Sign up for our free daily newsletter

Get the latest news and some fun stuff

in your inbox every day

Get the latest news and some fun stuff

in your inbox every day

Tesla, the car company that makes the best looking electric cars in the world, released their Fourth Quarter & Full Year 2014 results on Wednesday night last week. Elon Musk, the founder and CEO went to Pretoria Boys, so this company has a soft spot with us in the office, seeing as both Paul and Byron went to that fine establishment. The results were not as great as the market were expecting, they had pencilled in a profit compared to the 4Q loss of $0.13 a share, resulting in a drop around 7% in the share price.

Starting with the reason for the miss; the logistics of delivering cars. Tesla had production delays and then they struggled to get the cars to their customers due to, them being on vacation, weather and shipping. Tesla can only book the revenue and profits once a car has been delivered, in 4Q they delivered 9834 cars out of an expected 11 200. The good news is that there is a waiting list for the cars so the delayed cars were delivered int the 1Q of this year.

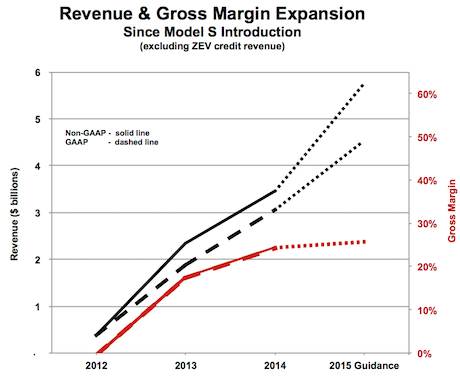

In 2014 they only produced 35 000 cars, which compared to Ford who sold 220 000 cars for December in the US alone; Tesla is still very small. For 2015 Tesla plans to deliver 55 000 cars, which is still relatively small but and increase of around 70% from 2014 figures. Along with the sales growth, Tesla is focusing on growing their margins as well, from the current 26.7% to around 30% in the 4Q in 2015. The industry average margin is the low teens, so their margin numbers are spectacular! Part of their revenue and by extension their margins is the sale of ZEV (Zero Emission Vehicle) credits. They get the credits due to their cars not having emissions and they sell them on to other car companies, who need a certain amount of credits based on the number of cars that they sell. Margins drop to 22% if you strip out the sale of credits, which you cant rely on due to regulations being able to change down the road.

Here is a look at the staggering growth they have had and the forecast growth.

Going forward they expect to launch their Model X, which is an off road vehicle, in the 3Q. There are currently 20 000 reservations for the Model X and 10 000 reservations for the Model S, no problems with demand. They are also spending a "staggering" amount of money on Capex going forward to improve their production and to add to their Supercharge network (fuel stations for Tesla's).

As far as shares go they are very expensive, they dont make a profit, so we cant use P/E. Having a look at their market cap of around $25 billion, on production of 35 000 for the last year, compared to Ford who have a market cap of $61 billion, on sales of 220 000 just for December. You can quickly see that the market has high expectations for the company. Granted Tesla is growing at a rapid pace, have super high margins and is the technology of the future, they still have a lot to live up to.

A big thing for me and something that tips the scales in Tesla's favour as an investment is their battery technology. They plan to launch a battery in the middle of this year that you could use in your house as back up power or to store solar power. A bigger battery play is through their Gigafactory, which will bring down their battery production cost by 30% and have the capacity to supply 500 000 Tesla's a year. I think the battery aspect will go further though because as the world become more green, green energy needs somewhere to put its energy until you need it. Tesla will have the technology and the production capacity to supply you with long lasting batteries. They are not just a car company.

This is a company that I really like and if you are brave, can consider adding a small position to your portfolio. There is no doubt it will be a bumpy ride until the company is mature but in the end I think it will be worth it.