Market scorecard

Yesterday, US markets had an uneventful trading session. The Dow broke its eight-session green streak, the S&P 500 was basically unchanged even though nine of its eleven sectors ticked lower and the tech-heavy Nasdaq advanced slightly thanks to gains by Apple and Nvidia.

In company news, Uber is looking to buy Delivery Hero's Taiwanese business called Foodpanda for $950 million. The food delivery business has been a standout performer for Uber. Elsewhere, Anglo American turned down BHP's second offer that valued the miner at $43 billion.

At the end of the day, the JSE All-share ended up 0.28%, the S&P 500 declined by just 0.02%, and the Nasdaq was 0.29% higher.

Our 10c worth

One thing, from Paul

Good investors pay attention to long-term trends, and try to position their portfolios accordingly. Big shifts in the global economy create both opportunities and threats for leading companies.

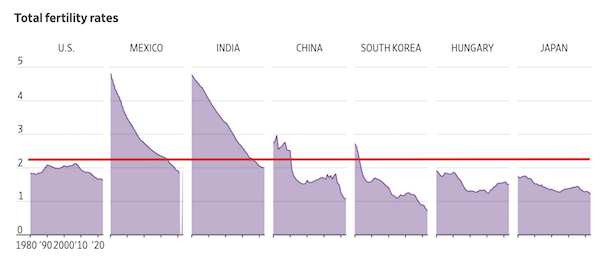

I'm noticing more and more articles about how birth rates worldwide are falling surprisingly quickly. Demographers consider the global replacement rate to be 2.2. That's the number of children women need to have to keep the overall population from declining. See the red line on the chart below.

In high-income nations, fertility fell below replacement in the 1970s, and took another big leg down during the pandemic. Now it's dropping in developing countries, too. India surpassed China as the most populous country last year, yet its fertility is now below replacement at 2.03.

So far, government interventions to reverse the trend with tax incentives and more maternity leave have failed to make a difference. Women are less interested in marriage and child-rearing than ever. People that do start families have fewer kids because parenting is becoming more time-consuming and much more expensive.

Experts now suggest that the world population will peak at around 9.5 billion in 2061 and then start declining.

In time we'll have shrinking workforces, slowing economic growth and underfunded state pensions. GDP per capita will still rise, because productivity and technology will accelerate. I'm not sure yet what the implications are for our investment strategy.

Byron's beats

Last week Tim Cohen wrote a great piece about the current power situation in South Africa titled Business has once again saved the ANC's ass. A cheer perhaps? He's referring to the recent purple patch of uninterrupted power supply. What bliss! Many are suggesting that this is just the ANC burning billions of Rands worth of diesel ahead of the elections, hoping that voters will forget about the previous 17 years of loadshedding under their watch.

According to a report from Business4SouthAfrica (B4SA) this might not be the case and things have in fact improved drastically. As Tim says, all the ANC had to do was get out of the way and let business fix the problem.

Rooftop solar grew by 2.6 GW in 2023 which has taken a huge amount of pressure off the grid. It is expected that by the last quarter of 2024, we should be in a position of sustained average stage-1 loadshedding, thanks mostly to new-generation solar and wind power. Things are also expected to improve at Eskom I must add. All the loadshedding pain of the last 2 years, while they were doing extra maintenance, is now paying off.

If you are looking for something positive to read for a change, click on the link above and enjoy.

Michael's musings

Cash flow is the lifeblood of any business. With cash, companies can return money to shareholders, hire top talent, and invest in future operations. One of the reasons that we like tech companies is that they have massive profit margins and produce truckloads of cash.

The new buzzword in investing is the Magnificent 7, and they are called magnificent for a reason. Tony Pasquariello from Goldman Sachs notes that the "total capital expenditure and R&D for the group - Apple, Amazon, Alphabet. Meta, Microsoft, Nvidia, Tesla - is expected to be $348 billion this year."

"Another way to frame it: the Magnificent 7 reinvests 61% of their operating free cash flow back into capex and R&D; that's tracking to be 3 times the other 493 members of the S&P 500".

That level of investment is a bit mind-numbing - $350 billion is a huge number! All this capex bodes well for the future of these seven companies.

Bright's banter

"Roaring Kitty," the guy who ignited the whole meme stock frenzy back in 2020 and 2021, made a surprise return to Twitter after almost three years of radio silence.

His mysterious tweet got day traders all riled up, sending GameStop shares soaring by as much as 110% yesterday. That company was a key meme stock, and its trading got halted multiple times yesterday, eventually settling up around 74%. Another Meme stonk AMC Entertainment closed up 78%.

Back in 2021, "Roaring Kitty," whose real name is Keith Gill, rallied day traders on Reddit to take on hedge funds' short positions, driving up the prices of the stocks they were betting against. This shake-up led to some hefty losses for big firms like Melvin Capital, Ken Griffin's Citadel, and Steve Cohen's Point72.

Linkfest, lap it up

People are mining seaweed now. Seaweed provides a habitat for marine life, shelters coastlines and absorbs carbon dioxide - Salty, slimy seaweed also traps precious minerals.

Cicadas spend most of their lives underground, only emerging above ground in cycles. Once every 221 years, the 13-year cycle cicadas and the 18-year cycle cicadas emerge at the same time - A rare double-brood event.

Signing off

Asian markets are somewhat lower this morning. Benchmarks fell in India, mainland China, and South Korea but rose in Hong Kong and Japan as technology stocks advanced. Companies like Tencent and Alibaba led gains, but keep an eye on them as they will be reporting earnings in a few hours from now.

US equity futures are in the green at this point. The Rand is looking handsome at around R18.37 to the US Dollar. A good rate for those looking to further their investments offshore?

Today, companies that report their earnings include Home Depot, Sony, Sea Limited, and On Holdings. On the economic front, we will see the release of US producer-price index data this afternoon.

Onwards!