Sign up for our free daily newsletter

Get the latest news and some fun stuff

in your inbox every day

Get the latest news and some fun stuff

in your inbox every day

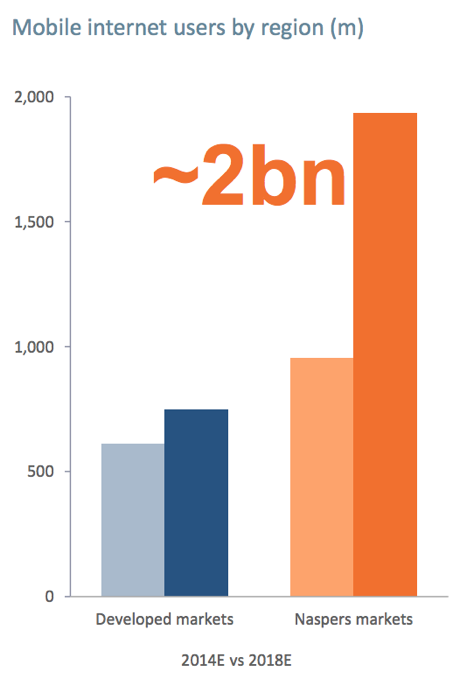

Naspers released their 6 months number to September this morning, these results were so highly anticipated that I hardly slept last evening. No, not true at all, I slept like a baby, you know, I woke up every three hours crying for food. Naspers are a business in another transitional phase, they are setting themselves up to become a major ecommerce player globally, and of course becoming more dominant in the mobile space, the whole idea of shopping on your phone. Naspers have a whole lot of interesting slides in the Financial Results Presentation, including the one that suggests that in emerging markets there could be more than double the number of mobile internet users in the developed world in 2018 than currently. They measure that against a relatively flat number in developed markets, here is the slide that I am talking about:

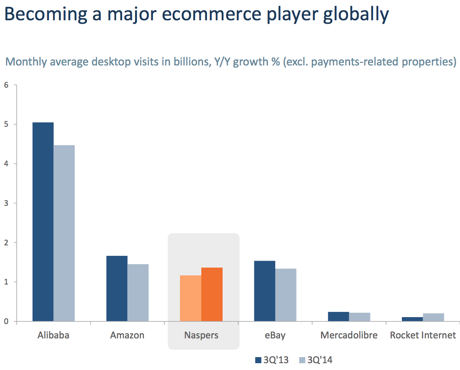

They really, really push the ecommerce part of their business, the first part of the results presentation is dedicated to this next big push in their businesses history. Koos Bekker has made that clear, we should not be that surprised. There was however one image in the slide presentation that caught my eye. It was this one:

So who does that include? What I mean by that is, who and what are the Naspers ecommerce businesses, remembering that the others are single platforms that are well know globally. Kalahari you will know and recognise (they have just teamed up with Takealot), flipkart in India you may have heard of, Souq in the Middle East is making progress, the European businesses (markafoni, emag, mall.cz and esky are amongst the ones in Europe) and avenida in Argentina. Konga in Nigeria. Yip, it is all happening in places that do not necessarily have english as their first language and if you cast your eye back up to the first image, it is happening away from where those others operate. The ecommerce business is bleeding money at this point in time, trading losses for the six months of 2.426 billion Rand was recorded.

Of course there is the small matter of a growing classifieds market too, OLX is surging, operating in more than 40 countries across the globe, 8.5 million monthly transactions, 11 billion monthly page views (JUST BROWSING!!!), 200 million active monthly users with 25 million new monthly listings. Wow. Yes, they, Naspers own this too. The growth in the number of listings on OLX are mind blowing. Of course this is mostly at a standing start. In terms of the countries that OLX operates in, they are number 1 in 8 of the top 9 countries by population, the only one missing is the USA. Who wants to fight against the biggest rich population in the world? 58.com in China, OLX in India, Indonesia and Brazil is the top dog. Collectively Naspers' classified businesses cover around 3.9 billion people in the most populous states in the world. That is potentially a lot of people, remembering of course that eyeballs do not translate to transactions, which would translate to profits!

The numbers, what do they look like? First of all, the company is investing heavily in their businesses, 4 billion Rand to be exact, up 35 percent from the comparable six months. Here is the revenue spread, Internet is 58 percent of revenue, Pay TV business represents 32 percent of revenue and the balance (10 percent) is Print. That is likely to be less and less in the coming years, trading profits at the print business was 96 percent lower than the prior reporting period. And to think that the local business is in far better shape than the international segment, Brazil sucks, the Abril business lost over 100 percent more than in the six months to September last year. Notwithstanding the fact that the ecommerce business made a loss, the internet business now generates more for Naspers than the TV business, mostly as a result of a 59 percent jump in the Tencent share of trading profits. We didn't even discuss or look at carefully (in this piece) the payu, the payments system, which is growing like crazy.

So what do you need to know here as a shareholder? First and foremost, the company now has 72 percent of their revenues earned offshore. True story. Yet, it always seems like a proxy for Tencent, the Naspers share price. What you get right now is a new business, a business again in transition that basically has this ancient (by media standards) legacy media business, a maturing TV business and the exciting part, the ecommerce and classifieds business, that is what Naspers are investing in heavily. The share price and the valuation part is always tricky, this is a sum of the parts calculation, something that we will again be looking at in detail over the coming days. We continue to recommend this company as a buy.