Sign up for our free daily newsletter

Get the latest news and some fun stuff

in your inbox every day

Get the latest news and some fun stuff

in your inbox every day

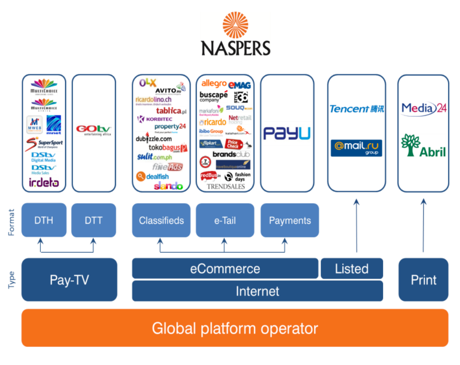

Naspers reported their six month numbers yesterday. But before we get into that, Meloy Horn, an ex analyst and now investor relations contact at Naspers and her team do a fabulous job in explaining what Naspers is. Here goes their business overview, Fact Sheet - November 2013 and here is the group structure, which segregates the business into pay TV, internet and print. Print is the local media 24 business (60 magazine titles and 50 newspaper titles) and the 30 percent stake in the Brazilian business Abril and a teeny weeny stake in two Chinese businesses. The Pay TV part of the business is where the company was able to lift their presence and drive acquisitions using the strong cash flows associated with pay TV into their internet businesses. Which are then segregated further into e-commerce (where CEO Koos Bekker thinks the next big growth is). As well as the significant stake in TenCent (which basically makes up the most of the current share price) and Mail.ru.

The internet businesses (e-commerce) are the ones that deserve the most airtime. There are the classifieds parts of the business, perhaps difficult for us here to understand but in places such as Russia, people love doing business through the classifieds. Perhaps it was being kept under communist rule for so long that drew people to wanting an active role in the trading of goods. Unleashing the inner entrepreneur in everyone, remember the last full year numbers which were very detailed covered the e-cmmerce push: Naspers FY numbers, ecommerce next big.

Koos Bekker acknowledged that whilst the pay TV business is very important, people in developed markets are shifting to the second screen, the so called two screen effect, where people interact with other viewers real time as they are watching TV. TV is a one way medium, there is NO feedback, no matter how loud you are in your living room, calling on the fleas of one thousand camels to infest the referees armpits, he is not going to hear or see that. But Twitter and Facebook make you able to interact with sports TV presenters during the actual match. Pommie and Haysie read out your tweets during the cricket, wow, imagine that five years ago. And the explosion of smartphones and tablets into your lives mean that you go about business very differently from before, interacting with friends and family differently, doing product research very differently. But the reason why this is important is that Naspers has a little graphic in amongst a whole lot of others in their A global platform operator, November 2013 snapshot:

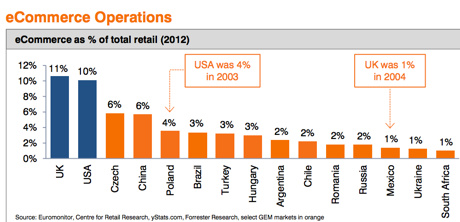

There you go. We are at a very, very low level in terms of retail spend in some of their core new business opportunities, retail spend that is. Most trade takes place in a very formal manner, and that is still the case. That is part a lack of quality broadband and then higher broadband prices to boot, but that no doubt will catch up. Remember that Telkom have only 900 thousand ADSL lines in South Africa. That means that less than 2 percent of South Africa have fixed line broadband access in a small business and home environment. So half of them then shop online. And I guess that is what Koos Bekker and Naspers talk about, in the next big thing for Naspers and their e-commerce businesses. They say as much, move to mobile (fixed lines infrastructure worse in developing world) and step up spending. Total development spend this year is expected to top 7 billion Rand, or roughly one eighth of revenue, sizeable to say the least. But there is a shift in Capex spend, most of the spend came last year, and the two years prior in Pay tv, this is to be focused on their internet business.

It will however have a negative impact on earnings. Big fat note, the e-commerce business still makes a loss, but is growing aggressively: This segment is growing well with revenues almost doubling to R7,9bn. We are investing aggressively in marketing, people and product. Development spend was R2,3bn with trading losses of R1,8bn. So how do you value this business? A little like Amazon, where the ramp up and spend is making profitability next to nothing. Amazon trades on 2.86 times sales, this could give you a fair indication of how the market could possibly value this segment later. Interestingly eBay trades on 4.51 times sales.

This (e-commerce) business is probably already more valuable than the print business, even if you apply a 2 times sales valuation at around 16 billion Rand. The print business made 408 million ZAR, but continues to fall as a result of lower advertising revenues. So I guess if you afforded that business more than an 8 EBITDA multiple and you annualised this half, you get somewhere in the region of 7 billion Rand. Not to be sneezed at, and in fact that segment alone at that very modest valuation would be nearly three times bigger than Times Media Group, which has a market cap of 2.573 billion Rand. And a negative multiple, hardly making a profit at all. So that 2.5 billion market cap is perhaps flattering, but we will see how the restructuring goes.

But then the rump of the business, the part that really matters for the time being, TenCent and we are going to use the trusty percentage calculator:

TenCent market capitalisation is 821.94 billion HKD (Hong Kong Dollars) as at the close: Tencent Holdings Ltd (HKG:0700)

1 HKD = 1.31 ZAR - HKDZAR

Naspers own 34.26 percent of TenCent. Naspers value of that in Rands is (821.94 billion HKD x 34.26%) = 281.59 billion HKD = 368.89 billion ZAR!

Current market cap of Naspers (last evenings close) = 387.629 billion ZAR. 95.1 percent price you see today is TenCent.

Effectively the rest of the business, including a fast growing other businesses, not to mention a Pay TV business that is still growing strongly (generating trading profits for this half of 4.477 billion Rand, subscriber base of over seven million) is for nothing. So you see. Naspers could be undervalued. So why does the South African investment community continue to undervalue the company relative to their Chinese counterparts? Possibly. We continue to hold and add to where people are underweight. We will continue to do a detailed analysis of this business over the coming days, a series of parts on Naspers.