Market scorecard

US markets ended higher yesterday despite data indicating a decline in factory activity. Investors appear to be waiting for additional data, such as Friday's crucial jobs report, to gain more insight into the economic outlook. The S&P 500 turned positive in the final minutes of trading, as a rally in big tech overshadowed a drop in energy producers.

In company news, Nvidia shares climbed another 4.9% after unveiling a new chip generation to fuel the ongoing AI development surge. Meanwhile, GameStop closed up 21%, after being up as much as 90%, as "Roaring Kitty" revealed what seemed to be a $116 million stake in the video game retailer. AP Moller-Maersk, a bellwether for global trade, upped its full-year profit forecast. The company said congestion in the Red Sea is causing disruption in global supply lines, leading to higher freight rates.

In short, the JSE All-share closed up 1.36%, the S&P 500 eked out a 0.11% gain, and the Nasdaq was 0.56% higher. We are trundling ahead.

Our 10c worth

One thing, from Paul

Vestact clients have been accumulating Eli Lilly shares, on our recommendation. Their weight-loss drug Zepbound will soon be supported by medical aids around the world. Slimmer people have much better health and longer life-expectancy, and go on paying their premiums. We expect that half of the world's adults will be on GLP-1 treatments in time.

A client said to me "An investment in Eli Lilly sounds great, thank you. Such a pity society invests in these kinds of developments when a good diet and exercise does it for free!"

I replied, "Yes, ideally that would be the case, but most people find it very hard to avoid delicious, high-calorie food. Consider the way people react when presented with a buffet at a hotel?"

As for exercise, many people would rather plonk themselves on a couch. At least to start with, exercising is painful. Some refuse to move for weirder reasons, like sweating disturbing their clothing and cosmetic routine.

All things considered, if an ongoing prescription (with no or very limited side effects) helps people get slim, this seems like a win for humanity.

Byron's beats

According to Reuters, Facebook is back in favour with young adults. A few years back the social media site had lost its allure with younger people and it was considered uncool to engage on the site.

Reuters reported that more than 40 million US and Canadian adults aged between 18 and 29 now check Facebook daily. This is the highest number in that category over the last 3 years.

Extra features like Reels, Marketplace, Groups and Dating have been very successful in bringing back engagement. As shareholders of Meta, we are happy to see growth among young users, they are big future consumers that advertisers want to engage with as soon as possible.

Michael's musings

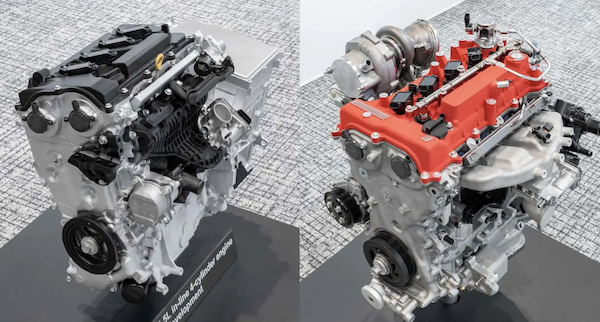

Last week, Toyota, Mazda, and Subaru teamed up to show their latest developments. No, it wasn't a new EV motor but smaller and more fuel-efficient combustion engines. The idea is to have compact engines that produce more power and can run on either liquid hydrogen, biofuel, or synthetic fuel. These engines will be paired with a battery pack to create low-emitting hybrid cars.

I'm not sure of the exact game plan here, given that many developed nations plan to phase out hybrid cars in the next 10 to 15 years. Maybe the companies are taking the view that lawmakers will shift the restrictions to accommodate low-emitting engines running on what is viewed as sustainable fuel? Some people feel that the power grids of these developed nations won't be able to grow and transform quickly enough to have the capacity to power EVs with 'green energy'. In that scenario, low-emitting hybrid cars are the solution.

I'm not sure what the future holds, or what will become the dominant technology. I'm enjoying the different approaches from all the competitors. This is how humanity moves forward when individuals and companies embrace competition, risk, failure and success. Thanks capitalism.

Bright's banter

Shein is gearing up for an IPO in London that could value the online fashion giant at around GBP50 billion ($64 billion). The exact timing of the filing is still up in the air, but if it goes through, it could be one of the UK's biggest IPOs ever.

Shein chose London over New York, partly because the US SEC was unlikely to approve a New York IPO of a Chinese-linked company, with politicians like Senator Marco Rubio raising concerns about the company's lack of transparency regarding its China operations.

Founded in China and now based in Singapore, Shein still needs the green light from the China Securities Regulatory Commission to proceed with the listing. This comes amid the UK's election in July, with the Labour Party currently ahead in the polls. Shein's executive chairman has been in talks with several Labour politicians as the company navigates its next big move.

Linkfest, lap it up

How much is a great memory worth? We can place a price tag on a BMW M3, but how do we value the memories of being out on a road trip to see grandma? - The case for spending money on memories.

The airline industry is turning to ethanol to reduce its carbon footprint. Fuel produced from corn and soy may be more environmentally friendly - Is plant-based ethanol better for the planet?

Signing off

Asian markets are mixed this morning, struggling for direction. Benchmarks declined in India, Japan, and South Korea, while those in Hong Kong and mainland China rose.

Locally, Brait announced a R1.5 billion bookbuild, underwritten by Christo Wiese's Titan Investments. The funds will be used to reduce debt on Brait's balance sheet, which will give them more leeway to sweat the Virgin Active and New Look assets before selling them.

US equity futures are little changed pre-market. The Rand is trading at around R18.55 to the US Dollar after the greenback stabilised against the Group-of-10 basket of currencies.

Tonight CrowdStrike will report its quarterly earnings. The stock price has been under pressure over the past week, so these numbers are important.

Keep it up folks.