Market scorecard

US markets ended on a high note yesterday, with the S&P 500 hitting its 25th record close of the year, and the Nasdaq notching its 13th new high. Technology giants like Nvidia (+5.2%), Broadcom (+6.2%), Applied Materials (+5.3%), Meta (+3.8%), and Netflix (+3.0%) were the primary drivers of these gains.

In company news, Alphabet has appointed former Eli Lilly finance chief Anat Ashkenazi as its new CFO, replacing Ruth Porat, who announced her departure plans last year. Powerful women at the top of the business world. Elsewhere, Lululemon shares jumped 9.7% after-hours as the athleisure company reported earnings and an outlook that exceeded market expectations. They make very nice tights.

Here's the lowdown, the JSE All-share was unchanged, the S&P 500 rose 1.18%, and the Nasdaq powered 1.96% higher. What can we say? Things are going very well for equity investors.

Our 10c worth

One thing, from Paul

Vestact-recommended cybersecurity company CrowdStrike had super results out on Tuesday night, and the shares rose by 12% in the market on Wednesday. This move puts it close to all-time highs, which is $365 per share.

First-quarter revenue surged to $921 million from $693 million a year before, and subscription revenue accounted for nearly all of that total. Profit came in at $43 million, or 17 cents a share, compared to breaking even in the same period last year. Very good!

"CrowdStrike started the fiscal year from a position of momentum and exceptional strength," CEO George Kurtz said in a prepared statement. "Customers of all sizes are standardizing on the Falcon platform to achieve better security outcomes and lower their total cost of ownership." The company's Falcon cybersecurity platform offers detection, prevention, and remediation services.

We are happy holders of CrowdStrike, which is probably our most risky, early-stage investment. A modest holding in this one could go far in time.

Byron's beats

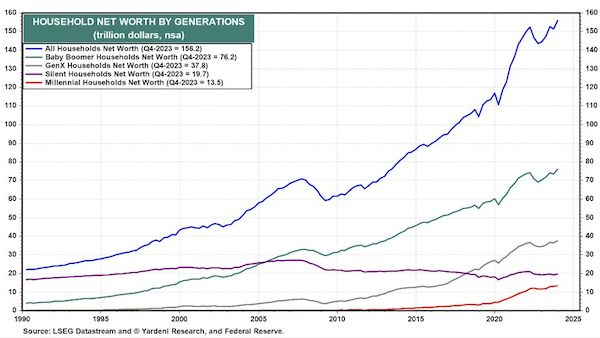

I really enjoyed this graph created by Yardeni Research showing the net worth of the various generations in the US. The dark blue line at the top is the overall net worth, which was a whopping $156 trillion at the end of 2023.

Baby Boomers who were born between 1946 and 1964 hold nearly half of US net worth of $76 trillion. A good lesson that it takes time and patience to get wealthy and to really benefit from compounding asset growth. This generation also owns their homes, which makes up a big portion of the overall wealth.

Individuals who were born between 1965 and 1980, called Gen X, are next on the list with $37.8 trillion. The Silent Generation, born between 1928 and 1946, is third with $19.7 trillion. That line is flat, I would imagine because they are dying and the other generations are inheriting their wealth.

The last group on the list worth noting are millennials with $13.5 trillion. They enjoyed a nice $5 trillion bump since Covid. I assume they have been investing in stocks and growing their wealth. Good for them (me)!

Michael's musings

Yesterday Nvidia became a $3 trillion company, overtaking Apple, and just slightly smaller than Microsoft. Simply amazing.

I remember writing three years ago that we thought Nvidia would be the next $1 trillion company. At the time, even that seemed like a tall ask, as it was 'only' worth about $500 billion after dropping from $800 billion a few months earlier.

A key reason for owning Nvidia is that humans are living more online, which creates large amounts of data. As the saying goes, in a gold rush, sell shovels. Data is modern society's gold, and Nvidia's data-processing chips are those shovels.

Bright's banter

ASML Holding has become Europe's second-biggest listed company, surpassing LVMH in market value for the first time. This comes after LVMH's shares dropped on fears of slowing luxury sales. Their competitors, Chanel and Kering, have battled, indicating tough times ahead.

ASML's shares surged 8.1% yesterday, valuing the semiconductor equipment maker at around EUR377 billion ($410 billion), EUR641 million more than LVMH.

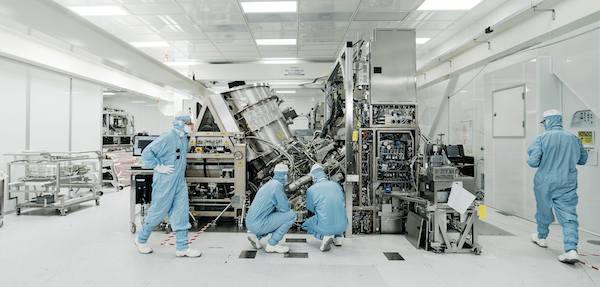

This rise was fuelled by news that Taiwan Semiconductor (TSMC), ASML's biggest client, will receive ASML's high-NA extreme ultraviolet machine by year-end, priced at EUR350 million each.

This reassured investors about future sales despite previous concerns over pricing. We expect significant orders in the coming quarters as TSMC ramps up production of 2-nanometer chips in late 2025.

Linkfest, lap it up

Apple News+ is a fast-growing revenue stream for Apple. It's only available in certain countries, but recent upgrades to the service have meant an uptick in subscribers - Apple News+ subscriptions growing 4x faster than major publishers.

Wind farms have a 30-year lifespan. That may also be how long it takes for investors to get their money back - ROI of onshore wind farms.

Signing off

Asian markets are up this morning with benchmarks rallying in India, Hong Kong, Japan, and mainland China. South Korean markets are closed for Memorial Day. Meanwhile, China's listed property sector is heading towards a technical bear market amid scepticism about Beijing's measures to support the sector.

Locally, Capital Appreciation shares rose 1.7% after reporting full-year results with a 19% revenue increase and more than double the profit after tax at R171 million. Meanwhile, asset manager NinetyOne announced a 1% rise in headline earnings per share as its assets under management surpassed R3 trillion despite experiencing local and offshore outflows.

US equity futures are marginally higher pre-market. The Rand is trading at around R18.90 to the greenback. Our political future remains uncertain, and that's reflecting in the moves of the currency.

Keep your head down, and stay happy.