Market scorecard

Yesterday, US markets edged higher, propelled by gains in property and utilities companies. The gains in May from all three major indices have reversed April's declines, and they are approaching new record highs. This surge in confidence stems from the growing belief on Wall Street that the Federal Reserve will start cutting interest rates later this year. Sell in May and go away has been very bad advice so far.

In company news, Airbnb saw a 6.9% decline after its projection for the current quarter failed to meet analysts' expectations. Meanwhile, Warner Music Group ended 8.6% lower due to a slowdown in recorded music, and Roblox dropped 22% after its full-year guidance fell short of forecasts.

At the close, the JSE All-share closed up 0.47%, the S&P 500 rose 0.51%, and the Nasdaq was 0.27% higher.

Our 10c worth

Bright's banter

Amgen reported strong results last week. Its shares closed up over 10% on the day after its CEO expressed optimism about early trial results for its obesity drug, MariTide.

Even though the buzz around Amgen's new drug pipeline was the main focus of these results, the company also had a solid performance from existing brands. Revenue reached $7.4 billion, up 22% year-on-year. A significant portion of this growth can be attributed to sales of products acquired through Amgen's $27.8 billion acquisition of Horizon Therapeutics last year.

Assets brought in from Horizon contributed $914 million in sales, a 10% increase year-over-year. Among the standout performers from Horizon were gout treatment Krystexxa, which soared 26% to $235 million, and neuromyelitis optica spectrum disorder drug Uplizna, its sales rising 48% to $80 million.

The thyroid eye disease (TED) drug Tepezza emerged as the top-selling Horizon import, generating $424 million in the quarter, up 5% year-on-year. Amgen is currently conducting a phase 3 trial for a more user-friendly subcutaneous version of Tepezza, this could reignite growth in the drug.

Maridebart Cafraglutide, known as MariTide, was developed based on genetic data linking reduced GIP receptor activity to lower fat mass and body weight. Early trial data suggests promising weight loss effects with an acceptable safety profile, with the highest tested dose leading to a remarkable 14.5% weight loss over 12 weeks.

The company's phase 2 program is exploring various dosing regimens, including monthly injections, which would be a massive advantage over the current GLP-1 drugs which require weekly injections.

Amgen's shares have soared on the heels of promising MariTide trial results. Eli Lilly and Novo Nordisk watch out, there's a new kid in town!

Looking ahead, Amgen's innovative approach to weight loss medications, along with its robust pipeline spanning cancer and rare diseases, positions the company as a good long-term investment in the exciting pharma sector.

One thing, from Paul

Ah Friday, the best day of the week. A work session to enjoy, plus the delightful prospect of the weekend ahead.

Friday is also the day when I get to dish out some unsolicited advice to you our fantatstic readers.

With an election coming in a few weeks' time, and people's tempers heating up, I thought that these points from Nate Silver (pictured below) were helpful. He's a well-known political analyst in the US.

"Politics is [a matter of] personal identity - whose team are you on? People are trying to figure out where they fit in, who's on their side and who isn't. They derive value from a sense of social belonging and receiving reinforcement that their choices are honourable and righteous."

"Politics is seldom a battle of ideas. This is not to suggest that people don't hold reasonable moral intuitions about political affairs. But when it comes to mass popular opinion, the number of people who are interested in ideas for ideas sake is vanishingly small. Political elites considerably overstate the extent to which they can persuade the public by marshalling the right arguments or presenting them with the "right" facts."

There you have it. Let's go easy on each other for the next few weeks.

Byron's beats

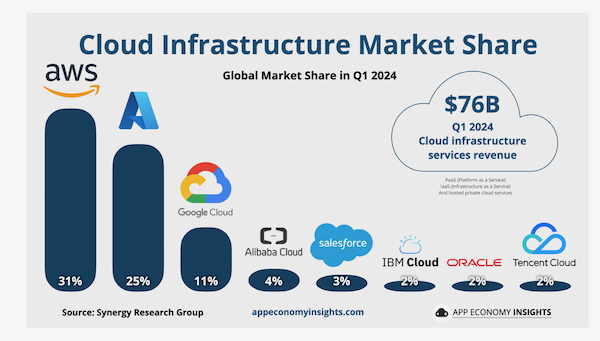

The cloud business is incredibly lucrative. As you probably know by now, we are heavily exposed to the theme through the three biggest players, Amazon (AWS), Microsoft (Azure) and Google (Google Cloud). The below image from App Economy Insights shows us the latest market share figures.

AWS still leads the pack but has slipped from 34% to 31% in recent years. Azure has been the fastest growing of late, stealing market share along the way. In the latest quarterly results Azure grew by 31%, Google Cloud grew by 28% and AWS grew by 17%.

The battle for market share will ebb and flow but in reality the sector is growing so fast that all participants are able to benefit. According to Andy Jassy, the Amazon CEO, 85% or more of global IT spending still remains on premise. In other words, that could all be moved to remote cloud hosting at some stage in the future. That sounds like a good result for our holdings.

Michael's musings

We learnt on Monday that Shell plans to sell its South African petrol station business. The company is looking to the future, which is charging electric vehicles. Another incentive to divest from this part of its business is that Shell was recently sued in Europe for not transforming its business model fast enough away from fossil fuels.

Shell isn't the only oil major turning its attention to EV charging stations. Yesterday, Bloomberg announced that BP is interested in buying some of Tesla's North American charging network. On top of that, it plans to spend another $1 billion in the next few years to expand the network.

Tesla has 74% of the charging network in North America. The company needed to install charging stations to convince customers to buy EVs, but now that critical mass has been achieved in the EV market, Tesla can commit its capital to other ventures.

Linkfest, lap it up

Some deafness is inherited. Faulty DNA leads to loss of hearing - Pioneering gene therapy restores UK girl's hearing.

The world is currently in an energy transition. China is leading the charge to renewables - More than 30% of the world's electricity is now coming from renewable energy.

Signing off

Asian markets are mostly higher this morning. Benchmarks rose in India, Hong Kong, Japan, and South Korea but fell in mainland China.

The Rand is trading at around R18.50 to the buck. US equity futures are unchanged pre-market.

Another week is done. Have a good weekend.