Sign up for our free daily newsletter

Get the latest news and some fun stuff

in your inbox every day

Get the latest news and some fun stuff

in your inbox every day

Diving into the Q2 figures from Tencent yesterday. The figures were higher than the already lofty expectations, with net profit for the quarter sitting at 5.84 billion Yuan (analysts were expecting 5.51 billion) and revenue for the quarter was 19.75 billion Yuan (analysts were expecting 19.2 billion).

The revenue figure is up 7% from the previous quarter and up 37% from a year earlier, which has translated into net income being down 10% from the previous quarter and up 59% the same time last year. The main reason for the difference is that margins are currently sitting at 40%, compared to 42% last quarter and 32% last year.

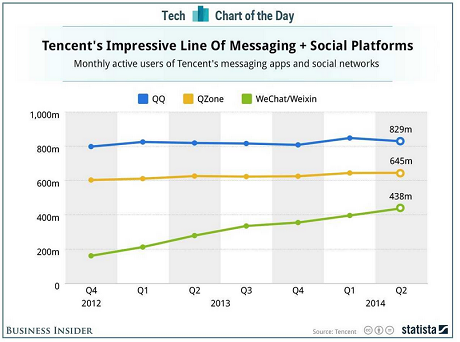

The below graph shows the user numbers for each of their platforms. There are some huge numbers there! The WeChat Monthly Active Users (MAU) is up 57% Yoy.

QQ is mostly a chat service for computers having started way back in 1999. WeChat/Weixin (the name of the service in China) is also a chat service, but it was only launched in 2011 and is geared towards mobile. WeChat also has more international subscribers, where QQ is more Chinese. Then the last one Qzone is most similar to Facebook.

The basics of their business model is to get people onto their platforms which then directs them to games (which accounts for 56% of revenue) or towards their shopping or financial services platforms."For instance, users can now purchase products from JD.com through a direct access point in Weixin and settle the transactions via Weixin Payment, and can search content of Weixin's Official Accounts via Sogou" (a search engine that Tencent has a minority share in).

That snippet from the results announcement highlights their value chain. Tencent gets a slice of revenue during every step and then added to that, they will have advertisements along the way. One small innovation shows the power of their platform, "A new single- click link to JD.com in the Chinese version of WeChat has produced an eightfold increase in daily transaction volumes, compared with the previous two clicks, JD.com said in June." A small concern for Tencent is increased government regulation in the instant messaging sector. A recent regulation has been implemented so that users now have to register with their real name, which isn't huge but it adds red tape to signing up. This is a great company with solid prospects for growth as they find new ways for their over 800 million users to spend their money.