investment in its cloud infrastructure and logistics network in Germany, aiming to expand its data centre network in Europe. This comes on top of their earlier commitment to spend EUR 7.8 billion by 2040 to establish a sovereign cloud business in Germany. Meanwhile, Netflix revealed plans to open two large entertainment venues called "Netflix House" - one at King of Prussia Mall in Pennsylvania and the other at Galleria in Dallas, Texas.

At the close, the JSE All-share was up 1.21%.

Our 10c worth

One thing, from Paul

Everyone craves respect. Humans are hard-wired to strive, achieve great things, and to enjoy being held in high regard.

In private client asset management, the respect of customers comes firstly from good portfolio performance, and secondly from speedy client service. If a firm is growing clients' capital, and its managers answer their emails timeously, its reputation for excellence will grow.

Vestact has been in business for over 20 years, and it's going well. Let us know what more we can do for you. Please refer us to your colleagues, family members and friends if they have funds to invest.

Byron's beats

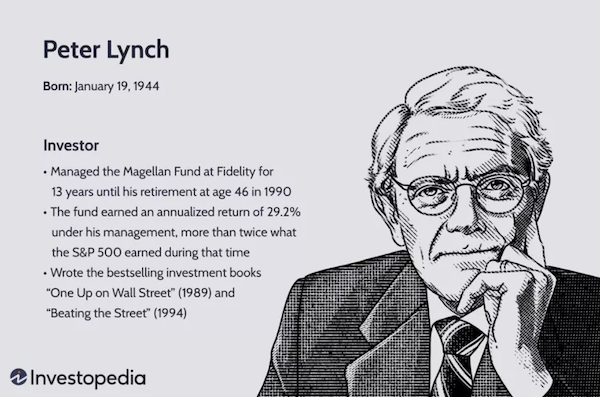

US stocks are on a tear and we are loving it. Naturally, this can make some clients anxious that the market has run too hard and is due for a correction. At times like these, I like to repeat my favourite quote from legendary investor Peter Lynch. "Far more money has been lost by investors trying to anticipate corrections, than lost in the corrections themselves".

He is talking about all the people who went to cash during a rally, only for the market to continue marching higher. Statistically, markets do well when they are already at all-time highs. This came up at the beginning of the year after a few clients were anxious about adding money to their accounts after such a good 2023.

We are nearly six months into 2024 and the market is up another 15.7%. I certainly did not expect that, but I'm not overly surprised.

Where to from here? According to Eddy Elfenbein, the S&P is trading at 22.7 times the consensus forecast for 2024 earnings. That's not cheap but it doesn't feel overly expensive. Earnings growth is good, and we are about to go through a rate-cutting cycle. If you are fully invested, keep it that way. If you have funds to send, just do it now and we will buy you more shares.

Michael's musings

The World Bank just released its container port performance index for 2023. Unsurprisingly, South African ports were at the arse end of the index with Cape Town, Ngqura, and Durban, being ranked 405, 404 and 398 respectively, out of 405.

Since then, I've seen a few articles talking about how things are bad, but that the rankings are unfair - 'We're not the worst in the world': Transnet CEO and Yes, there are problems at SA ports, but World Bank report is not entirely accurate - SAAFF. I just had to chuckle, because being bottom half of any index is a problem. Does it matter if we are 205 or 405 out of 405?

The root causes of our problems are a lack of planning, maintenance, and capital investment, similar to many other SOEs and South African municipalities. It will be hard, slow and costly to reverse these deficiencies. The issues at our ports have a real impact on the South African economy. Not being able to get goods in and out quickly and efficiently pushes up prices and hampers GDP growth.

Here's a real-life example. My family runs a bearing, gearbox, electric motor and power take off distribution business in the Lowveld. Issues at the ports results in long delays for them to receive new stock. The result is that they now hold 25% more stock than normal, just to compensate for slower lead times. The money tied up in stock could have been spent in other areas of the economy. It can be considered 'dead capital', and a bad thing for GDP growth.

Bright's banter

A group backed by BlackRock and Citadel Securities is launching the Texas Stock Exchange (TXSE) to challenge the NYSE and Nasdaq. They've raised about $120 million and plan to start trading in 2025, with the first listing in 2026.

TXSE aims to attract companies frustrated with current regulations and promises a more CEO-friendly environment. The exchange will be fully electronic with a physical presence in Dallas.

Citadel and BlackRock are good backers to have as they are heavyweights on Wall Street. Texas is becoming a major financial hub, with initiatives like the Texas Business Courts and the recent incorporation move by Tesla further boosting its stature.

Linkfest, lap it up

Bike theft is an issue all over the world. Some fancy bicycles from the US West Coast are ending up in Mexico - The mastermind behind bike trafficking in the Americas.

Rob McElhenney is backing himself. As "Welcome to Wrexham" ends its third season, McElhenney is eyeing his next project - A profile of Rob McElhenny and his grand ambitions.

Signing off

Asian markets are mixed up this morning, as usual. Benchmarks rose in India and South Korea, while Hong Kong, Japan, and mainland China are in the red.

Locally, tertiary education company Stadio reported an 8% increase in student numbers, rising to 46 300 from 42 874 a year ago. Meanwhile, there's speculation that MultiChoice's various side deals, such as their partnership with Comcast on Showmax, could complicate the Canal+ takeover.

Today we'll see earnings reports from Accenture and Kroger. US equity futures are pointing towards a positive open. The Rand is trading at around R17.94 to the US Dollar.

It's Thursday. Keep moving.