Tesla Motors, the sleek, electric sport car manufacturer based in California is up more than 500% this year. The company was founded by Elon Musk (the new Steve Jobs in my opinion) who also founded Pay Pal and Space X (a space transport company). To top off this storey Mr Musk is a South African, he matriculated from Boys High before moving to the US of A. The name Tesla is from Nikola Tesla, one of the fathers of AC (Alternating Current) electrical supply.

The Tesla market cap is sitting at just over $20 billion (bigger than FIAT and Mitsubishi combined), which is substantial considering that the company has yet to make a full year profit. Having said that, Tesla has more than doubled its' 2012 revenue figure in only 6 months this year (2012 full year revenue: $ 413 million; 2013 six month revenue: $ 966 million). The substantial increase in revenue has also decreased the loss in earning per share from -3.69 to a -0.26.

So why has the share shot up at such a rate? I think that there are a number of reasons:

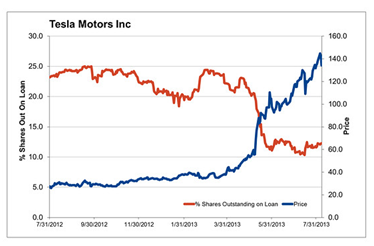

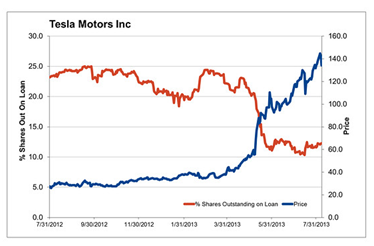

- 1) Short covering: A short position is where investors borrow shares and sell them with the hope that the stock price falls, where they will then buy the stock back and return the share to its original owner, meaning that they make money when the share price drops and lose money when the share price rises. Short covering is when the share price rises causing the shorts to start losing money, resulting in them buying back shares to cover their shorts. The increased buying (covering) from the shorts pushes the price up, causing more shorts to cover their positions. As shown in the graph, the short position in Tesla went from about 25% of outstanding shares being short positions, to about 12.5%.

- 2) Better than expected performance. Tesla had strong 2013 1Q results, which were better than what Wall Street expected them to be. The results came out on 8 May where the Share was at 55, since then the share is up more than 300%. These good results and the resulting increase in the share price is what would have triggered the short selling.

- 3) The Elon Musk and new technology factor. Investors are expecting Tesla to do to the car industry what Amazon did to the retail sector and what Jobs & Apple did to the computer sector.

- 4) Limited liquidity. About 76% of outstanding stock in Tesla is owned by Institutions, Elon Musk and large individual investors, who all wont be trading much.

Relating to the value of Tesla shares, a professor of Finance at NYU did research where in his words "my estimated value per share of $67.12 is well below the market price of $168.76, I am assuming that Tesla will grow to be as large as Audi, while delivering operating margins closer to Porsche's".

He does go on to say that he does understand why people are buying at these levels. You can view his valuation and comments on the following links.

Tesla: A Follow up and

Valuation of the week 1: A Tesla Test. Tesla is a 'cool' innovative company, and only time will tell what its true value is. If you only get one thing out of this, let it be that Elon Musk is South African and he is busy changing the world.