Market scorecard

US markets were up yesterday. The S&P 500 hit another record high, its 24th this year, while the Nasdaq also closed at a new high. Notable performers included First Solar (+8%), Tesla (+6.7%) and Eli Lilly (+2.6%). All three major indices have gained over 5.4% this month, driven by a strong earnings season and lower inflation. Beautiful!

In company news, Macy's rose 5.1% after increasing its profit forecast for the year. In contrast, Lowe's dropped 1.9% following a report of declining sales. Newly-listed Finnish company Amer Sports posted better-than-expected sales and profits, largely driven by its (badly-spelled) Arc'teryx brand, but its shares fell 7.9%.

Here's the lowdown, the JSE All-share closed down 0.33%, but the S&P 500 rose 0.25%, and the Nasdaq was 0.22% higher.

Our 10c worth

Bright's banter

Richemont shares jumped over 5% on Friday after the luxury goods company reported a 3% rise in annual sales to a record EUR20.6 billion for the year ending in March. Not bad considering the global slowdown in luxury sales, as reported by competitors.

Fourth-quarter sales dipped 1% at actual exchange rates, but the company's operating profit increased by 13% to EUR4.8 billion, with overall profit at EUR2.3 billion.

Richemont, which owns brands like Cartier, IWC, Mont Blanc, and Van Cleef & Arpels, saw the Americas, particularly the US, surpass Europe in sales. Revenues also accelerated in Japan and the Middle East.

Recently, Richemont acquired 70% of Gianvito Rossi and Italian jewellery maker Vhernier to enhance its portfolio. Johann Rupert expressed optimism about the potential of these acquisitions, citing the significant growth at Buccellati since its 2019 acquisition.

The company has re-established the CEO role, appointing Nicolas Bos, while Jerome Lambert becomes COO. Additionally, Bram Schot will replace SA-based stalwart Dillie Malherbe as non-executive deputy chair, as he approaches retirement.

We like Richemont as a long-term investment for Rand-area investors. We are lucky that it is still listed here at home on the JSE as there are very few high-quality businesses like this one in the world. Richemont remains an anchor position in our local portfolios.

One thing, from Paul

In the asset management business, high portfolio turnover is a red flag. If you own direct stocks in a portfolio and your adviser has a hot idea every month, and is constantly pushing you to buy and sell stocks, watch out.

If your portfolio manager liked a company in March, and wants you to sell it in May, how well thought through was the initial recommendation?

Bob Howard is a veteran of the investment newsletter business. He's been writing Positive Patterns for the last 32 years, from the Ozarks, and addressed the issue of portfolio turnover yesterday:

"One of the first things a money manager needs to be asked is "What is your annual turnover rate". If it's above 50% your money manager is a trader not a long-term investor, despite what they might say. That's a complete turnover in just 2 years of the entire portfolio. Pay attention to the facts, not the propaganda. If it's a 10 to 20% turnover, that's a good sign."

Vestact's portfolio turnover is below 5% per annum. We buy carefully, stay patient in tough times, and only sell very reluctantly.

Byron's beats

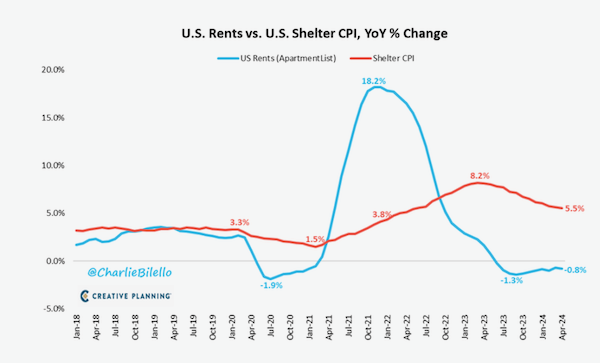

The cost of shelter plays a large role in the US CPI calculation, making the graph below important viewing. Shelter costs are sticky and come down very slowly due to certain lag effects. The good news is that the red line is dropping, albeit slowly. The bad news is that it is still at 5.5% as per the last releases, which is well above the overall CPI number of 3.6%.

Looking at the trend of the red line and the delayed fall in the cost of shelter, I would assume that the number is not going to plunge off a cliff. It is going to be a gradual drawdown, as we have seen so far since March 2023. It is such a sticky and delayed reading that you can also safely assume it is not going to surprise us and spike higher.

I am looking forward to the day when shelter comes in below the average CPI number and it starts pulling the overall average down, given its heavy weighting. Hopefully, this will be by the end of the year.

Linkfest, lap it up

Jeans are adult fashion's mainstay. They have survived more trends than any item of clothing - Denim never dies.

Do you like salty food? Do you worry about excess sodium intake affecting your health? - A $127 electric spoon makes food tasty salty, without needing extra salt.

Signing off

Asian markets are mixed this morning. Benchmarks fell in India and Japan which reported a trade deficit, but rose in Hong Kong, mainland China and South Korea.

Locally, Alexforbes anticipates a decent boost in full-year earnings, with headline earnings from continuing operations projected to rise by up to 20%. Elsewhere, Transaction Capital reported reduced losses for the half-year period, mainly due to the consolidation of losses at SA Taxi. Revenue decreased to R981 million from R1.3 billion the previous year.

US equity futures are edging higher pre-market. Perhaps we will have more new highs at the close tonight. The Rand is trading at around R18.07 to the US Dollar.

Today, PDD Holdings and Target report earnings pre-market while after-hours we will see the highly anticipated quarterly numbers from the mighty Nvidia. No going to bed early!

Pace yourself, it's only Wednesday.