Market scorecard

US markets slid yesterday and ended in the red, thanks to a selloff in the technology sector. Big names such as Adobe (-6.6%), Oracle (-5.4%), Nvidia (-3.8%), and Microsoft (-3.4%) led the decline. The damage was quite contained, and nine out of the S&P 500's other eleven sectors actually posted decent gains for the day.

In company news, Salesforce ended the day 19.7% lower after posting quarterly numbers that the market didn't like. ServiceNow was down 12% in tandem. Elsewhere, Chinese carmaker Nio closed up 9.5% in New York as deliveries are expected to top estimates by a large margin. Dell dropped 17.8% after-hours, even with good revenue and earnings numbers as AI-orientated servers flew off the shelves, but its outlook was conservative.

At the end of the day, the JSE All-share closed down 1.80%, the S&P 500 lost 0.60%, and the Nasdaq was 1.08% lower. Given the epic run from the technology sector in recent times, a little "profit taking" seems reasonable.

Our 10c worth

One thing, from Paul

It's Friday, so here's a spot of advice to consider.

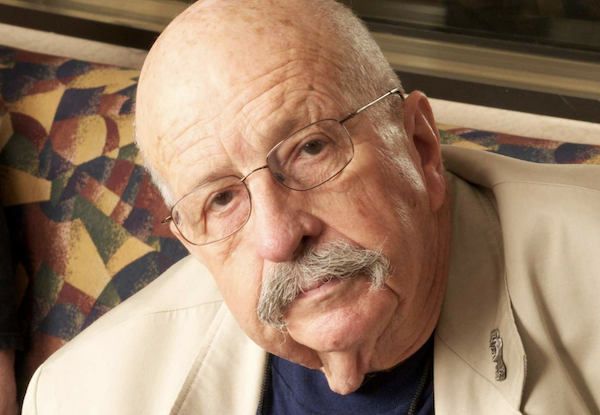

Science fiction writer Gene Wolfe (pictured below) said "What a man knows hardly matters. It is what he does."

In other words, you won't be remembered for anything that happened inside your head. No one will say, "wow, that guy had some great theories about socialism and South African politics."

Your family, friends, colleagues and acquaintances will judge you by what you built. What will be your legacy? It could be a business, a building, a garden, a book, a sports club, or a thriving family.

Michael's musings

Have you noticed your attention span getting shorter? According to research by the University of California, Irvine, the average American adult today tends to focus on a screen for about 47 seconds before clicking away or tending to something else. In 2012, it was 74 seconds, and in 2004, it was 150 seconds.

Society is currently drawn to short forms of media and entertainment. TikTok videos need to be short and sharp. Tweets need to be to the point or skipped. And, Michael's Musings shouldn't be longer than three paragraphs. Ten years ago, Sasha used to write long, meandering morning messages, and our audience loved it.

Hollywood is also adjusting to accommodate our shorter attention spans. Earlier this year I read about content producers creating movies and series on the assumption that their audience would be on their phones while watching, doing things like scrolling Instagram. The result was shallower plot lines, and more repetition of what was happening, to make it easier for an audience only paying half attention to keep track of what was going on.

Is the shorter attention span a problem, or is this just society's new normal?

Bright's banter

Amazon announced that it wants to increase its stake in Grubhub to 15% and is expanding the partnership so US users can order food directly from the Amazon app. In short, if you have a US Amazon Prime account, you'll get a free Grubhub subscription.

Amazon currently holds a 4% stake and will buy an additional 3% this year and 1% next year. The deal is a complicated warrant structure, with the option to boost its shareholding to 15% in the long term.

Following this announcement, Grubhub's parent company, JustEat Takeaway, gained by 2.3% on the Dutch exchange.

Linkfest, lap it up

Your real life and social media life are pretty different. The more you tweet, the more the internet knows about you and the more it takes from you - When you share part of your life online, it's no longer yours.

I'm sure we've all heard of lifestyle creep. This is when spending on non-essential items becomes the norm as your standard of living improves - How luxuries become necessities.

Signing off

Asian markets snapped a three-day losing streak and edged higher this morning. Benchmarks rallied in India, Hong Kong, Japan, mainland China and South Korea. This is impressive considering that China saw manufacturing and non-manufacturing PMIs miss estimates.

Locally, Woolies dropped 7.2% after announcing that its full-year earnings are expected to be over 20% lower year-on-year due to the sale of David Jones, and declining apparel sales. Meanwhile, Zeda reported lower half-year earnings as the used car market faced challenges in 2024, but its car rental brands, Avis and Budget, enjoyed growth of 19.6%.

US equity futures have slipped a little further downwards in pre-market trade. There is important US inflation data out today. The core PCE price index, which excludes the volatile food and energy categories, is anticipated to have risen by 2.7% in April compared to a year earlier. This represents a slight easing from the 2.8% increase recorded in March.

In the aftermath of the election, the Rand is trading at around R18.77 to the US Dollar. It's unclear what shape our future government will take, as the ANC goes cap in hand to the leaders of its main rivals, trying to find a palatable coalition. These are interesting times.

Stay warm this weekend. Have a good one.