Market scorecard

US markets were mixed yesterday. Many stocks were red, but thanks to a surge in Apple's share price, both the S&P 500 and the Nasdaq managed to close in the green, and at new record highs. Apple shot up 7.3%, adding over $200 billion in market cap, and is now only $40 billion behind Microsoft.

In company news, Paramount Global had a terrible day, falling 7.8% after a merger deal with Skydance was called off. This Paramount saga has been going on for months, an endless dance with multiple suitors, and now it all seems for nothing. Boeing also struggled (-2.4%), after announcing the sale of just four aircraft in May. Boeing used to be known for its engineering prowess, but now it's known for taking shortcuts. A tarnished reputation is hard to repair.

Yesterday the JSE All-share closed down 0.15%, but the S&P 500 rose 0.27%, and the Nasdaq charged higher by 0.88%.

Our 10c worth

Michael's musings

On Monday Apple released a range of new products, including the much anticipated Apple Intelligence (AI). The new upgrades are coming to iPhones, Macs and iPads in the second half of this year. Apple Intelligence will be powered by generative AI, giving Siri a massive upgrade, and if Siri can't assist you, free access to ChatGPT will.

For functionality, speed and privacy, much of the AI work will be done on the device, instead of being sent off to a data centre somewhere to process the request. This means that upgrades will only work on the latest hardware. For the iPhone, you will need a 15 or later. For Macs and iPads, they will require Apple's M1 chip - I guess I need a new Mac now. A new super-upgrade cycle is about to happen for Apple iPhones and Macs.

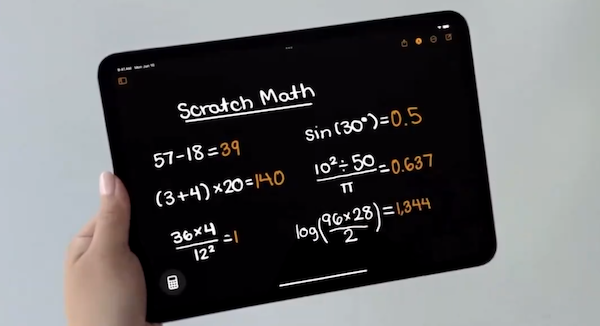

Apple's new AI has all the features that you would expect. It can write and proofread emails, transcribe phone calls, do a bit of coding and some next-level photo editing. It also has the ability to solve maths problems as you write them out. Cool.

Apple also announced a few other things: an upgrade to its payment app (which caused PayPal shares to drop 3.6%), the ability to access your iPhone screen from your Mac, and a renewed focus on gaming.

Usually after these Apple conferences, I read through the new features introduced and yawn, as I probably won't use any of them. This year, Apple has done itself proud.

Apple analysts took a little time to digest all the new products launched, after dropping 2% on Monday, the market changed its tune and Apple closed up 7% yesterday, comfortably setting a new all-time high record. Apple has an exciting AI future ahead of it.

One thing, from Paul

I love travelling, especially to new cities. My ideal day away is (1) waking up in a nice hotel, then (2) heading out on an exploratory run around the city for an hour and a half with a family member, and (3) finishing up at a noisy coffee shop. That's me jogging in Singapore in the picture below; the photo was taken by my son.

Next (4) I'll do a work shift for a few hours, checking the market news, answering client emails and WhatsApping with my colleagues back at the office. Then (5) we'll venture out to a tourist attraction like a high-up building with an observation deck, or a cultural museum, often with a professional guide. The last activity of the day is (6) taking public transport to a restaurant that offers high-end local cuisine and having a long meal with drinks. Then, (7) we go to bed early!

Tourism is about 8 percent of global GDP, and rising. In 2022, that was $7.7 trillion. There was a post-pandemic boom, and spending is still going higher.

We have battled to find a way to invest in the travel industry. Airlines are doing well, but they are notoriously cyclical. We tried Airbnb but that didn't work. I've recently gone back to an old favourite, Booking.com, initiating a new position.

Byron's beats

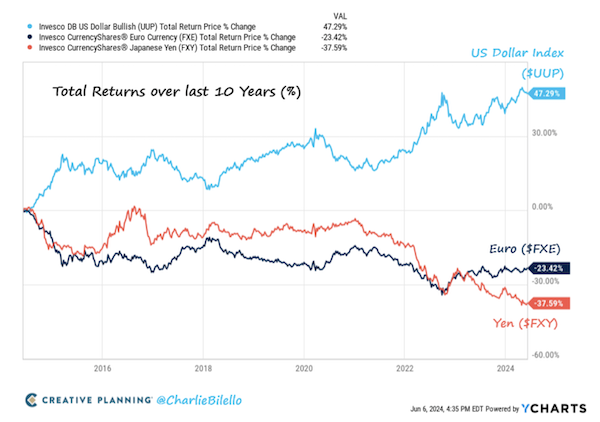

Remember all those articles going around suggesting that the US dollar was finished because the BRIC nations were going to create their own currency? Absolutely laughable.

The graph below was created by the brilliant Charlie Bilello and shows how the US dollar (light blue) has traded versus the Euro (dark blue) and the Japanese Yen (red) over the last 10 years. One would imagine that the Euro and the Yen are good candidates for a reserve currency, yet the divergence over the last decade has been huge.

It's no coincidence that the US market and the US economy has also done much better than the general Eurozone and Japan over that period.

Your Vestact investment is placed in the best stocks we can find, and it's also denominated in a strong, stable currency that has been appreciating over the years.

Bright's banter

Lululemon reported quarterly earnings that took the market by surprise. Their better-than-expected results boosted shares by 4%.

Before these numbers, the Lululemon stock had taken a hit, down over 40% this year, due to concerns about slowing growth in North America and the exit of Chief Product Officer Sun Choe. It's now down 'only' 37% for the year.

Lululemon reported a 7% year-over-year growth in comparable sales to $2.21 billion and an 11% jump in net income, both beating expectations.

Despite this, growth in the Americas region is a concern, with flat comparable sales. CEO Calvin McDonald blamed inventory issues, which he said should be fixed in the second half of the fiscal year.

Competition is also heating up with brands like Alo Yoga and Vuori, which have gained market share and opened stores near Lululemon locations. Together, these competitors have annual revenue representing 38% of Lululemon's size in the US market. Gap's Athleta is also growing again after a period of decline.

Lululemon still expects 12% revenue growth in 2024, driven mostly by international expansion. It has a strong operating margin of around 20%, thanks to a creative product mix focusing on items people love.

Lululemon remains a leader in high-end athleisure apparel. To maintain its premium valuation it needs to regain popularity and solidify its dominance in the US market under new creative leadership. Do they have what it takes? I think so.

Linkfest, lap it up

Hydrogen fuel cell car sales are down 30% globally. That hasn't deterred Honda, who are launching new models - America's first plug-in hydrogen fuel cell vehicle.

Enjoy riding your bike? Your knees will thank you and you may live longer too - Cycling is the real 'longevity drug'.

Signing off

Markets in the East are mostly in the red this morning. Australia, Japan and Hong Kong are down, but South Korea's market is up. I can't tell you why, but given that we don't own stocks there, does it matter?

Locally, Premier Group, the owner of Snowflake and Blue Ribbon brands, reported a solid set of results after being spun out of Brait last year. Revenue was up 4%, and profits were up 16%. Its share price rose 5.6% yesterday.

The Rand is at $/R18.58 and US futures are slightly higher this morning. Today is a double-data-day with both a US CPI release and a Fed interest rate decision coming out. Will CPI continue to slow? What forecasts will the Fed make about when their first rate cut will occur? We will let you know tomorrow.

You've made it to Wednesday, half way to another long weekend. Yay!