Market scorecard

US markets rose for a fourth day, thanks to US producer prices dropping. Expectations were for a rise so this was really good news. Lower producer prices usually leads to lower inflation for the consumer. The market is now pencilling in two rate cuts from the Fed this year.

In company-specific developments, Tesla closed 3% higher on the news that Elon Musk's pay package has been approved. A judge in Delaware still needs to approve the scheme though. The best performer yesterday was server manufacturer Super Micro Computer (+12.4%), which jumped along with other AI stocks after strong results from chipmaker Broadcom. Virgin Galactic fell 14.28% after the company announced a 1-for-20 reverse stock split, a necessary evil in order to remain listed on the NYSE. At this rate, they'll never get off the ground.

Yesterday the JSE All-share closed down 0.87%, but the S&P 500 rose 0.23%, and the Nasdaq closed up 0.34%. Solid!

Our 10c worth

One thing, from Paul

It's Friday, so here's some life advice: to be successful you need to be a good schmoozer.

To illustrate the point, here's a story about Katalin Kariků (pictured below), who spent 20 years below the radar at the University of Pennsylvania (no funding, denied tenure) before winning the Nobel Prize for her work on mRNA vaccines. She just wrote a memoir called "Breaking Through", and here's a quote.

"I was learning that succeeding at a research institution like Penn required skills that had little to do with science. You needed the ability to sell yourself and your work. You needed to know how to do things which I have never had any interest (flattering people, schmoozing, being agreeable when you disagree, even when you are 100 percent certain that you are correct). You needed to know how to climb a political ladder. I wasn't interested in those."

Well, tough luck. It's great to be smart, like Kariků, but it's even better to be smart and capable of operating effectively in social situations. It's a learnable skill, so make the effort.

Byron's beats

I've seen a few market bears suggesting that the recent AI-induced rally is very similar to the dot-com bubble and will most likely end in tears, just like in the year 2000. The dot-com meltdown was an ugly market collapse that lasted until 2003.

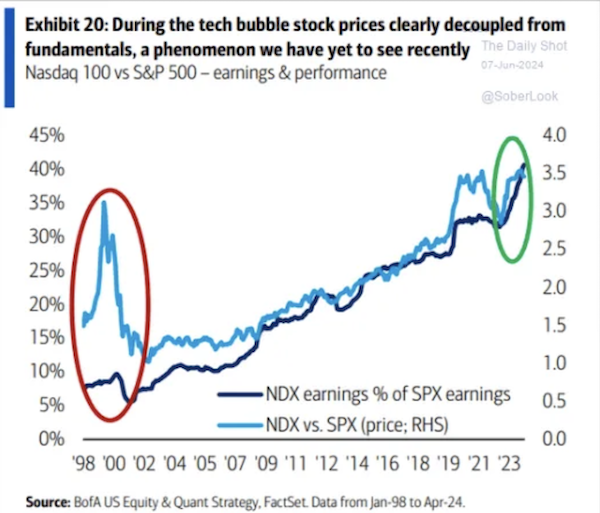

I'm not buying that argument because of one very decisive factor, earnings. Take a look at the graph below created by Bank of America. It shows the Nasdaq earnings (dark blue) against the Nasdaq price (light blue) as a percentage of the S&P 500.

As you can clearly see, the average price of tech stocks completely decoupled from actual earnings during the dot-com bubble. That is not the case now. In fact, earnings and price are pretty much in line.

Earnings are the most important underpin of a stock price. I'm very comfortable that the recent rally is justified.

Michael's musings

Oil is a central input to the global economy. For South Africa, the price of oil is hugely important. We need it to run generators, and due to Transnet's failures, most of our freight transport is done by road instead of rail. It means that when the price of oil goes up, so too does inflation, and then interest rates follow.

I was pleased to read that the International Energy Agency, whose members include the world's biggest oil consumers, predicts that we are heading towards a massive oil surplus. The forecast is for oil demand to peak in 2029 at 105 million barrels a day, but oil production capacity is going to grow much more quickly over the same period, reaching a peak of 114 million barrels a day.

According to the IEA, "This would result in levels of spare capacity never seen before, other than at the height of the Covid-19 lockdowns in 2020," and "Such a massive oil production buffer could usher in a lower oil price environment".

This would be a brilliant result for most countries on earth. It grates me to think that every time I drive my car, I'm funding the construction of Neom, a new city in the Saudi desert.

A drop in local petrol prices would help lower inflation, and by extension lower interest rates, meaning consumers will have more money to spend on other things. It's an all-round win.

Linkfest, lap it up

In large corporations, employees can get lost in all the chaos. How busy are home-based workers? - Wells Fargo fires employees for faking keyboard activity.

The USA is currently hosting the cricket T20 World Cup. Las Vegas will host another, equally competitive tournament - Microsoft Excel world championships.

Signing off

Markets in the East are the usual up-down affair. Japan and South Korea are higher, but Australia, Hong Kong, and mainland China are lower. Japanese markets were volatile this morning, and the Yen weakened after the Bank of Japan decided to keep interest rates on hold.

In South African company news, Gold Fields dropped 11% yesterday after announcing that gold production would fall sharply due to adverse weather conditions at their Chilean operations. The market was expecting strong results because gold prices have been rising. Sad.

Equity futures are pointing towards a fifth day of gains for US markets. Next week will be interrupted by the Juneteenth holiday coming up on Wednesday.

The Rand is in a holding pattern at $/R 18.43. Today we will find out what coalition government we will have for the next five years, at the first sitting of Parliament in Cape Town.

Enjoy the long Youth Day weekend in South Africa.