Sign up for our free daily newsletter

Get the latest news and some fun stuff

in your inbox every day

Get the latest news and some fun stuff

in your inbox every day

Kumba Iron Ore reported profits for the half year to end June. This is of course a pure commodities producer, a single commodity producer. Their only product is iron ore, which for those of you who want to know what it is used for, steelmaking. So for infrastructure development, this is one of the bulk commodities that you need a lot of. Anglo American are the main shareholder here, they own 69.71 percent of this business, the IDC owns 12.9 percent and the PIC owns 2.7 percent. That leaves very little for minority shareholders, less than 15 percent in total. Indirectly, as it is a very profitable business, it is very important to the many Anglo American shareholders.

Kumba can trace their roots back to the first mine, which is a tiny part of the business now, Thabazimbi, which supplied what is now Iscor's Pretoria Steel works. That was 1932! Sishen, the mine, was established in 1954, 60 years ago. The government as it was back then decided to build the Sishen-Saldanha rail link and port facility, to be built by Iscor. The line was finished in 1976 according to Wikipedia, it is 861 km long from Sishen to Saldanha. I saw a video that reported a 3780 metre long train carrying 342 wagons. The higher voltage was chosen to haul bigger haul, you can see why that was a good idea back then and now particularly.

Iscor was privatised in 1989 and trundled along for years doing very little. Enter China, the new consumer. In 2001 the two different entities split paths, the coal and the iron ore business became known as Kumba Resources and the Iscor company, the steel maker was separately listed. Now you can see where the iron ore agreement on a cost plus very little came from. In those days Iscor was a big customer of the newly formed Kumba. Kumba then split in 2006 into Exxaro and Kumba Iron Ore, the shareholdings of each of these businesses along the way have changed hands many times.

When Kumba Resources as it was known back then reported profits for their full year to end June 2002 (year end subsequently changed) the iron ore division reported 12 month revenues of 4.34 billion Rand and operating profits of 1.221 billion Rand. The year prior, 2001 had seen revenues for the 12 months of 2.944 billion Rand from their iron ore division and operating profits of 699 million Rand. Total production was a record 28.3 million tons, of which 25,9 tons came from Sishen. An agreement had been reached with Transnet to move 23.5 million tons a year through Saldanha Bay.

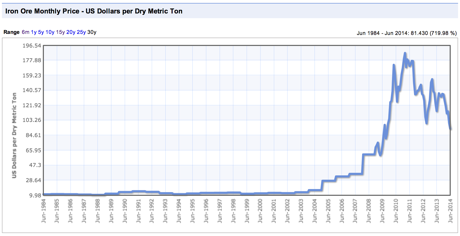

The average iron ore price? They were contractual back then. Marius Kloppers the ex BHP Billiton CEO did a lot to change that to spot pricing, perhaps making the process more transparent. The iron ore price was around 12.99 Dollars a ton, the Rand to the US Dollar had fallen out of bed in the year prior, nearly 12 to the Dollar in late December 2001 from around 6 to the Dollar in early 2000. Yowsers. But the weakening Rand to the Dollar aside, here is the 30 year price graph of the iron ore price, we have shown this many times:

The only part that is worth pointing out in that graph is how the Chinese demand for the product made the price soar, and the subsequent sell off over the last three years has been softening demand from the same said customer. Or let me rephrase that, lower growth. The ten year growth in iron ore prices is 465 percent according to Index Mundi. My only point, the company did not make the iron ore price, the demand side from China boosted both volumes and prices and the company was in the right place at the right time.

OK, so the half year results are are follows, revenues of 26.429 billion Rand, operating profits of 12.3 billion Rand, translating into 20.3 ZAR of half year earnings per share, and with a revised 1.3 times dividend cover that equates to 15.61. After tax, that is 13.2685 per share. On a share price currently of 347 Rand, if you annualise that you are getting an after tax return of 7.6 percent. Too good to be true? Probably.

They are still profitable, very profitable, just not as much as before. Their costs are low, relatively speaking, even though they have been rising. Chinese demand here remains key in order to put a new floor in on the iron ore price. What helps Kumba and their other competitors is that there is a lot of supply that is completely unprofitable at around 75 Dollars a ton, and even more below 70. Kumba do not have that problem.

As a shareholder it depends how long you have been in. I say that because some clients have a massive capital gain built in, and even if earnings fall to 28-30 Rand a share, the dividend flow could be in the region of 23 Rand (19.6 Rand after tax) per share. Somewhere in the region of 5.6 percent. Would I buy them on that basis? No. But if I have held them since the split, then definitely yes it is a hold, Anglo American, the parent company will continue to extract all they can from this company that they are the majority share holder of. It is a hold at best.