Sign up for our free daily newsletter

Get the latest news and some fun stuff

in your inbox every day

Get the latest news and some fun stuff

in your inbox every day

If you are an investor in Naspers you would know or at least should know that their Tencent stake is extremely influential on their share price. In fact if you plot the Tencent share price to the Naspers one the correlation will be very strong. I was asked on CNBC the other day whether management would be worried about the share price movements of Naspers in relation to the volatile Tencent price. My short answer was no, management would not be focusing on the share price, they will be focusing on operations within the business and whether they still think Tencent is a good asset under the Naspers umbrella. If you look at the direction of the Naspers business model, Tencent fits in perfectly with the mix. I expect them to hold that stake for many years to come, if not forever.

I am not going to go into the details of the valuations of Naspers, Sasha updates that very six months or so. Today I am going to look at the Tencent 2013 full year results which were released last week.

If you are uncertain of the Tencent business model I have covered the company before where I look at the details of the business here Tencent Q1 2013 Results.

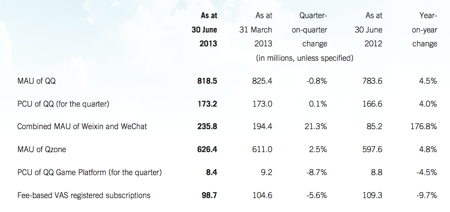

But for a better idea here is a table which shows you the trends of their users. MAU stands for Monthly Average Users and PCU stands for Peak Concurrent Users (peak users at one given time).

Revenues for the full year increased 38% to $9.9bn while operating profits increased 24% to $3.1bn. Wow those margins are huge. The reason the share price fell so much on the day was because for the fourth quarter operating profit actually decreased 1%.

There was valid reasoning for that however. They are busy migrating their main QQ platform from a primarily PC experience to a mobile one which has been expensive. It is imperative that they stay ahead of the times.

Operationally here is what management had to say about the year.

"In 2013, we accelerated the mobilisation of our services and reinforced our leadership in mobile applications in China. Building on our strengths in communications and social platforms on mobile devices, we expanded the user base of various mobile applications, such as news, music and utilities, and launched new services on our core mobile platforms, such as Game Center and Weixin Payment, which enhanced user engagement, while opening up monetisation opportunities. We also extended our leadership in online games and open platforms, while expanding our online advertising business and our eCommerce transactions business."