Market scorecard

Technology stocks boosted the S&P 500 and Nasdaq on Friday, concluding a turbulent but positive week. Both major indices extended their winning streaks to five weeks. The leaders on the day included Qualcomm (+4.3%), AMD (+3.7%), Tesla (+3.2%), Meta (+2.7%) and Nvidia (+2.6%).

In company news, Intuit dropped 8.3% after the company reported a decline in the number of people using the free version of its TurboTax product. Elsewhere, Deckers Outdoor surged 14% as the maker of Ugg boots and Hoka shoes stomped all over Wall Street's sales and profit expectations.

On Friday, the JSE All-share closed up 0.25%, the S&P 500 gained 0.70%, and the Nasdaq was 1.10% higher. A good final outcome, that's what counts.

Our 10c worth

One thing, from Paul

This is an exciting week for South African citizens. The forthcoming national election will be the first in living memory where no single party is expected to win a clear majority.

No one knows what the turnout will be, and how the seats in the national assembly will be allocated in the end. Analysts have taken to drawing a matrix of possible outcomes, alongside a probability number, and the possible reaction of the Rand and the JSE.

A number of loud-mouthed politicians have been predicting landslide victories for their own parties. I'm looking forward to seeing their sad little faces on TV after they do poorly.

Given our dire economic circumstances, infrastructural challenges and rampant unemployment, a change in government is what we need. Of course, some coalitions would be more attractive to the tax-paying middle classes than others. We will have to wait and see what's possible.

Within 14 days of voting everything has to be settled, in line with our constitution. I'll be glued to the IEC website, watching the results roll in.

Byron's beats

Jensen Huang, the CEO and founder of Nvidia, can do no wrong at the moment. When he speaks, the world listens. I was encouraged to hear him talk very highly of Tesla at the Nvidia results release last week.

Huang said Tesla is far ahead in self-driving cars and that every single car someday will have autonomous capability.

During the earnings call last week, Nvidia also spoke about their support of the Tesla AI training cluster after Tesla bought 35 000 H100 GPUs from Nvidia for expansion. The Nvidia team believes that this will pave the way for the success of Tesla's FSD (full self-driving) software. Nvidia also predicts that automotive applications will be the largest growth driver within their data centre business this year.

Tesla and Nvidia have faced very different business cycles in recent years. Both remain Vestact-recommended stocks, and we look forward to the pivotal period when Tesla cracks the self-driving code.

Michael's musings

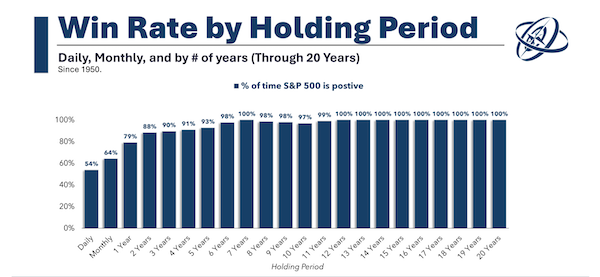

Some people feel that the stock market is rigged in favour of large institutions and billionaires. Over the short term, there is probably some truth to that. When you are trading, there is always someone with more information than you, and that person will have an advantage. You could say the market is rigged in their favour.

Over the long run though, having small amounts of insider information from 5 years ago will give you no advantage. If anything, insider knowledge can cloud your judgement, and make you miss the big picture. The true advantage in the stock market comes from being patient, which is easier for individual investors than professionals, who have performance numbers to report.

Last week Ben Carlson wrote a good article on the topic - No, the stock market is not rigged against the little guy. Here are his concluding thoughts:

"The only dumb money is those investors who assume there is easy money available in the short run. Making money isn't supposed to be easy. The stock market is hard. But it works for patient investors with a long enough time horizon."

Bright's banter

Sir Paul McCartney has now reached billionaire status with a net worth of GBP1 billion ($1.27 billion). According to the Sunday Times Rich List, McCartney is Britain's first musician to reach that level.

He crossed the line thanks to a GBP50 million boost from his recent 'Got Back' tour, the rising value of his music catalog, and Beyonce's cover of his song "Blackbird."

All you need is love, but it's also nice to have truckloads of money.

Linkfest, lap it up

Humans feel the need to act, move, or go. Think of the maxim "If you're moving, you're improving" - The case for hitting pause.

The view of marijuana in the US has shifted. Many argue it is less harmful to the public than alcohol - More people use weed daily than booze.

Signing off

Asian markets are mostly higher this morning. Benchmarks rose in Hong Kong, Japan, mainland China, and South Korea, while they ebbed in India.

Locally, JPMorgan has increased its stake in Capitec from 5.11% to 8.37%, bringing its total investment in the South African bank to approximately R22 billion. Elsewhere, Quantum Foods reported a 650% surge in core earnings for the half-year ending in March thanks to high egg prices and a reduction in load-shedding. Pick n Pay is out with results this morning, with more details of their chaotic restructuring efforts.

US markets are closed today for the Memorial Day holiday, and it's also a bank holiday in the UK. We expect it to be quiet here, as a result. The Rand is trading at around R18.41 to the US Dollar.

Enjoy the week, it is going to be historic.