Market scorecard

US markets rose in a quiet trading session yesterday, with the S&P 500 and the Nasdaq Composite closing at fresh record highs. The top performers were Broadcom (+2.4%), Meta (+2.0%), Eli Lilly (+1.8%), and Amazon (+1.50%). Year-to-date, the S&P 500 is up 13.0% and the Nasdaq Composite is up 16.4%. That's excellent.

In company news, Nvidia successfully executed its 10-for-1 share split, so don't worry when you see the shares trading at $122 because you now have 10 shares for each one you held before. Apple dropped 1.9% despite unveiling new AI features for their forthcoming iOS 18, iPadOS 18, and MacOS Sequoia software platforms. There will also be a partnership with Sam Altman's OpenAI.

At the end of the day, the JSE All-share closed down 0.86%, but the S&P 500 rose 0.28%, and the Nasdaq was 0.35% higher.

Our 10c worth

One thing, from Paul

Stock market investing requires a steady hand, and an unflappable temperament. That's because you need to hold stocks when the market is crashing, and also hold stocks when the market is trading at all-time highs. Those that panic, or get over-excited, are lost.

Commodities trader Richard Dennis once said: "It's far more important to know what Freud thinks about death wishes than what Milton Friedman thinks about deficit spending."

I looked this up: in psychoanalytic theory, death wishes lead an organism to seek activities that eventually cause its demise, and explains why people engage in aggressive and harmful behaviours. According to Freud, such wishes are a major source of guilt, desire for self-punishment, and depression.

I guess what Dennis meant is that to invest well, you need to know yourself, and not be emotionally unstable. You must avoid self-sabotage.

Byron's beats

It seems that Meta uses Brazil as their WhatsApp guinea pig. The region was the first to get Whatsapp for businesses and now they will be the first to get AI tools to enhance the business product.

Mark Zuckerberg explained the new enhancements via a video released last week. The AI tools will use behaviour from Facebook and Instagram to message target customers. Businesses will pay for these very specific messages to be sent to prospective clients.

Treading the line between useful targeted messaging and spam is a delicate challenge, but they are taking that issue very seriously. Messages will only go to accounts who are most likely to engage and have their numbers linked to Facebook and Instagram.

Business chatbots will also be enhanced by Meta's AI capabilities.

Although WhatsApp has a massive user base, Meta has struggled to properly monetise it. Maybe AI is the answer.

Michael's musings

Eli Lilly is a newish addition to Vestact portfolios. The company is a $820 billion pharmaceutical giant, which traces its roots back to the 1870s, producing quinine to treat malaria. More recently, it has been one of the main suppliers of drugs to treat diabetes. Its future will be dominated by GLP-1 weight-loss drugs, which are repurposed diabetic medications that help people eat less. Bullish forecasters project that one in three Americans will be on GLP-1 drugs in the future, and given that Eli Lilly is a US company, it will get the lion's share of those sales.

We also like Eli Lilly because it has a long pipeline of drugs to treat neurological degeneration, like Alzheimer's and Parkinson's disease. Yesterday, one of those drugs, Donanemab, got FDA approval. This drug is similar to Biogen and Eisai's Leqembi, but has two key advantages. Donanemab only needs to be taken once every four weeks, instead of every two. Also, the clinical trials showed that Donanemab was slightly more effective at slowing mental degeneration from Alzheimer's.

Eli Lilly has another drug in phase 3 trials, Remternetug, which should also get approval soon. The drug is used to treat early-stage Alzheimer's so it could be very widely prescribed. According to the company website, there are six other drugs in phase 2 trials and two in phase 1 trails, which could treat neurological degeneration.

Bright's banter

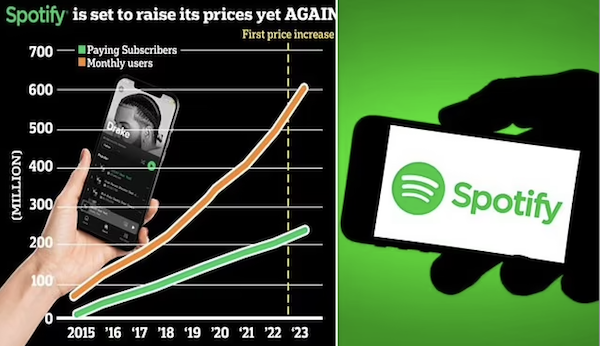

Spotify is raising prices again. Starting next month, Spotify Premium subscribers will pay $11.99 a month, up from $10.99. That's almost a R20 increase for us here in Mzansi.

This is the second price hike within a year as the company aims to cover the costs of its expansion into audiobooks and address its ongoing struggle to post consistent profits, despite being the most popular music streamer by subscriber count.

Last year, Spotify also raised prices to align with competitors. Following the announcement, Spotify shares jumped 5.7%. They are trading close to all-time highs, which were first reached back in early 2021.

Linkfest, lap it up

Heat waves are making pregnancy more dangerous. They also exacerbate existing maternal health disparities - The link between extreme heat and premature birth.

Getting a reservation at a top-rated restaurant in Manhattan can be tough. It's even harder when scalpers get involved - New York bans black market operators.

Signing off

Asian markets are mixed this morning, as usual. Benchmarks fell in Hong Kong and mainland China while India, Japan, and South Korea are all in the green. Eyes will be on China's inflation data this week. In other news, Dexin China Holdings received a liquidation order from a Hong Kong court, exacerbating the region's property market troubles.

Locally, chemicals company Omnia reported a 16% drop in revenue due to lower commodity prices in its agriculture division, but its profit after tax remained steady. Elsewhere, Alex Forbes enjoyed a 29% increase in headline earnings, driven mainly by new business. The company's assets under management grew by 16%, reaching R525 billion.

The Rand is trading at around R18.76 to the US Dollar, so not much changed, despite continued political uncertainty.

Oracle will report its quarterly earnings after market close. US equity futures are marginally higher pre-market.

Have a good day.